US equity futures are little changed in thin trading with most traders away from the screens, while the bulk of overnight actions was once again in gold and silver as precious metals soared to a new record high driven by feverish Chinese demand. As of 8:15am, S&P futures were flat after closing Wednesday’s session at a new record high, while Nasdaq 100 futs were fractionally in the green. Asian markets were mostly higher while European bourses are closed. The dollar was unchanged as were treasuries, with the benchmark 10-year yield at 4.13%. There is no macro on today’s calendar.

In premarket trading, Mah 7 stocks were mixed (Nvidia +0.7%, Tesla +0.2%, Alphabet +0.1%, Apple little changed, Amazon -0.1%, Meta Platforms -0.1%, Microsoft -0.2%).

- Miners including Coeur (CDE) and Freeport (FCX) are higher as gold, silver and platinum jumped to all-time highs and copper surged to a record in Shanghai and rallied in New York.

- Biohaven (BHVN) drops 14% after a mid-stage study of the company’s experimental drug BHV-7000 for the treatment of major depressive disorder missed the primary endpoint.

- Coupang (CPNG) gains 6.3% after Yonhap News reported the e-commerce company has identified the former employee who allegedly accessed personal data of 33 million customers; the company has retrieved all hard disk drives and devices that the ex-worker used.

As the Santa Rally accelerates, the MSCI All Country World Index gained 0.1%, rising for a seventh day, while a gauge of Asian stocks climbed 0.2%; Australia, Hong Kong and markets in Europe remain for holidays. Bloomberg’s index of the dollar held near the lowest since October. Treasuries were little changed, with the benchmark 10-year yield at 4.13%.

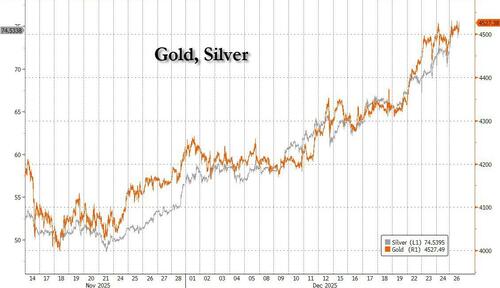

Once again, the bulk of the overnight action was in gold and silver, which jumped as escalating geopolitical tensions and dollar weakness helped extend a historic rally for precious metals. Spot silver advanced for a fifth day, climbing as much as 5.2% to cross $75 an ounce for the first time. Gold, set for its best annual advance since 1979, rose as much as 1.2% to above $4,500 an ounce.

Copper surged to a record in Shanghai and rallied in New York, adding to substantial annual gains as investors bet on tighter global supplies in 2026, while also pricing in the impact of a weaker US dollar.

Meanwhile, the “Santa Claus Rally” which we said would be unleashed by Abu Dhabi’s bailout of the AI sector last week, is set to push stocks to fresh records even as exuberance over artificial intelligence and the Federal Reserve’s interest-rate path are being questioned. The rally is traditionally seen as taking place on the final five trading sessions of a year and the first two of the new one. Of course, the rally can well start early, and it did just that with the S&P 500 rising Wednesday for a fifth day in a shortened session ahead of the Christmas holiday.

“As equity markets enter the fourth year of a bull market, our underlying market call remains constructive,” Scott Chronert, head of US equities strategy at Citigroup Inc., wrote in a note this week. “The current fundamental backdrop clearly has the opportunity for an ongoing AI-related tailwind to large-cap growth.”

After earlier concerns over high valuations for tech stocks amid the AI boom, traders are regaining confidence that companies will deliver solid earnings growth in 2026.

European bourses are closed; Asian stocks extended gains for the week, helped by advances in Japan, Taiwan and South Korea. The MSCI Asia Pacific Index climbed as much as 0.5%, putting the gauge on track for its best week since late November. Samsung Electronics, TSMC and SK Hynix were among the biggest boosts to the index’s gain. Markets in Hong Kong, Australia and Indonesia remained closed for a holiday. Markets fell in Vietnam, Thailand and India.

Tech shares traded higher, amid a year-end rally in US peers, with Samsung Electronics rising to an all-time high. Japanese stocks rose as tech shares and exporters bolstered the indexes, while buying in dividend names also lifted shares. Mainland China shares rose, with gains in stocks related to solar, precious metals, lithium batteries and new energy vehicles boosting the gauge.

“China equity markets enter 2026 with the wind at their back, and new momentum from advanced manufacturing and tech self-sufficiency drivers,” according to a note by UBS CIO. “With domestic investors on board and global investors adjusting their stance, we see more upside ahead, even if occasional volatility and geopolitical squalls lie on the horizon.”

“There were AI-related concerns earlier this month, but those seem to have been digested by the market,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management in Tokyo.

In FX, the yen weakened 0.4% to about 156.44 to the dollar after a report showed Tokyo’s inflation cooled more than expected as pressures from food and energy prices faded. That triggered weakness in the currency on bets the Bank of Japan may push back the timing of its next rate hike. Meanwhile, China set the yuan’s daily reference rate at a level that was below market estimates by a record margin, in the latest sign of policymakers’ intention to slow the currency’s appreciation.

The move came after the offshore yuan advanced past the psychological level of 7 per dollar on Thursday for the first time since September 2024. The PBOC has steered the yuan toward a path of appreciation to appease Beijing’s trading partners, but has sought to maintain a gradual pace of gains to avoid a surge of hot-money inflows.

In commodities, oil headed for the biggest weekly gain since October, as traders tracked a partial US blockade of crude shipments from Venezuela and a military strike by Washington against a terrorist group in Nigeria.

Loading recommendations…