Submitted by QTR’s Fringe Finance

If there’s one thing I’ve learned over the last decade being involved with capital markets, it’s that psychologically, market participants don’t change their tune or their optimistic outlook easily.

More than once, I’ve seen situations where it appeared blindingly obvious to me that both markets and the economy were heading for a crash landing, but the market did not budge in the slightest, nor did its investors.

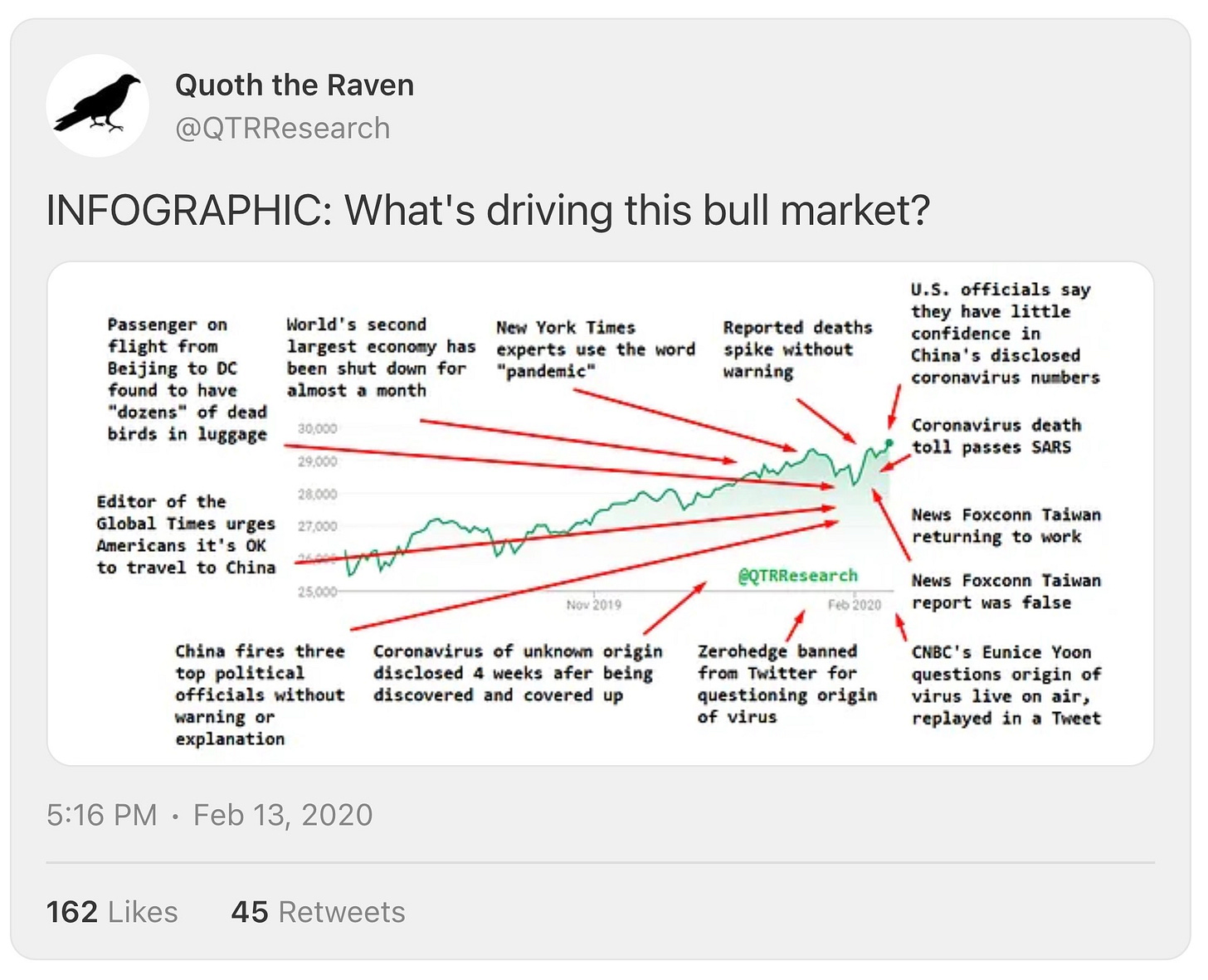

The most recent example of this was Covid. While I sat by and watched the case count grow, and government officials and analysts pretend as though nothing was happening and nothing would change, all the stock market did was go straight up—even as late as February 2020.

I’ve learned that the market’s default setting is somewhere between blindingly optimistic and extremely irrational hubris and euphoric exuberance. We can thank years of 0% interest rates for this. The new reality is that it takes a tidal wave of bad news to break the psychological backs of market participants. And even then, the market appears to be resilient in its default setting of ignoring valuations and reality in general, so that computers can continue to bid up stocks and retail can continue to goose the markets higher, weaponizing call option gamma as fuel.

We are another living, breathing case study of this as we speak.

Markets tanked over the last couple of weeks because of a reality they couldn’t ignore—namely, astronomical tariffs applied willy-nilly to every country on the face of the Earth—presented to them in a way even the most lobotomized market participants couldn’t ignore: President Trump stood there with a big f*cking chart with the numbers on it and waved it in front of their blank faces while assuring them it was going to happen.

Despite months of TariffTalk™, the market finally had no choice but to swallow and digest this pill because it was presented in such a way that they could no longer ignore.

With Covid, we saw a similar quick sell-off in the markets, along with a spike in volatility, only when the reality of the pandemic was also presented to us in a way we couldn’t ignore: people were beating the sh*t out of each other in the aisles of Costco over toilet paper.

