The last coupon auction of the first full week of 2026 was also the strongest one.

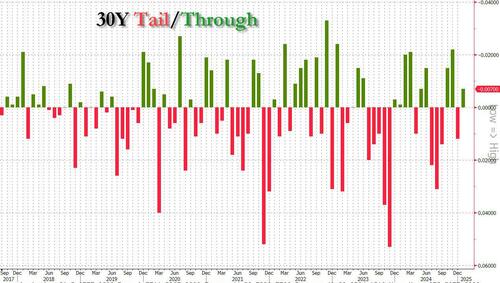

Moments ago the Treasury sold $22BN in 30Y paper in a very solid auction: the sale priced at a high yield of 4.825%, just fractionally higher than the 4.773% in December, and also stopped through the When Issued 4.833% by 0.8bps.

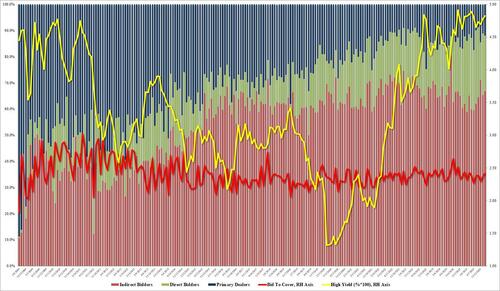

The bid to cover was a solid 2.418, up from 2.365 last month, and the highest since June.

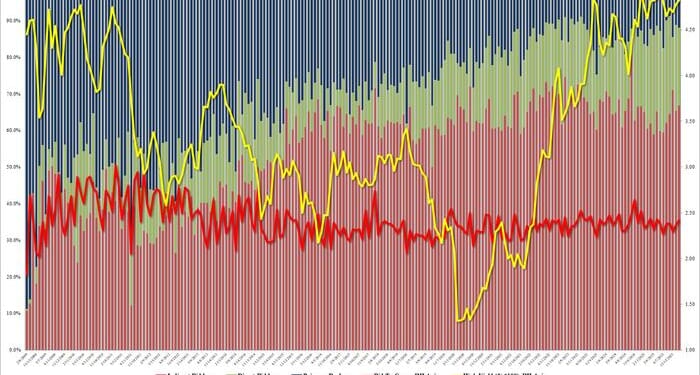

The internals were also impressive, with foreigners buying 66.8%, up from 65.4% in December, and above the six-auction average of 63.7%. And with Direct Bidders awarded 21.3%, bit below the recent average of 23.9%, Dealers were left holding 11.95%, which was also below the recent average of 12.4%.

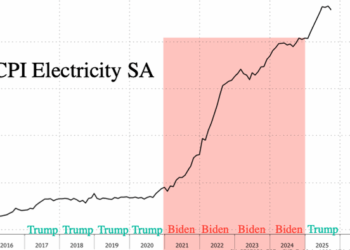

Bottom line: a very strong auction, which was also facilitated by today’s surprisingly cool CPI report, which swung the long-end from an intraday high of 4.20% to a low of 4.15%, and was last trading at 4.165%.

Loading recommendations…