Rick Rieder, senior investment executive at BlackRock, met with President Donald Trump yesterday, according to Bloomberg, a development that has intensified speculation around who Trump will choose as his next chair of the Federal Reserve.

The meeting immediately elevated Rieder’s standing in what is now a narrowing field of candidates. Rieder is best known as BlackRock’s chief investment officer for global fixed income, a role that has made him one of the most influential voices in bond markets over the past decade. While he has never served inside the Federal Reserve or in a government policy role, his public views on monetary policy are closely followed by investors and policymakers alike.

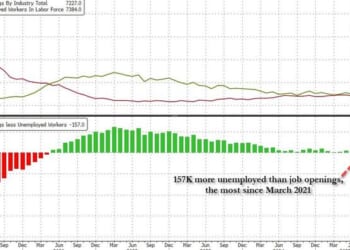

Rieder has consistently argued that interest rates remain higher than necessary given how the economy is evolving. He has said the Federal Reserve should be open to cutting rates toward what he views as a more neutral level, often pointing to something closer to 3 percent over time. His thinking reflects concern that keeping policy too restrictive for too long could strain credit markets and slow growth more than intended, particularly as inflation pressures cool unevenly across sectors.

Rather than focusing narrowly on inflation, Rieder tends to emphasize overall financial conditions and market plumbing, a perspective shaped by decades spent navigating bond markets through crises.

He has suggested the Federal Reserve has leaned too heavily on backward-looking inflation metrics and risks overtightening by keeping rates restrictive for too long, even as growth cools and financial conditions do some of the work for policymakers.

Rieder has also raised eyebrows by downplaying fears around large government deficits, arguing that strong demand for U.S. assets and structural forces like aging demographics and high global savings make those deficits more manageable than critics claim. At times, he has gone further, questioning whether inflation slightly above target is necessarily harmful if it helps stabilize debt dynamics and sustain employment, a view that runs counter to the Fed’s traditional emphasis on price stability above all else.

Those views align with Trump’s long-standing criticism of the Fed for maintaining overly tight policy. Trump has made no secret of his desire for a central bank leader who is more willing to lower rates and less inclined to err on the side of restraint. Still, a Rieder nomination would be unconventional, putting a Wall Street asset manager in charge of the institution that sets the benchmark for global interest rates.

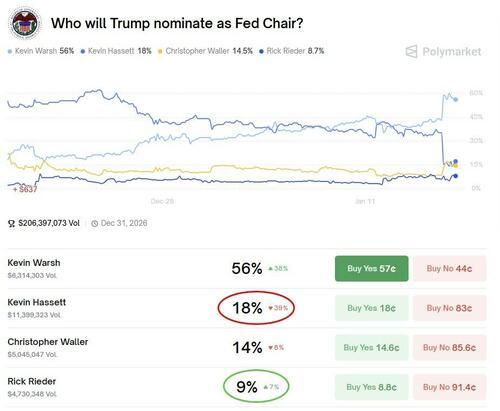

At the same time, Trump has begun to publicly rule people out. Last week he signaled that Kevin Hassett will not be his pick, despite months of speculation that the current economic adviser was a leading contender. Trump suggested he wants Hassett to remain in his current role, implying that moving him to the Fed would leave a gap inside the White House. That statement effectively removed one of the most familiar names from consideration.

With Hassett sidelined, the race appears to be tightening around a smaller group. Alongside Rieder, the remaining names most often mentioned include former Fed governor Kevin Warsh and current Fed governor Christopher Waller. Both bring deep experience inside the central bank and would represent a more traditional choice, in contrast to Rieder’s market-driven background.

Treasury Secretary Scott Bessent has said the decision is coming soon. He has indicated that Trump plans to announce his Fed pick before, or right after Davos, signaling an effort to provide clarity well ahead of the end of Jerome Powell’s term.

With the field narrowing and Trump actively meeting candidates, Rieder’s appearance at the White House underscores that the president could be weighing both conventional and unconventional paths for the future of U.S. monetary policy.

Loading recommendations…