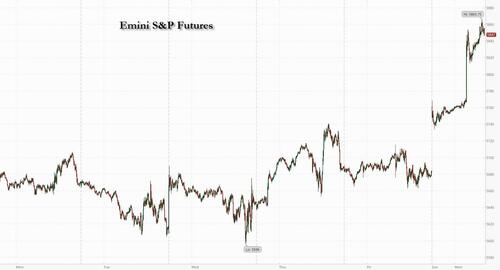

US equity futures and the dollar soared after China and the US agreed to slash tariffs and de-escalate a trade war that had sparked turmoil in global markets. Treasuries and gold tumbled after the US cut China tariffs from 145% to 30% while China slashed US tariffs from 125% to 10% for 90 days. With the countries agreeing that they do not want to de-couple, there is optimism that a longer-term deal can be reached. As of 8:00am, S&P futures surged 3% and Nasdaq futures spiked almost 4%. JPM writes that while Trade War 1.0 tariffs remain, as do sectoral tariffs but, this is an unambiguous positive for all global risk assets and will allow markets to look through any near-term weakness in macro data but if CPI, PPI, and Retail Sales surprise to the upside, then that will provide another tailwind to risk assets. Premarket Mag7 names are higher with many up more than 3%, Semis/Cyclicals are also higher as the market will need to reset its growth expectations higher. Commodities are higher, led by Energy, despite a spike in bond yields/USD.

In premarket trading, Magnificent Seven stocks jumped as trade tensions ease: Apple rises 6.3% after the WSJ reported that the company is considering raising iPhone prices (Amazon +7%, Tesla +7.9%, Meta Platforms +5%, Nvidia +4.8%, Alphabet +2.8%, Microsoft +2.2%). Pharmaceutical plunged fall after US President Donald Trump said he planned to order a cut in US prescription drug costs to bring them in line with other countries, prompting concern that profits will take a hit (Eli Lilly -4%; Pfizer -2.7%, Bristol-Myers Squibb -2%, Merck -3%). Semiconductor, travel, shipping and consumer stocks also rally on trade news (Advanced Micro Devices +7%, Delta Air Lines +7%, United Parcel Service +4%, Nike +6%, Estee Lauder +6%). Precious metals mining stocks dropped as gold falls, with demand for haven assets declining as the US and China agree to lower tariffs on each other’s products for 90 days (Barrick Mining Corp. -5%, Coeur Mining -6%). Here are some other notable premarket movers:

- ACI Worldwide (ACIW) rises 4%, rebounding from a two-day rout, after DA Davidson & Co upgraded the stock to buy, citing the application software company’s “strong” first-quarter results.

- Johnson Controls (JCI) gains 2% after Deutsche Bank upgraded the company to buy, seeing a “rare opportunity” to own a stock with significant potential for operating margin improvement that’s not reflected in current consensus forecasts.

- NRG Energy (NRG) gains 6% after agreeing to acquire natural gas-fired power assets from LS Power Equity Advisors LLC for about $12 billion including debt.

- Shopify’s US-listed shares (SHOP) jumps 8% after Nasdaq announced on Friday that the Canadian e-commerce platform will replace MongoDB in the Nasdaq-100 Index prior to market open on May 19.

Risk appetite erupted across the globe after Treasury Secretary Scott Bessent hailed the trade discussions as “very robust and productive.” US megacap tech stocks, which had been hard hit this year, were on track to tally some of the biggest gains, pushing Nasdaq 100 futures up 4%, with the index set to re-enter a bull market. The dollar topped a one-month high. Gold fell more than 3%. The 10-year Treasury yield climbed seven basis points to 4.45% as traders pushed back the timing of possible interest-rate cuts.

The breakthrough in the China-US talks delivers a shot of relief to investors who were bracing for the possibility that a spiraling trade war between the world’s biggest economic powers might cause a global recession. The countries will lower tariffs on each other’s products for 90 days, according to a joint statement released in Geneva.

“The risk of a deep and protracted US recession has gone,” said Guy Miller, chief market strategist at Zurich Insurance Co. “From a company earnings perspective the headwind to revenues has clearly diminished.”

The trade war has been the biggest driver in markets this year and investors went into the weekend talks eager for clear signs the rebound from Trump’s “Liberation Day” announcement of tariffs on April 2 could be sustained. Rounds of retaliation had raised US levies on imports from China to 145%, while the Chinese put in place a 125% duty on US goods. That stoked fears of stagflation and recession, even though calmer minds warned that all of this was just negotiating strategy by the White House.

