Tesla shares slipped about 1.5% in early trading on Monday after Morgan Stanley cut its rating on the stock to Equal-weight from Overweight, even as the firm raised its price target to $425 from $410. With Tesla changing hands around $455 into the move, the new target implies modest downside and a more balanced risk-reward profile in the eyes of the bank’s analysts.

The downgrade also coincides with a notable change in coverage leadership. Longtime Tesla watcher Adam Jonas is no longer the primary analyst on the name. Coverage is now being assumed by a broader team led by Andrew S. Percoco.

Percoco and his colleagues frame Tesla as a clear global leader in electric vehicles, manufacturing, renewable energy and real-world artificial intelligence, but argue that the stock price has caught up with their base-case outlook for now. They assume coverage at Equal-weight with a $425 price target, which the team says implies roughly 6% downside from the prior close. Their stance is that Tesla is “deserving of a premium valuation” given its leadership position, but that “high expectations on the latter have brought the stock closer to fair valuation.” In practical terms, that means they expect a choppy trading environment over the next 12 months as they see downside risk to near-term estimates while many non-auto AI and robotics catalysts already appear reflected in the shares.

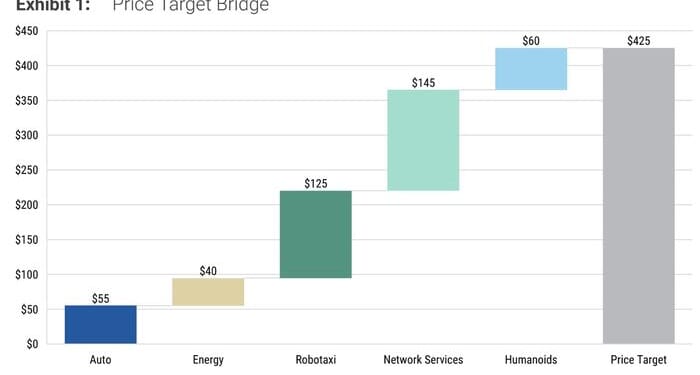

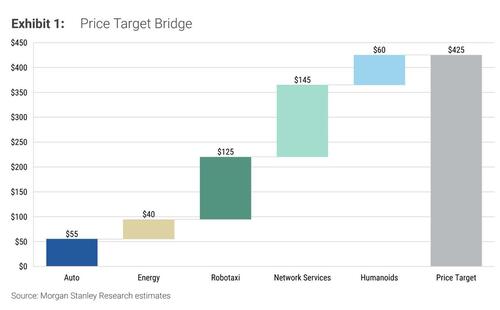

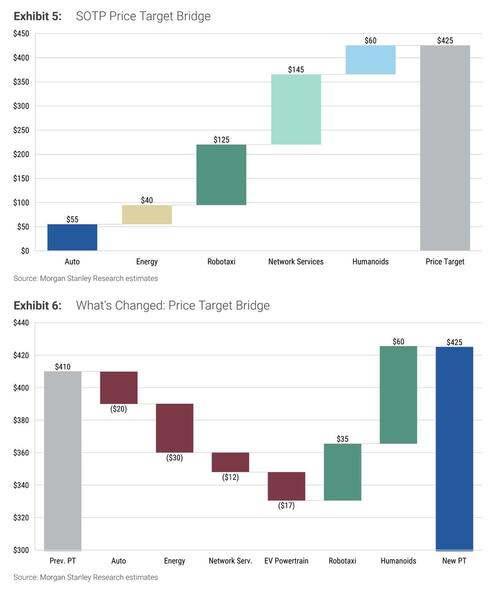

A central part of the new report is a complete refresh of Morgan Stanley’s sum-of-the-parts valuation framework for Tesla. Percoco’s team breaks the company into five pillars: the core auto business, the energy segment,

Network Services (including Full Self Driving), the Tesla Mobility robotaxi platform, and the Optimus humanoid robot business. In the new model, they assign roughly $55 per share of value to autos, $40 to energy, $145 to Network Services, $125 to robotaxis and $60 to humanoids, adding up to the $425 target. The mix reflects a deliberate shift: less credit for the auto and energy segments, and more emphasis on high-margin, software-driven and AI-enabled businesses.

On autos, the analysts still describe Tesla’s vehicle business as the financial engine that funds expansion into autonomy and robotics, but they have turned more cautious on the global EV backdrop. Their 2026 auto volume forecast now sits materially below the Street, and they have reduced long-term delivery assumptions through 2040 in light of a slower U.S. adoption curve and intensifying competition globally, particularly from Chinese manufacturers.

