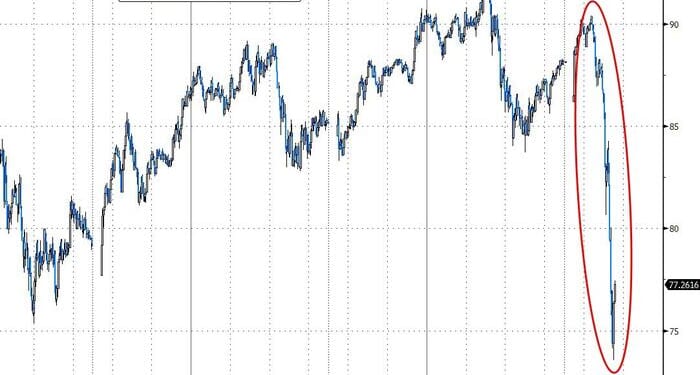

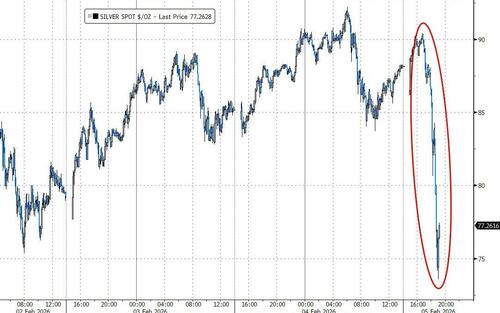

On the heels of today’s momentum collapse in the US, Silver prices have puked almost 20% in a matter of hours after Asian markets opened…

…erasing the rebound gains of the last three days…

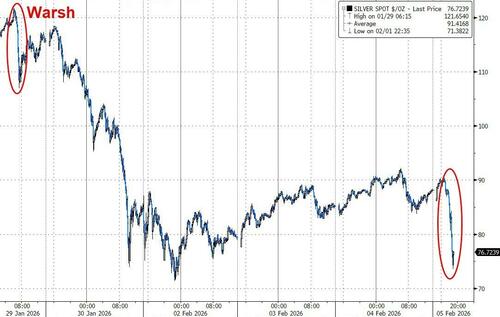

The overall decline from when Trump’s announcement of Warsh’s nomination as the next Fed Chair is now back up to 40%.

“Sentiment seems to have turned soggy across most asset classes, including regional equities and metals,” said Christopher Wong, a strategist at Oversea-Chinese Banking Corp Ltd.

“This underscores fragile sentiment” and has created “a feedback loop amid thin market liquidity,” he said.

Spot Gold prices are also down (around 4-5%), with $5000 seemingly acting as serious resistance…

There’s no obvious specific catalysts for the decline in precious metals for now.

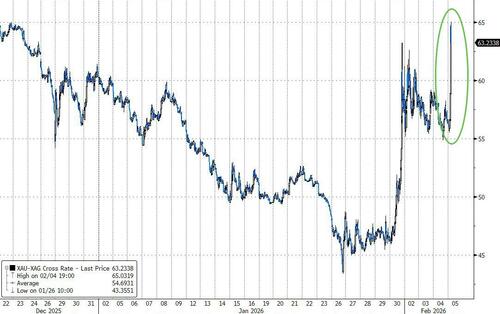

Silver’s relative underperformance has smashed the Gold/Silver ratio back above 65x (6 week highs)…

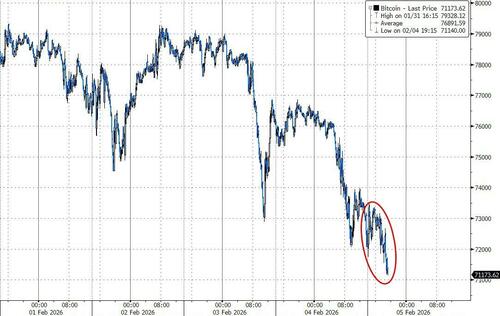

Bitcoin is also accelerating its losses during the US day session, back below $72,000…

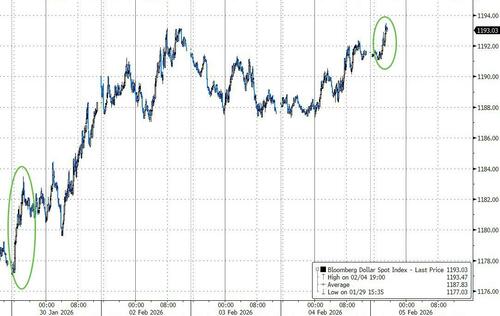

The collapse of these ‘alt’ currencies is coming as the US dollar’s recent gains accelerate…

“Price action is likely to remain volatile until there is greater certainty on the monetary policy outlook,” Standard Chartered Plc analysts including Sudakshina Unnikrishnan said in a note.

Some of this near-term volatility is resulting from investors redeeming their holdings in exchange-traded products, they said, but “structural drivers remain intact and we continue to expect a rebuild to the upside.”

Loading recommendations…