“In our view, equity markets are returning to where they would have moved to if Liberation Day had not happened and Trump had just applied the 10% universal tariff,” said Roberto Scholtes, head of strategy at Singular Bank. “Corporate fundamentals are healthy, first quarter results have substantially surprised on the upside, and there’s plenty of cash to be invested.”

Not everyone was celebrating however: pharmaceutical companies missed out on the broader rally as drug-company stocks fell across the world after Trump said he planned to order a cut in US prescription costs to bring them in line with other countries, prompting concern that profits will take a hit. Trump said in a social media post that he’ll sign the executive order at 9 a.m. Monday in Washington. Novo Nordisk A/S, AstraZeneca Plc and Roche Holding AG slid, while in Asia, the pharmaceuticals subgroup in Japan’s Topix Index posted its biggest one-day loss since August. Shares in US drugmakers were also weaker, with Eli Lilly, Pfizer, Bristol-Myers Squibb and Merck all down in premarket trading in New York.

Elsewhere, shares in India jumped almost 4% and those in Pakistan rallied 9% after the two nations agreed to an immediate ceasefire after four days that saw the worst fighting between the countries in half a century. And after a weekend of hectic diplomacy, Ukraine’s Volodymyr Zelenskiy said he will travel to Istanbul on May 15 where Russian President Vladimir Putin has proposed direct negotiations between the two countries.

In Europe, the Stoxx 50 rallied 1.7%. Miners, consumer products and tech are the strongest-performing sectors in Europe. FTSE 100 lags, adding 0.4%, as shares of pharmaceutical companies fall globally after President Donald Trump’s plan to cut US drug prices. Here are the biggest movers Monday:

- European mining shares are the best performing sector in the Stoxx 600 benchmark on Monday, driven by a surge in copper and most other industrial metals, after China and the US agreed to lower tariffs for 90 days in a sign of easing trade tensions

- MTN Group shares rise as much as 2.2% in Johannesburg, after the telecommunications company reported first-quarter results that analysts at Avior said were “mixed”

- European pharmaceutical stocks drop after US President Donald Trump said he plans to order a cut in US prescription drug costs by mandating that Americans pay no more than people in countries that have the lowest price

- European defense stocks slide on cooling geopolitical tensions as Russian President Vladimir Putin offered to hold direct talks with Ukraine, while India and Pakistan agreed to an immediate ceasefire mediated by the US. The sector remains sharply higher this year

Earlier in the session, stocks in Asia jumped after the US and China said they will temporarily lower tariffs on each other’s products, a move that gives the world’s two largest economies more time to resolve their differences. The MSCI Asia Pacific Index advanced as much as 1.2% Monday, headed for its highest close since October. Chinese tech sector leaders Tencent and Alibaba, as well as South Korea’s Samsung Electronics, offered the biggest boosts to the benchmark. The risk-on rally was evident from the opening in the region’s markets, with investors remaining optimistic that the US and China would reach a deal after they touted “substantial progress” on their trade discussions. The combined 145% US tariffs on most Chinese imports will be reduced to 30%, while the 125% Chinese duties on US goods will drop to 10%, according to a statement and officials in a briefing Monday.

In FX, the Bloomberg Dollar Spot Index eyes its best day since April 4 as it climbs by as much as 1%. The euro falls as much as 1.5% to $1.1084, on track for its worst day this year. Haven currencies and assets underperform; JPY and CHF lag G-10 peers.

In rates, front-end bonds lead a broad selloff. Bund, Treasury and gilt curves all bear-flatten. The US 10-year yield climbs 7 basis points to 4.45%, its highest in nearly a month. Japan’s 30-year government bond yield climbs to its highest level in almost 25 years.

In commodities, oil leads a commodity rally. Brent crude added as much as 3.7% in London to above $65 a barrel and copper rose 1.4%. Most base metals trade in the green while spot gold falls roughly $100 to near $3,229/oz. Spot silver loses 1.6% near $32. Bitcoin fades gains after failing to break above its January record high, trading around $104,535.

