Due to the FOMC meeting falling on a Wednesday, the Treasury is scrambling to issue this week’s coupon auctions, starting with a $58BN 3Y auction which saw solid demand when it was offered at 1pm ET.

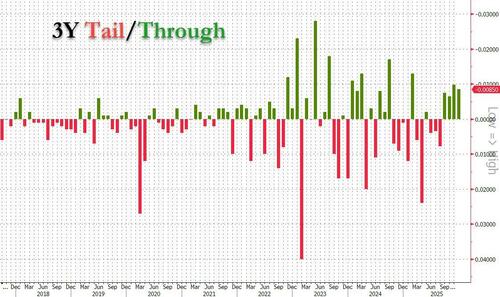

The sale of $58BN in 3 year paper priced at a high yield of 3.614%, up from 3.579% in November, and the highest since August. The auction also stopped through the 3.622% When Issued by 0.8bps, the 4th consecutive stopping through 3Y auction.

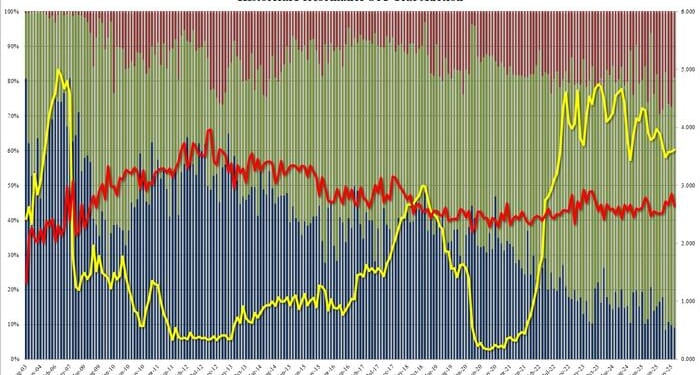

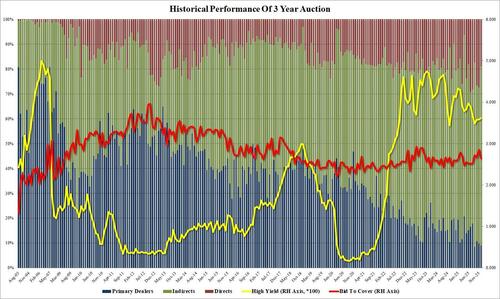

The bid to cover was dropped to 2.641 from 3.850 but was still just above the 2.632 six-auction average.

The internals were more solid, with Indirects awarded 72.0%, up sharply from 63.0% in November and the highest since September. It was also one of the highest foreign awards on record.

And with Directs taking down 19.0%, down from 27.32 last month, Dealers were left holding just 9.03%, the lowest since September, and below the 13.1% recent average.

Overall, this was a very solid auction, one which came at just the right time: with 10Y yields surging today just shy of 4.20% before retracing the move and dipping by about 1bp on the solid 3Y auction results.

Loading recommendations…