SpaceX is preparing a record-breaking IPO targeting a valuation of roughly $1.5 trillion, with expectations to raise $30 billion or more and debut in the second half of 2026. If the Bloomberg report is accurate, the offering would surpass Saudi Aramco’s 2019 listing and become the largest public listing in history.

The report says SpaceX management and advisers are seeking a 2H26 listing that could raise more than $40 billion in stock, making it the largest IPO of all time, well above Saudi Aramco’s $29 billion listing.

Current internal valuation (based on a secondary share price of around $420) already places SpaceX above $800 billion, according to the people familiar with the discussions.

Wild to look at SpaceX’s valuation history.

If this chart were linear, the first 10 years would basically be invisible, even when it became a unicorn in 2010.

Years of grinding… then rocket reusability + Starlink, and the whole thing went vertical.

SpaceX is the clearest… pic.twitter.com/5O74VZHXia

— Justin Mateen (@justinmateen) December 6, 2025

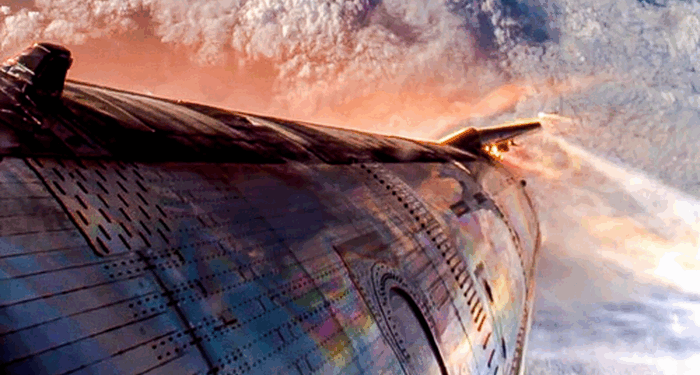

The accelerated timetable for going public is partly driven by Starlink’s rapid global expansion and its new direct-to-mobile service. Successful Starship test launches are also a significant factor. We published a note last week indicating that Starlink filed a trademark for “Starlink Mobile,” indicating the company may soon become AT&T and Verizon’s worst nightmare.

SpaceX’s revenue is about $15 billion this year and is forecasted to climb to $22 to 24 billion in 2026, according to one source, with most of it coming from Starlink. The company’s mini-dish offering has been a major hit with consumers, helping push Starlink’s global user base to around 8 million and skyrocketing up and to the right.

BREAKING: SpaceX has announced that @Starlink now has over 8 million customers, up from 7M in August and 6M in June 2025.

Starlink added a record 14,250 new customers on average per day since they hit 7M, beating their previous record of 12,200. That growth rate is 17% higher… pic.twitter.com/IahhZWJvxe

— Sawyer Merritt (@SawyerMerritt) November 5, 2025

The people noted:

SpaceX expects to use some of the funds raised in the IPO to develop space-based data centers, including purchasing the chips required to run them, two of the people said, an idea Musk expressed interest in during a recent event with Baron Capital.

“SpaceX has been cash-flow positive for many years and does periodic stock buybacks twice a year to provide liquidity for employees and investors,” Musk wrote on X last week.

He noted, “Valuation increments are a function of progress with Starship and Starlink and securing global direct-to-cell spectrum that greatly increases our addressable market.”

Last week, Musk shut down the claim by corporate media that SpaceX was raising money at an $800 billion valuation, calling the report “not accurate.”

While I have great fondness for @NASA, they will constitute less than 5% of our revenue next year. Commercial Starlink is by far our largest contributor to revenue.

Some people have claimed that SpaceX gets “subsidized” by NASA. This is absolutely false.

The SpaceX team won…

— Elon Musk (@elonmusk) December 6, 2025

Musk has previously stated:

The report on SpaceX’s IPO plans sent EchoStar shares up 5% in premarket trading. This is because SpaceX recently bought $17 billion in AWS-4 and H-block spectrum licenses.

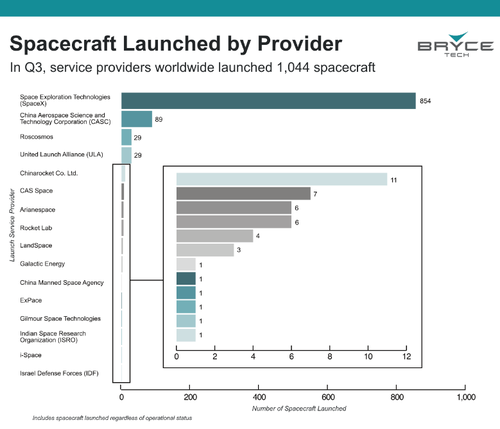

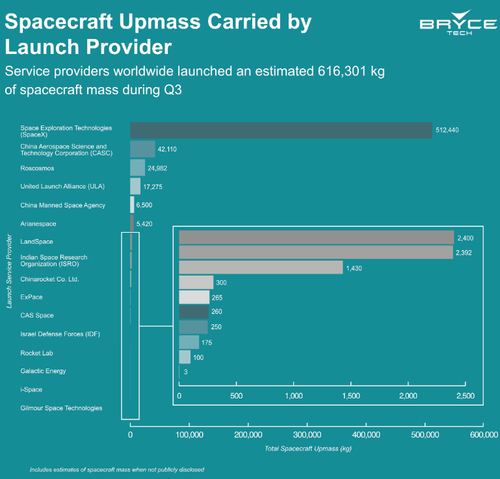

Let’s remind readers that SpaceX is effectively America’s rocket program – and it leads the world by light-years.

In terms of spacecraft upmass…

View the Bryce Tech report here.

Loading recommendations…