Today’s US data slate includes April Federal budget balance at 2pm; besides CPI, retail sales, PPI and University of Michigan sentiment are ahead this week. Fed speaker slate includes Kugler at 10:25am. Chair Powell is scheduled to give remarks on the framework review at the Thomas Laubach Research Conference on Thursday

Market Snapshot

- S&P 500 mini +3.2%

- Nasdaq 100 mini +4.%

- Russell 2000 mini +4.0%

- Stoxx Europe 600 +1%

- DAX +1.1%

- CAC 40 +1.6%

- 10-year Treasury yield +8 basis points at 4.45%

- VIX -1.8 points at 20.1

- Bloomberg Dollar Index +0.7% at 1236.4

- euro -1% at $1.1138

- WTI crude +3.2% at $62.99/barrel

Top Overnight News

- US and China agree to bring down reciprocal tariffs by 115ppts for 90 days, sparking immediate risk on price action; DXY, ES, Crude bid; XAU & Fixed hit

- US President Trump said there was a very good meeting with China on Saturday and many things were discussed and much agreed to, while he stated a total reset was negotiated in a friendly but constructive manner. Trump also said great progress was made and they want to see for the good of both China and the US, an opening up of China to American business.

- USTR Greer said differences are not as great as previously thought, and Treasury Secretary Bessent said he looks forward to sharing details on Monday morning.

- Chinese Vice Premier He Lifeng said trade talks were constructive and they made substantive progress, while both sides reached an important consensus and agreed to establish a China-US trade consultation mechanism with a joint statement to be issued on May 12th. Furthermore, He said the atmosphere was candid, in-depth and constructive, and noted that the nature of relations is mutual win-win, and they are going to provide more certainty and stability in the world economy.

- Chinese Vice Commerce Minister Li Chenggang said any deal to be reached will be in China’s development interest and that they reached an important consensus with the two sides to have regular contact, while Li added that they are not in a position to release more substance on what they agreed on and declined to answer when asked about the timing of the statement but said it will be good news for the world.

- US President Trump’s administration opened a Section 232 investigation on whether imports of aircraft, engines and components are a threat to national security, while the Commerce Department is also investigating the impact of imported medium-duty and heavy-duty trucks on national security.

- White House Economic Adviser Hassett said the Chinese are ‘very, very eager’ to engage in trade talks and rebalance trade relations with the US, while he added that more trade deals could be coming as soon as this week. Furthermore, he said Commerce Secretary Lutnick briefed him about 24 deals that Lutnick and USTR Greer are working on, according to Fox News Sunday Morning Futures.

- US President Trump is reportedly seeking USD 1tln in deals during his Gulf trip. The Qataris are also expected to announce USD 200-300bln in deals and investments, including a “huge” commercial aircraft deal with Boeing (BA) and a USD 2bln deal to purchase MQ-9 Reaper drones, according to a source: according to Axios.

- US President Trump posted on Truth Social “IN JUST THREE MONTHS, TRILLIONS OF DOLLARS (and therefore, record numbers of JOBS!) HAVE BEEN POURING INTO THE USA. THIS IS BECAUSE OF MY TARIFF POLICY, and our great November 5th Election WIN!”.

- US President Trump posted that his next TRUTH will be one of the most important and impactful he has ever issued and later posted that he will sign an executive order on Monday at 09:00EDT with prescription drug and pharmaceutical prices to be reduced almost immediately by 30%-80% and the US is to pay the same price as the nation that pays the lowest price anywhere in the world.”

- Fed’s Cook (voter) said a less productive economy could need higher interest rates to contain inflation and that tariff policies could lower productivity, limit potential output and increase inflationary pressure, while Cook said less investment and higher costs could lower the economy’s potential output.

- Fed’s Musalem (2025 voter) said economic activity has moderated and sentiment has declined, while he added that they should not commit to rate cuts until the impact of tariffs on inflation becomes clear and rate cuts are still possible if increased inflation proves short-lived, expectations remain anchored, and the economy becomes meaningfully weaker.

- Fed’s Hammack (2026 voter) said on Friday that it is reasonable to take a wait and see approach and she would rather be slow and move in the right direction than be fast and wrong, while she said they will be ready to move on rates when there is clear and convincing evidence. Furthermore, she would like to be pre-emptive and action-oriented when possible, but noted it is hard given uncertainty over tariffs and other policies.

- US Treasury Secretary Bessent urged Congress to raise the debt limit by mid-July and expects the debt limit to be hit in August.

- Punchbowl Reports that US Clean energy tax credits from the Inflation Reduction Act are in for a massive overhaul as part of the GOP tax bill.

Tariffs/Trade: In one line: US and China agree to bring down reciprocal tariffs by 115ppts for 90 days, sparking immediate risk on price action; DXY, ES, Crude bid; XAU & Fixed hit

- US-CHINA JOINT STATEMENT: US to cut tariffs of Chinese goods to 30% from 145% for 90 days; China to cut tariffs on US goods to 10% from 125% for 90 days.

- US will modify the application of rate of duty on articles of China by suspending 24ppts of that rate for an initial period of 90 days.

