Authored by Christina Dass, Bloomberg Markets Live reporter and strategist

Traders are growing increasingly worried that this year’s stock-market rally may be all but over.

The S&P 500 Index just posted its biggest weekly range since June, and Nvidia’s good results as well as Jensen Huang’s reassurances that artificial intelligence isn’t in a bubble did little to calm investors’ nerves. Meanwhile, Bitcoin has lost about one-third of its value since hitting a record high last month, and concerns are growing over the pace of Federal Reserve cuts.

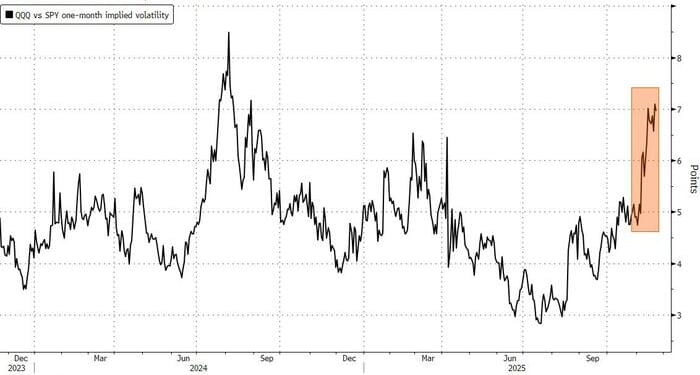

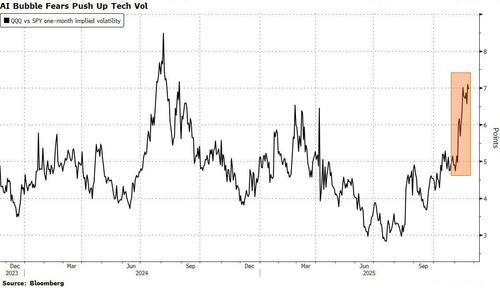

While the S&P 500 is still up more than 12% this year, traders are paying up to lock in gains, especially when it comes to tech. The cost of options on the Invesco QQQ Trust Series 1 exchange-traded fund is hovering near its highest level since August 2024 versus that for the SPDR S&P 500 ETF Trust.

Tech jitters came to the fore on Thursday, when an early surge following Nvidia’s earnings quickly reversed. That day, the market had its wildest peak-to-trough move since April 8, at the height of the tariff selloff, and the VIX closed at its highest level since April.

“Whoever bought puts yesterday at the top can retire today,” Vuk Vukovic, chief investment officer at Oraclum Capital, a hedge fund active in the short-dated options market, joked on Friday. Moments of market stress like the down day on Thursday are “good for us,” he said, “because when you’re buyers of vol and vol explodes, that’s when you make the most returns.”

He noted that option sellers did not step into the market until Friday, sending the VIX lower. Vukovic expects volatility to compress once again before Christmas, though he forecasts one more surge before the end of the year.

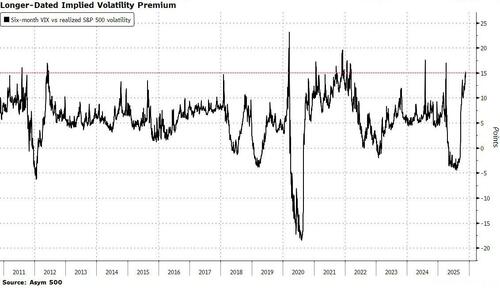

Volatility risk premium — the gap between implied and realized swings — remains relatively high, said Asym 500 founder Rocky Fishman. He pointed out in a note to clients that the six-month VIX has rarely been at a larger premium to realized six-month S&P 500 volatility.

Barclays equity-derivatives strategists including Stefano Pascale called the drawdown “fairly contained,” but they found it “a bit puzzling” given the resilient economic picture and strong earnings results, especially from Big Tech. In a note last week, they concluded that AI bubble fears and reduced bullish sentiment from retail traders triggered the selloff, highlighting concerns surrounding capital expenditures.

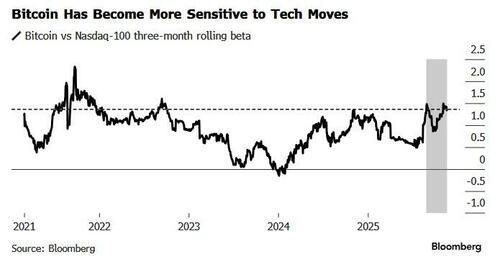

The latest slump in tech coincided with a plunge in Bitcoin, whose sensitivity to the Nasdaq 100 Index has increased in recent weeks.

“The correlation is very high with leveraged Nasdaq,” said Vukovic, referring to funds like the ProShares UltraPro QQQ ETF. Wall Street options traders view Bitcoin as a pure risk asset, rather than the hedge against market volatility that the cryptocurrency was once viewed as, he said.

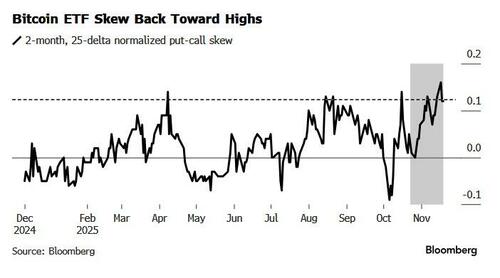

Just as in QQQ, the put skew — reflecting the cost of hedging against slides — has risen for the iShares Bitcoin Trust ETF, signaling that investors are concerned about more declines. The fund, known by its ticker IBIT, has lost almost $2.2 billion in assets in November after more than $27.6 billion in inflows this year.

On Friday, an investor bought $43 puts in the ETF, financed by selling $52 calls — a position hedging against a Bitcoin decline below the early-April lows. The so-called risk reversal would allow the trader to sell 10 million shares of IBIT on a further 9% drop in the next four weeks, while risking being caught short on a rebound.

Late in the week, some traders were starting to cash in bets on higher volatility, as has often been seen after big price swings. More than 250,000 VIX December 25/30 call spreads were sold on Thursday and Friday, according to market participants. Based on open interest data, the trades appear to be closing out a position that was put on in early November.

“I wouldn’t say that people are in a rush to monetize hedges, otherwise you wouldn’t have a very large volatility risk premium,” Fishman, a former Goldman Sachs Group Inc. strategist, said in an interview. “I think that for all the hedge monetizers there are probably people who are putting on more protection at the same time.”

Loading recommendations…