As we’ve seen over the last week or two, markets have rebounded under the guise that tariff and trade deals are being put in place, and that the adults in the room have it all under control somewhere in the background. I don’t know whether or not this is the truth, but it goes to show you that the market is an pornographically optimistic forward-looking indicator because, in the absence of any solidified deals, stocks are trading as though all of the tariff problems created less than a month ago have been solved. They haven’t been.

This leads me to my next point: we may soon be in for another one of those blindingly obvious pills of reality to swallow and digest.

They say history doesn’t repeat, but it rhymes. And I’m no senior vice president at Goldman Sachs, nor am I some PhD opining on macroeconomics, but it is not lost on me that reports of China shipping fewer goods to the United States will eventually hit shelves.

Cargo shipments from China to the U.S. have plummeted since Washington hiked tariffs to 145% in April, with some estimates pointing to a drop as steep as 60%. The sharp decline is being blamed on businesses scrapping orders and postponing deliveries in a bid to sidestep the steep cost increases triggered by the tariff spike.

Just as we saw during Covid, there is a lag between supply chains shutting down and the effects of the shutdown hitting store shelves. As we did back in 2020, stores are going to have to run through all of their current inventory before shelves start to turn up empty. But they eventually do turn up empty.

Out of all the trade deals we’re likely going to strike, China is probably going to come last. They are the crown jewel of trade deals due to the amount we consume from them, but they’re also likely going to be the toughest negotiators with President Trump. We’re talking about a country that welded its people into apartment buildings during Covid—which is to say more about the grit of the common citizen in the country than it is about the authoritarian government. But regardless, both the government and its citizens are far grittier than the United States and will not be the first to fold globally in our trade war against them.

I’m optimistic about the United States working things out with other major trading partners like Japan and India. But for China, the posturing of their government makes it clear that they are not going to be the ones to back down from the standoff they are currently in. In fact, my prediction is that President Trump or someone in his cabinet will float a made-up, fabricated concession by China and then use that as the impetus to be the first to lower our restrictions against them, in an attempt to put a PR spin on the fact that we are reluctantly going to have to be the first to give ground.

And to be frank, I don’t really care too much about that. There’s not going to be such a focus on keeping up appearances if the United States can successfully renegotiate a number of its trade deals, which I believe it is going to.

But again, the deal with China is likely going to be the last one hashed out.

In the interim, you have once again an overvalued stock market operating on top of an economy that, at least in the short- to mid-term, has had its best days behind it, in my opinion. Personal savings continues to dwindle, credit card delinquencies continue to rise, the American consumer continues to be tapped out, and tariffs and supply chain issues are going to act as great excuses for companies that want to make job cuts and need to put a public relations spin on it. The job numbers — lagging indicators of their own — will eventually reflect this.

And while I think the market is in the midst of a bear market rally, and that valuations will indeed wind up having to contract further, the catalyst of the economy and the consumer crumbling might take months or quarters more to play out. What won’t take that long to play out, in my opinion, is the average American citizen walking into their local Target and once again finding the shelves are empty, akin to the way they were during Covid.

You’ve heard the saying “Everybody has a plan till they get punched in the mouth”? It means that people start to panic once they are confronted with a reality that they can no longer avoid. For people like me and my readers, we try to look ahead at least a couple of weeks or months to try and figure out what the economy or markets will be doing. For the average retail investor and everyday American, they’re only watching what happens on a day-to-day basis.

For those of us that looked ahead during Covid, the shortages weren’t an issue at all. I had a basement full of toilet paper and hand sanitizer (and lots and lots of whiskey). For everybody else who woke up one morning too late and decided they wanted to stock up on toilet paper, it became like storming the Costco beaches at Normandy.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life: Get 50% off forever

The same thing can happen now. I don’t know a lot of ways to jar the average, barely-conscious, brainless, thoughtless American consumer automaton out of their hypnotized stroll down the primrose path, but making their iPhone 16, preferred brand of lip filler or cheap wooden “Live, Laugh, Love” signs unavailable is a great start.

Any day now, people are going to start turning up at their favorite shops to buy the everyday garbage hat they need think they need and they’ll once again be reminded that the cheap consumer crap feedbag doesn’t just magically replenish and re-appear overnight thanks to the fairy godmother. And then, the only thought the average dolt is going to have—other than “My favorite cat food is unavailable, and so this must be the end of all life as we know it on Earth”—is the thought that “Things are bad. Stocks might go down.”

And then, we may have a repeat of what happened during Covid. Except this won’t be a one-time dip that eventually gets bid back without QE like we had during Covid. Instead, until such time, it has more of a chance of being a second jolt of reality that wakes the average investor up to the fact that U.S. stocks are overvalued and global stocks are extremely undervalued.

From there, it’s going to be difficult to ignore the fact that things aren’t exactly the way they were prior to the trade war. My guess is this puts markets on rocky enough footing that the economy will have enough time to crumble at the same time, and stocks may continue what started weeks ago—in my opinion, a long-term contraction in valuations and recalibration versus other global markets.

Then it’s only a matter of time before pesky things like math rear their heads. Remember that Treasury basis trade blowup we’re all pretending didn’t happen? The Yen carry trade? The CRE market? Subprime auto? And private credit markets? These are just some of the economic hemorrhoids set to burst during the next bout of “the tide going out”.

If I had to guess whether or not this rally is going to bring things back to “the way they were” before the trade war, I’d say that over the medium to longer term, those expecting another euphoric, random jam higher in stocks for no reason at all are going to be extremely disappointed.

As for me, I’ll be paying attention to my store shelves.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Loading…