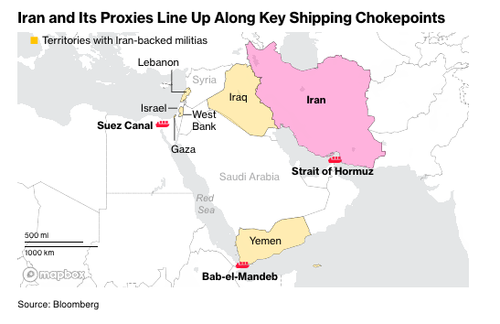

Shell Plc is preparing contingency plans in case the conflict between Israel and Iran broadens and disrupts oil and gas flows through the critical maritime chokepoint of the Strait of Hormuz.

On Thursday, CEO Wael Sawan told Bloomberg’s Shery Ahn at the Japan Energy Summit & Exhibition in Tokyo, “If that artery is blocked, for whatever reason, it has a huge impact on global trade,” adding, “We have plans in the eventuality that things deteriorate.”

Shell CEO Wael Sawan tells me about contingency plans in case the Israel-Iran conflict disrupts supplies. https://t.co/AqQXOwbH56#MiddleEastCrisis #energy @Shell pic.twitter.com/3XBHOCoNw0

— Shery Ahn (@SheryAhnNews) June 19, 2025

Although energy flows through the critical waterway—responsible for approximately 20% of global oil trade—remain uninterrupted (at the moment), traders have been on high alert all this week amid widespread GPS jamming in the region, which has degraded navigational awareness and may have contributed to what is shaping up to be a major ecological disaster.

On Wednesday, former Iranian Economy Minister Ehsan Khandouzi stated on X and warned…

“Starting tomorrow, for 100 days, no oil tankers or LNG cargoes will be able to pass through the strait without Iran’s approval,” Khandouzi said.

He stated, “This policy is decisive if it is implemented in a timely manner. Any delay in its implementation means enduring more war inside the country. Trump’s battle must be ended with a combination of economy and security.”

Such messaging, especially when paired with the Islamic Revolutionary Guard Corps (IRGC) naval activity in the region, raises the increasing probability of IRGC actions targeting commercial shipping lanes in the strait. This escalation could serve as the catalyst that turns JPMorgan’s $120–$130 per barrel Brent crude forecast from a scenario into a market reality.

Back to Shell’s CEO—he told Bloomberg’s Shery Ahn, “What is particularly challenging right now is some of the jamming that’s happening,” adding that “Shell is being very careful” along major maritime routes in the region.

The most imminent threat of a Strait of Hormuz blockade could come as soon as this weekend. Bloomberg reported overnight:

Senior US officials are preparing for the possibility of a strike on Iran in coming days, according to people familiar with the matter, as Israel and the Islamic Republic continue to exchange fire.

Some of them pointed to potential plans for a weekend strike. Top leaders at a handful of federal agencies have begun getting ready for an attack, one person said.

Commenting on the dire situation, Manish Bhargava, CEO of Singapore-based Straits Investment, warned, “Direct US involvement in an attack on Iran would almost certainly trigger a major spike in oil prices.” He said, “This surge would aggravate global inflation, making central bank efforts — like the Fed’s — to control it more difficult and potentially delaying interest rate cuts.”

Loading…