- US will retain the remaining rate of 10% on those articles; China to retain the remaining ad valorem rate of 10% and remove modified rate.

CHINA’S STATEMENT ON U.S.

- China’s Statement on US: Commerce Ministry says it is to suspend 24% of additional ad valorem tariffs for an initial period of 90 days on trade talks with the US; says it will retain the remaining additional ad valorem rate of 10% China will adopt all necessary administrative measures to suspend or remove the non-tariff countermeasures taken against the United States since April 2. China says two sides will establish a mechanism to continue discussions about economic and trade relations. Parties commit to take the actions by May 14.

- China on trade talks with US: Parties will establish a mechanism to continue discussions about economic and trade relations.

US TREASURY SECRETARY BESSENT

- US Treasury Secretary Bessent says neither the US or China want to decouple.

- Says they have come to an agreement on a 90-day pause and substantially moved down tariff levels. Both sides on reciprocal tariffs will move down by 115ppts Very good personal interactions.

- Says there was no discussion on currency with China.

- Says the UK and Switzerland have moved to the front of the queue; EU is much slower.

USTR GREER

- USTR Greer says both sides committed to the 90-day pause period. Effective embargo was not a sustainable practice for both sides.

- Fentanyl issue remains unchanged as it stands. On a positive track, having very constructive conversations.

- Final result is very good for the US and China. Constructive path forward for a positive conversation with the Chinese.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week with mild gains amid hopes related to a US-China trade deal after substantive progress was said to have been made during talks in Switzerland over the weekend, but with gains capped given a lack of details announced so far and with the sides to provide a joint statement later today. ASX 200 was led higher by the commodity-related sectors with outperformance in energy after the recent oil rally. Nikkei 225 advanced at the open with the help of a weaker currency but then briefly wiped out all of the gains with pressure seen in pharmaceuticals after US President Trump announced he will sign an executive order on Monday with prescription drug and pharmaceutical prices to be reduced almost immediately by 30%-80%. Hang Seng and Shanghai Comp were underpinned following US-China trade talks over the weekend in which both sides noted that progress was made and they agreed to establish a China-US trade consultation mechanism, although further upside was capped given the actual lack of details and after Y/Y Chinese CPI and PPI remained in deflation.

Top Asian News

- Japanese PM Ishiba said the government was ready to take further measures to cushion the economic impact from higher US tariffs but suggested that a cut in Japan’s consumption tax was unlikely, according to Reuters.

- China April vehicle sales +9.8% Y/Y (prev. +8.2%); Jan-April +10.8% Y/Y (prev. 10.2%)

European bourses are broadly in positive territory with sentiment in Europe boosted after the US and China agreed to lower tariff levels by 115ppts each for a period of 90-days. The announcement sparked immediate upside across the equities complex, and now currently resides just off highs; DAX 40 +1.2%, Europe paring given Bessent’s “EU is much slower” language. To recap the main points; 1) US to cut tariffs on Chinese goods to 30% (prev. 145%) for 90 days, 2) China to cut tariffs on US goods to 10% (prev. 125%) for 90 days, 3) Bessent said both sides came to an agreement, 4) there was no discussion on currency with China, while fentanyl remains an issue. European sectors are mostly firmer, with the risk-tone boosted after the aforementioned US-China talks. The typical cyclical sectors outperform today, with the likes of Basic Resources and Autos leading whilst Utilities is towards the foot of the pile. Healthcare underperforms in Europe today, with pharma names broadly in the red after US President Trump said he will sign an executive order on reducing the price of prescription drugs, by 30-80%. Roche (-3.2%), AstraZeneca (-3.5%).

There is some underperformance in Novo Nordisk (-5.9%) after Eli Lilly’s study suggests Zepbound outperforms Novo’s Wegovy for weight loss.

Top European News

- BoE’s Lombardelli says underlying inflation pressure for the UK have continued to fall; sensible to continue gradual pace of cutting rates “When thinking about the process of disinflation, my focus is on wages, as they are the largest component of the prices set by domestic services firms, and so a key driver of moves in underlying inflation. Wage growth is still too high to be consistent with inflation at target.” “Productivity growth has been very low over the past couple of years… but that hasn’t been reflected in a substantial decline in wage growth.” “caution remains appropriate. I’ll be more comfortable when I see material deceleration in the data over a longer period.” Domestic inflation progress, not US tariffs, was the main factor behind the vote in May to cut by 25bps; though, US tariffs added to the reasoning.

- ECB’s Schnabel said the ECB should keep a steady hand and rates should be held close to where they are now.

- ECB’s Vujcic expects inflation to slow the ECB’s 2% target by year-end, according to Bloomberg.

