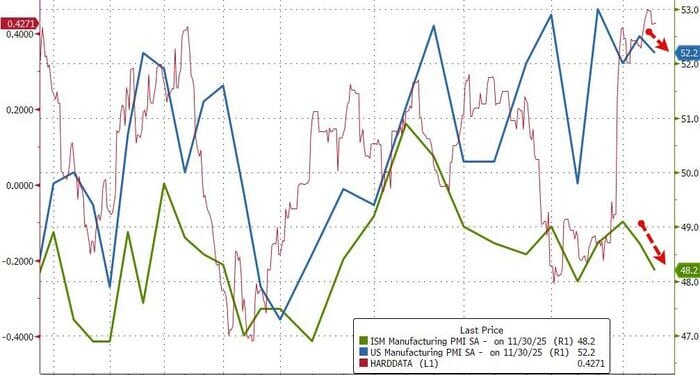

This morning’s survey data on the US manufacturing economy comes as the post-shutdown slump in ‘soft’ data has dominated desk conversations amid the vacuum of hard macro data…

But the picture remains mixed:

-

S&P Global’s US Manufacturing PMI BEAT expectations in November but dipped on a MoM basis from 52.5 to 52.2 (still in expansion territory and up from the 51.9 flash print).

-

ISM’s Manufacturing PMI MISSED expectations, dropping from 48.7 to 48.2 (well below the 49.0 expectation) and in contraction for the ninth month in a row.

Although the headline PMI signalled a further expansion of factory activity in November, “the health of the US manufacturing sector gets more worrying the more you scratch under the surface,” according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

“The main impetus came from a strong rise in factory production, but growth in new order inflows slowed sharply, hinting at a marked weakening of demand growth.”

Under the hood, ISM shows Price Paid higher, and new orders and employment worsening…

For two successive months now, warehouses have filled with unsold stock to a degree not previously seen since comparable data were available in 2007. This unplanned accumulation of stock is usually a precursor to reduced production in the coming months.

“Profit margins are meanwhile coming under pressure from a combination of disappointing sales, stiff competition and rising input costs, the latter widely linked to tariffs.

In short, Williamson notes that manufacturers are making more goods but often not finding buyers for these products.

“This combination of sustained robust production growth alongside weaker than expected sales led to a worryingly steep rise in unsold inventories.

However, there is hope, as manufacturers have grown more optimistic about the year ahead, with the ending of the government shutdown helping lift confidence from the sharp drop suffered in October.

“Optimism is being fueled by hopes of improved policy support, including lower interest rates, as well as greater political stability, though it is clear that uncertainty remains elevated and a drag on business growth in many firms, holding confidence well below levels seen at the start of the year.”

Loading recommendations…