The first coupon auction of the holiday-shortened week just priced and it was a snoozer, which came in right as expected.

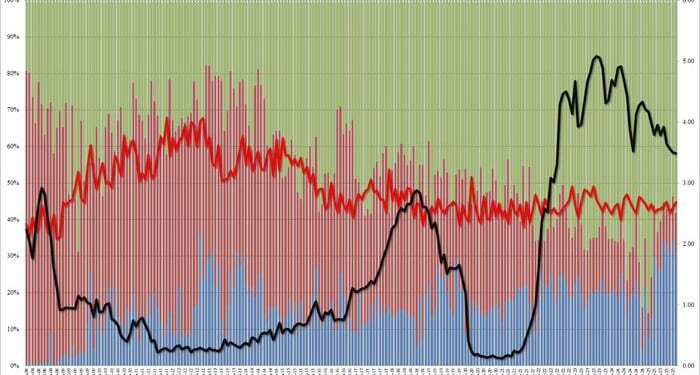

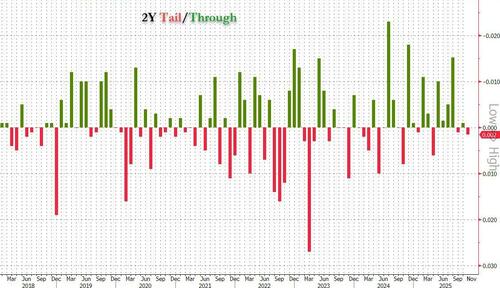

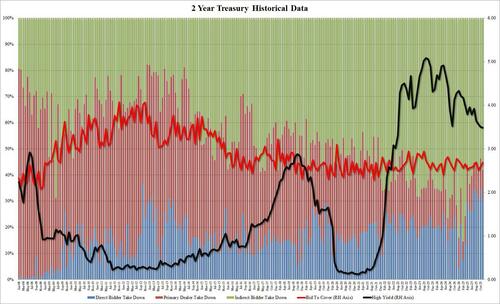

The sale of $69BN in 2 year notes, priced at a high yield of 3.489%, down from 3.504% in October and the lowest since August 2022; it also priced on the screws with the 3.489% when issued.

The bid to cover was 2.684, up from 2.590 and the highest since August.

The internals were also solid, with Indirects awarded 58.1%, the highest since June, and above the six auction average of 57.9%. And with Directs taking 30.7%, in line with the recent average of 30.9%, Dealers were left with 11.2%, also right on top of the recent average of 11.1%.

Overall, this was a solid auction, which came in line with expectations on most metrics, which explains why the market reaction was non-existent with yields trading near session lows after news of the auction priced, and why traders took one look at the results and went on their merry way.

Loading recommendations…