FX

- DXY is stronger after the US-China deal. Immediate upside seen on the release of the US-China joint statement following trade talks over the weekend, with the two sides agreeing to slash reciprocal tariffs by 115ppts each for a period of 90 days, marking a 30% levy on China (from 145%), and a 10% levy on the US (from 125%). DXY has spiked to a 101.81 intraday peak at the time of writing from a 100.50 base overnight, with the index eyeing its 50 DMA (101.94) ahead of 102.00. USD/CNH slumped under its 200 DMA (7.2213) to a 7.1983 trough from a 7.2400 intraday peak.

- EUR is bearing the brunt of the dollar’s strength, alongside some loss of the appeal it gained during the loss of US confidence earlier this year. Furthermore, US Treasury Secretary Bessent noted that talks with the EU on trade are slow. EUR/USD slipped to a 1.1083 low from a 1.1242 peak, eyeing its 50 DMA (1.1074) to the downside.

- Traditional havens slumped amid a broader outflow from safety and into risk assets following the aforementioned constructive US-Sino updates. USD/JPY shot higher to a 148.22 peak (vs 145.71 low), with the 200 DMA seen at 149.69.

- GBP has been hit by the Dollar strength on the aforementioned US-China news, with no reaction seen to BoE’s Lombardelli, who suggested it is sensible to continue the gradual pace of cutting rates, but caution remains appropriate. Several BoE speakers due today with BoE’s Greene on monetary policy with a text release at 11:30 BST, BoE’s Mann with a text release at 13:50 BST, and BoE’s Taylor at 17:00 BST.

- Antipodeans are subdued by the surge in the Dollar, but losses are largely cushioned by the antipodeans’ high-beta properties and amid optimism as China receives a 115ppts reprieve on reciprocal tariffs.

- PBoC set USD/CNY mid-point at 7.2066 vs exp. 7.2429 (Prev. 7.2095).

Fixed Income

- Today’s session began with a bearish bias as APAC trade was focussed on the initial language coming out of the US-China talks and source reporting around it, remarks/reports pointed to a positive outcome.

- Thereafter, the US-China joint statement and accompanying separate press conferences saw 115ppts of reciprocal measures removed by both sides (US now 30%, China now 10%) for a 90-day period. An update which sparked immediate and continuing pressure in the fixed income space.

- Specifically, USTs down to a 110-06 trough from 110-13+ pre-release.

- Bunds reacted to the above, sending Bunds lower by over 30 ticks at/just after the joint statement. Since, it hit a 129.92 low vs 130.49 open levels. However, as the European risk tone comes off best and equity bourses/futures in the region give back much of the upside, EGBs have lifted off lows by around 15 ticks. A lifting in EGBs that has seemingly occurred as participants digest the language from US officials regarding the EU. Specifically, Bessent said that while the UK and Switzerland have moved to the front of the queue, the EU “is much slower”.

- Gilts are in-fitting with the above, gapped lower by 58 ticks as the statement coincided with the open itself. Thereafter, slipped to a 91.69 base in-fitting with broader price action. Remained in very close proximity to that low since.

Commodities

- Immediate upside in crude benchmarks on the US-China joint statement, which, in short, reduced reciprocal tariffs by 115ppts each; the US to cut tariffs on Chinese goods to 30% from 145%, and China to cut tariffs on US goods to 10% from 125%; both for 90 days.

- Precious metals hit by the surge in the Dollar alongside outflows out of safe havens on the back of the aforementioned US-China trade updates, with the yellow metal unwinding much of the risk premium that was woven in during the tit-for-tat tariff increases between the US and China earlier this year. Spot gold slipped from a USD 3,324.73/oz peak to a USD 3,215.76/oz low at the time of writing.

- Base metals are boosted by sentiment amid the aforementioned positive US-China joint statement, with not much more to add, although upside is somewhat hampered by the surge in the Dollar and relatively subdued Chinese inflation data released over the weekend. 3M LME copper resides towards the upper end of a USD 9,577.00-9,577.00/t.

- Morgan Stanley downgrades European Energy sector to Cautious from In Line.

- Saudi Aramco reported Q1 (USD) profits fell 4.6% Y/Y to 26bln, and rev. rose to 108.1bln (prev. 107.2bln Y/Y), while it stated that global trade dynamics affected energy markets in Q1 with economic uncertainty impacting oil prices.

Geopolitics: Middle East

- “Israeli media: The army will cease fire in Gaza as of 12 noon local time [10:00 BST]”, via Al Arabiya.