That feeds into a lower standalone valuation for the auto business than in Jonas’s prior framework, even though Tesla is still expected to maintain a meaningful share of the global EV market and improve margins over time.

By contrast, the team leans heavily into Network Services and Full Self Driving as key value drivers. They characterize FSD as the “crown jewel” of Tesla’s auto franchise and call its leading-edge personal autonomy platform “a real game changer,” arguing it will remain a significant competitive advantage over both EV and legacy peers as the system moves toward more hands-off, eyes-off functionality. In their long-term view, an expanding installed base of Teslas and rising penetration of FSD, charging, maintenance and content subscriptions create a high-margin, recurring revenue stream that justifies the $145 per share valuation they place on Network Services.

The robotaxi business, branded as Tesla Mobility in the report, is another important piece of Percoco’s long-term story. Working with Morgan Stanley’s global autos and internet teams, they have built a bottom-up, city-level model of autonomous ride-hailing in the U.S. The note argues that Tesla’s camera-only, vertically integrated approach can drive a structurally lower cost per mile than sensor-heavy peers, though it also acknowledges regulatory and weather-related hurdles to scaling the service. In the base case, the analysts assume a steadily growing robotaxi fleet and falling per-mile costs that eventually undercut traditional rideshare economics, supporting the $125 per share value they attach to this segment.

The energy business remains a structural growth driver in the model as well, supported by rising electricity demand from AI data centers and electrification, plus accelerating deployment of battery storage. However, Percoco and his team have dialed back their earlier assumptions on storage growth and terminal margins to align more closely with Morgan Stanley’s global clean-tech forecasts. Tesla is still credited with a leadership position in energy storage systems and a meaningful slice of future global deployments, but the resulting valuation contribution is more conservative at roughly $40 per share.

Perhaps the most speculative, but also most eye-catching, part of the note is the explicit valuation assigned to humanoid robots via Tesla’s Optimus program. The analysts draw on Morgan Stanley’s global humanoid research, which envisions a multi-trillion-dollar annual market for humanoid robotics by mid-century. In that context, they argue that Tesla’s advantages in AI training data, custom silicon, manufacturing scale and energy give it a credible shot at becoming a major player. Their model envisions Optimus scaling over decades to a large installed base of commercial and household robots with attractive margins. Even so, they haircut their own discounted cash flow output by 50% to reflect the early-stage uncertainty, landing at $60 per share of value inside the overall price target.

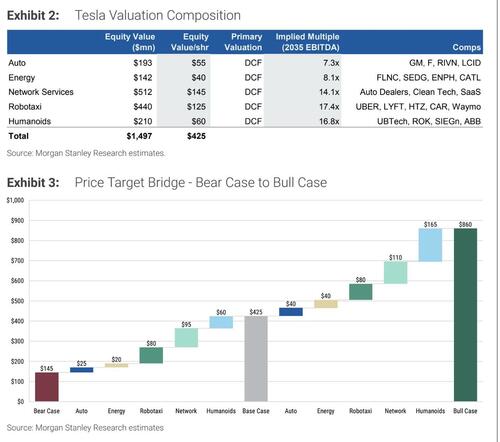

All of these pieces roll into a wide risk-reward range that Percoco and his colleagues lay out in the report. Their bull case, which assumes stronger EV growth, higher attach rates and margins in software and services, faster robotaxi scaling and a more favorable outcome for humanoids, reaches $860 per share. Their bear case, which bakes in tougher competition, more muted EV and energy growth, slower autonomy adoption and zero value for Optimus, falls to $145.

Against that backdrop, with the stock already discounting much of the AI and robotics upside and short-term earnings risk skewed to the downside, the new team is content to move Tesla to Equal-weight and “wait for a better entry.”

For investors, the immediate takeaway is that Morgan Stanley still views Tesla as a central player in what the firm has elsewhere dubbed the “Muskonomy” of interconnected AI and automation businesses, but is no longer willing to recommend the shares as a clear buy at current levels.

The downgrade from Overweight to Equal-weight, the shift to a team led by Andrew S. Percoco, and the sharper distinction between near-term headwinds and long-term AI optionality together help explain why the stock is trading lower in response this morning, even with the firm’s official price target moving higher.

Premium members can access the full 75 page note in the usual place.