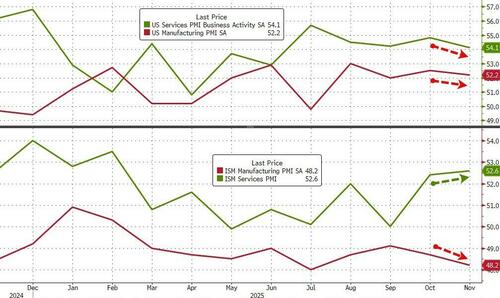

Following the disappointment on the Manufacturing PMI side (both S&P Global and ISM seeing their surveys decline in November), US Services surveys were more mixed in the face of ‘strong’ hard data (that has been largely absent due to the shutdown).

-

S&P Global US Services PMI dropped from 54.8 to 54.1 in November (lowest since June and notably worse than the flash print of 55.0)

-

ISM US Services PMI rose from 52.4 to 52.6, solidly better than the 52.0 expected.

Source: Bloomberg

Under the hood was also mixed (completely opposite) news with ISM seeing Prices Paid dropping bigly (S&P Global seeing it rise), ISM seeing new orders decline (S&P Global seeing improvement) and ISM seeing employment still contracting (S&P Global sees ‘solid increase’ in employment)…

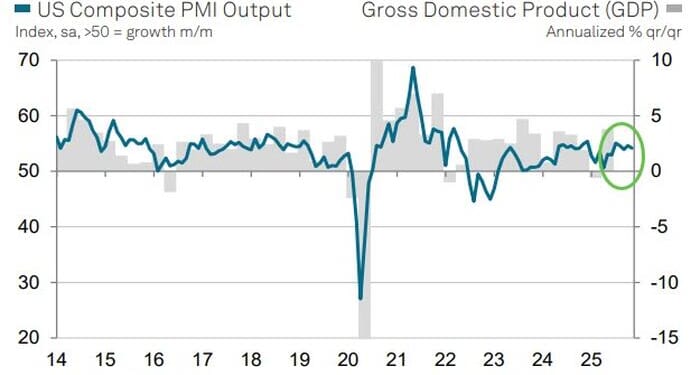

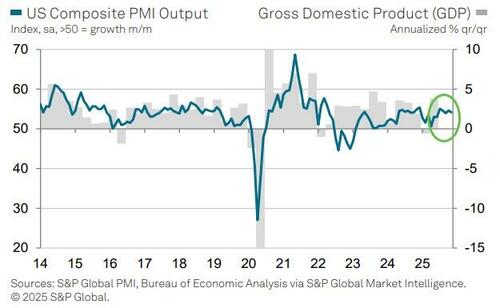

The S&P Global US Composite PMI posted 54.2 in November. That was little changed overall on October’s 54.6 and consistent with trend growth of the US private sector economy.

Similar rates of expansion were recorded across the manufacturing and service sectors. Latest data showed the strongest growth in new work for three months, which helped support a solid increase in employment. Meanwhile, input price inflation accelerated to a four-month high whilst output charges also rose at a stronger pace.

“The US service sector has reported another strong expansion in November, with demand for services rising at the fastest rate seen so far this year,” according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

“Together with a robust increase in output reported by the manufacturing sector, the survey indicates that the economy is so far expanding at a 2.5% annualized GDP growth rate in the fourth quarter.“

Supportive financial conditions, including lower interest rates and the equity market gains seen this year, are helping drive the sustained resilience of the economy, with Williamson noting a further surge in financial services activity reported in November.

Tariff fears remain top of mind…

“Consumer and business services are also continuing to expand, but report pressure on customer demand from affordability issues in particular. Worryingly, prices charged for services rose at an increased rate in November as firms sought to pass on higher costs, in turn often linked to tariffs.

“The concern is that rising prices could deter further rate cuts, in turn dampening the financial services expansion which has been doing much of the heavy lifting in terms of the sustained economic expansion in recent months.

But there is some optimism…

“More encouragingly, November saw an upturn in business expectations of growth over the year ahead compared to October, though this in part merely reflected some relief at the ending of the government shutdown, and some of this improved sentiment appears to have already faded towards the end of November.”

Overall, it’s choose your own adventure…

…with something for both the doves (weakening survey headline data) and the hawks (economy still expanding and tariff-driven inflation fears high).

Loading recommendations…