- Senior Palestinian official said Hamas was in talks with the US administration regarding a Gaza ceasefire and aid. It was later reported that Hamas said it will release the last US hostage in Gaza as part of efforts to reach a Gaza ceasefire and allow humanitarian aid.

- Israeli PM Netanyahu’s office said the US informed Israel of Hamas’s intention to release Edan Alexander without any compensation or conditions and the US informed Israel that the move is expected to lead to negotiations for the release of further hostages, while Israel’s policy is that negotiations will be conducted under fire with a continued commitment to achieving all war objectives. PM Netanyahu later said that Israel has not committed to any ceasefire or prisoner release with Hamas, but only to a safe corridor for release of Edan Alexander, and negotiations for the release of other hostages will continue while preparations are made to intensify fighting in Gaza.

- Israeli army carried out major bombing operations in the city of Rafah, Southern Gaza Strip, according to Al Jazeera.

- Israel’s military issued evacuation warnings to people present in three Yemeni ports of Ras Isa, Hodeidah and Salif, while the Houthi interior minister said that Israel conducted an attack on Hodeidah.

- US envoy Witkoff held direct and indirect talks with Iran in Oman and an agreement was reached to move forward with talks to continue working through technical elements, according to a senior administration official.

- The fourth round of Iran-US nuclear talks was conducted in Oman which Iran’s Foreign Minister Araqchi said were more serious compared to previous rounds and talks are moving forward, while he stated that “now both sides have a better understanding from each others’ views” but added that Tehran’s uranium enrichment program is non-negotiable.

- Iran’s Foreign Minister Araqchi said Tehran continues nuclear talks with the US in good faith and Iran will not back down from and of its rights if the US goal of talks is to deprive Iran of its nuclear rights, while he added a nuclear agreement is possible if the US aim is non-proliferation of nuclear weapons and Oman’s Foreign Minister noted that the next round of talks will take place after both sides have consulted with their respective capitals.

- PKK, Kurdish militant group, has decided to dissolve itself and conclude the armed conflict with Turkey, via Reuters citing a group-affiliated agency.

Geopolitics: Ukraine

- Ukraine and European leaders said they agreed to an unconditional 30-day ceasefire on sea, land and air starting on May 12th and peace negotiations will start in that period if there is a ceasefire, while they said if Russia fails to comply, they will respond with massive sanctions and increased military aid.

- Ukrainian President Zelensky said it is a positive sign that the Russians have finally begun to consider ending the war and the very first step in truly ending the war is a ceasefire. It was separately reported that Zelensky said Ukraine is ready to meet and he expects Russia to confirm a ceasefire beginning May 12th. Furthermore, Zelensky said Ukraine awaits a full ceasefire starting on Monday to provide a necessary basis for diplomacy and he will meet with Russian President Putin on Thursday in Turkey, and noted that the ceasefire beginning on Monday remains on the table and that Ukraine is awaiting a response from Russia but also noted that Ukraine will be ready to respond symmetrically if Russia violates the ceasefire.

- Russian drone attack on Ukraine rail infrastructure targets civilian freight train, injures locomotive driver, according to Ukrainian Railways which added that Russia is not observing Ukraine’s proposal for ceasefire.

- Ukraine’s Foreign Minister said President Zelensky and visiting European leaders had a phone call with US President Trump on Saturday, which was constructive and they discussed peace efforts.

- Russian President Putin offered Ukraine to resume direct negotiations and talks will begin on May 15th in Istanbul with no pre-conditions. It was also reported that Kremlin aide Ushakov said proposed peace talks in Turkey will take into account the situation on the ground and 2022 negotiations.

- Russian President Putin held a call with Turkish President Erdogan and they discussed in detail an initiative to resume direct Russian-Ukrainian talks in Istanbul, while Turkish President Erdogan told French President Macron in a phone call that Turkey is ready to host negotiations for a ceasefire and permanent peace between Russia and Ukraine.

- Russian Defence Ministry said Russian troops continued the special military operation after the Victory Day ceasefire ended and Ukrainian troops made five attempts to break through the border in Kursk and Belgorod regions during the ceasefire. It was also reported that Russia launched an air attack on Kyiv and that a Ukrainian missile attack injured three in the town of Rylsk in Russia’s Kursk region.

- US President Trump posted on Truth that Ukraine should agree to meet with Russian President Putin on Thursday to negotiate, while he stated that he was starting to doubt that Ukraine would make a deal with Russian President Putin.

- Polish PM Tusk said the Russian secret service was behind the fire that almost completely destroyed a Warsaw shopping centre in May 2024.

Geopolitics: India-Pakistan

- India’s Foreign Ministry said Pakistan’s Director General of military operations called on Saturday and it was agreed that both sides would stop firing, while Pakistan’s Foreign Minister said this is not partial and it is a full-fledged ceasefire understanding between the two countries.

- India’s Foreign Secretary said Pakistan violated the ceasefire and that Indian armed forces responded, while the official said they call on Pakistan to halt the violence and India’s armed forces have been given the instruction to deal with violations along the border.

- Pakistan’s military said dozens of its armed drones hovered over major Indian cities including Delhi and 26 military targets and facilities were hit in India during operations carried out on Saturday.

- Pakistan’s Foreign Minister Dar spoke with Chinese Foreign Minister Wang and China reaffirmed it will continue to stand by Pakistan in upholding its sovereignty and territorial integrity.

- US President Trump said he will increase trade substantially with both India and Pakistan, while he said he will work with both to see if a solution can be reached concerning Kashmir.

US event calendar

- 2:00 pm: Apr Federal Budget Balance, est. 256b, prior -160.53b

Central Banks (All Times ET):

- 10:25 am: Fed’s Kugler Speaks on Economic Outlook

DB’s Jim Reid concludes the overnight wrap

I’m off to the West Coast this morning. LA and San Fran rather than Cornwall or Wales, although I think the latter two are warmer than the former two at the moment. I coached my first U8 cricket match over the weekend in glorious sunshine and my record as coach is now 100% positive. I saw enough weaknesses though to suggest that record might not last forever. Hopefully the board give me time to work my own ideas into the team.

Let’s start with all the weekend news which includes “positive” US/China trade talks, a Ukrainian and European (and US backed according to Macron) 30-day ceasefire plan for the war, and an Indian/Pakistan ceasefire (mediated by the US). The US/China talks seemed to go well but remember with tariffs currently at 145% and 125% it doesn’t take much to improve the situation. Treasury Secretary Bessent and Greer (US Trade Representative) suggested “substantial progress” was made even if neither side has announced any specific measures. China’s Vice Premier He Lifeng stated that both sides had reached an “important consensus” and agreed to launch another new economic dialogue forum. Bessent had indicated that the US and China will jointly provide details on the progress at some point today so we will see if we get this.

On the war in Ukraine, Zelenskiy and European leaders have demanded a 30-day ceasefire from today to allow for negotiations. If this doesn’t happen Russia will face new sanctions that the US has seemingly approved according to Macron. Putin in return has countered and agreed to talks in Turkey with Ukraine on Thursday without addressing the ceasefire issue. Rather ambiguously Mr Trump said that Ukraine should “IMMEDIATELY” agree to the talks, as “at least they will be able to determine whether or not a deal is possible”. So we do seem to be moving towards talks but it’s unclear on what terms.

Elsewhere, after four days of tense clashes that pushed India and Pakistan close to war, a ceasefire appears to be holding after being announced on Saturday. The US played a role in encouraging a de-escalation, facilitating behind-the-scenes talks that led to the agreement between the two nuclear-armed nations. The NIFTY 50 has surged +2.88% as I type in early trading.

Moving to broader Asian markets, equities are edging higher on all the weekend news. Chinese stocks are outperforming with the Hang Seng (+0.93%) leading gains while the CSI (+0.62%) and the Shanghai Composite (+0.37%) are also trading in positive territory. Elsewhere, the KOSPI (+0.65%) and the S&P/ASX 200 (+0.22%) are also trading up while the Nikkei (+0.04%) is fairly flat. S&P 500 (+1.46%) and NASDAQ 100 (+1.95%) futures are rallying harder on the trade progress though with 10yr USTs +2.7bps higher, at 4.406% as we go to print.

In terms of economic data over the weekend, China’s factory-gate prices (-2.7% y/y) posted the steepest drop in six months in April, worse than a -2.5% decline in March while “better” than Bloomberg’s forecast for a -2.8% decline. At the same time, consumer prices eased -0.1% y/y last month, matching a -0.1% drop in March and the Bloomberg forecast.

Staying with inflation, the main event this week will be US CPI tomorrow but generally we start the April hard data reporting cycle now and it’ll be interesting to see any early impact of Liberation Day. It might be a bit too soon but watch CPI and PPI (Thursday), US Retail Sales (also Thursday) and Consumer Confidence and Housing Starts and Permits (both Friday), alongside some regional manufacturing surveys in the US. Within the Consumer Confidence data the inflation expectations will continue to be very important and something the Fed are looking at. Talking of which, Powell speaks on Thursday.

Moving on to European data, this week’s highlights include March’s monthly GDP (Thursday) and labour market indicators (tomorrow) in the UK and the May ZEW survey in Germany (also tomorrow). Over in Asia, Japanese Q1 GDP (Friday) is the highlight (DB expect -0.4% QoQ annualised) but the BoJ summary of opinions from the April meeting is also out tomorrow. The full day-by-day week ahead is at the end as usual.

Looking into the main US upcoming data in more detail, for US CPI tomorrow, DB expect the headline (+0.26% forecast vs. -0.05% previous) number to be slightly below that of core (+0.29% vs. +0.06%) with consensus for both at 0.3%. Both DB and consensus expect the YoY rate to remain unchanged at 2.4% and 2.8%, respectively. One of the main reasons our economists are expecting a firm core goods print is due to strong gains in vehicle prices after robust new vehicle sales in recent months. The risk to this month though is that dealers refrained from price rises in April knowing that with tariffs coming they will have to raise them soon. So we know auto price rises are coming but it may not be April.

Indeed April overall may be too early for tariff price rises to show up but our economists advise looking out for any early signs in some of the import-heavy categories such as apparel and household furnishings and supplies. In addition food prices could be another place to look for any early signs of the tariffs that went into place in February. Our economists note, that the effects from the washing machine tariffs in early 2018 took about two months to start showing up in the CPI data. Regular readers will note that perhaps I need to buy my new tumble dryer quickly.

For PPI on Thursday, DB and the consensus expect a 0.3% monthly print on headline and core but we’ll pay more attention to the components that feed into core PCE as usual. Retail sales on the same day will be the other big release of the week. Our economists expect slight dips in auto sales and gasoline prices to weigh on headline (unch. vs. +1.5%) and ex-autos (+0.2% vs. +0.6%) sales. However they expect retail control (+0.4% vs. +0.4%), which feeds into GDP, to remain solid. The potential curveball is if consumers have front loaded purchases ahead of tariffs and we get strong data. Thursday is a busy day as Powell speaks and this will provide him with an opportunity to comment on the data if he’s sees anything meaningful within it. So one to watch especially given that Powell said last week that “we don’t know which way this is going to shake out”.

Quickly rounding out events in politics, there will also be Eurogroup (today) and Economic and Financial Affairs Council (tomorrow) meetings in Brussels. An informal gathering of NATO foreign ministers will take place in Antalya on May 14-15. In Asia, APEC trade ministers meet in South Korea on May 15-16 and the sixth meeting of the European Political Community will take place in Albania on Friday.

Recapping last week now and the risk-on tone continued at a global level, with markets mostly seeing a further unwind of their moves since Liberation Day. That was driven by several factors, including hopes for a de-escalation between the US and China, not least given the news that they’d be starting talks in Switzerland. That was further support by the deal the US reached with the UK, raising hopes that further agreements might follow shortly. Then on top of that, several data releases continued to point away from a recession, which gave a further boost to support risk appetite. For instance, the ISM services index unexpectedly rose to 51.6 in April, whilst the weekly initial jobless claims fell back to 228k as well.

That backdrop generally proved supportive for markets, with several equity indices moving higher last week. That included the DAX, which hit a new record as it posted a fourth consecutive weekly advance, rising +1.79% (+0.63% Friday). Similarly in Japan, the Nikkei also posted a fourth weekly gain, up +1.83% (+1.56% Friday). However, the main exception to this pattern were actually US equities, with the S&P 500 down -0.47% over the week (-0.07% Friday).

More broadly, there were several other signs that stability was returning to markets. For instance, the VIX index of volatility fell to its lowest level since Liberation Day, closing at just 21.90pts on Friday. Credit spreads tightened further, with US HY down -9bps last week (+1bps Friday) to 343bps. Other risk assets climbed as well, and Bitcoin ended Friday at $103,195, which was its highest level since January. Meanwhile, Brent crude oil prices recovered from their 4-year low at the start of the week, moving up +4.27% over the week as a whole to $63.91/bbl.

Finally, the risk-on move put sovereign bonds under pressure, and yields moved higher as the Fed’s latest meeting signalled they weren’t in a rush to cut rates. That helped push the 10yr Treasury yield up +7.0bps (flat on Friday) to 4.38%, and the 2yr yield also rose +6.7bps (+1.6bps Friday) to 3.89%. Over in Europe, the 10yr bund yield also rose +2.9bps (+2.9bps Friday) to 2.56%. And over in Japan, the 10yr bond yield was up +10.5bps, closing at 1.37%.

Loading…