Submitted by QTR’s Fringe Finance

As far as my macro outlook goes, I think I’ve been pretty clear: over time, I expect nominal prices of everything to drift—no, march—higher as governments and central banks eventually capitulate to the obvious: their only escape route from the irresponsible, slow-motion debt disaster they engineered is to quietly (or, recently, not so quietly) brutalize the middle and lower classes through inflation.

It’s not elegant, it’s not moral, but it’s historically reliable and gets politicians and bankers off the hook of taking actual responsibility—so of course it’s the easy choice.

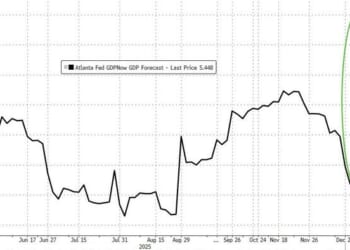

That said, for the last year or two I’ve also argued that once the consumer and the broader economy finally run out of steam, we’ll see a sharp deleveraging event. A quick, violent move lower—one that unwinds years of easy money, risk-free speculation, and the hilariously reckless funding of things that, in hindsight, will look indistinguishable from hot air. (Think: Fartcoin, Dogecoin, Ethereum treasury companies, cash burning SPACs or any other asset whose primary utility is generating memes. This blog excluded, of course.) The tidal wave of hubris and euphoria that’s defined the last decade eventually gets taken out back and put down. Frankly, it’s years overdue.

But—because I try not to permanently live inside my own echo chamber no matter how luxurious and genius-shaped it feels—I found myself thinking today about the “what if I’m wrong” bull case. Everyone knows the long-term bull case. I’m talking about the very short-term bull case. Is it possible we dodge the sharp deleveraging here and actually finish this year, and maybe even next year, much higher? Sure. The whole question boils down to how quickly the next wave of forced deleveraging hits and how long it actually lasts.

The common-sense part of me says: to clear out the crypto bubble, the AI bubble, frothy valuations, and the delusional optimism embedded in markets, we’d need at least six to twelve months of misery. That’s the time it would realistically take for bubbles of this size—in both asset prices and investor psychology—to deflate. Plus, monetary policy operates on a lag: even the fastest bailouts take months before they show up in actual economic data.

But here’s the flaw in that logic: stupid, dumbass me is still pretending that the economy and economic data shares even a single fucking molecule of relevance to stocks. If I’m wrong anywhere, it’s probably right here. The Fed can bail out anything—credit markets, real estate, equities, your cousin’s failed NFT project—basically overnight. When “creating liquidity” is literally just adding zeros to a spreadsheet, the Fed could send the Dow to 100,000 tomorrow if it felt like it. So maybe I’m the naïve one for assuming reaction times measured in months rather than hours.

The Lighning Round: Do dumb things, faster.

Anyway, the stock market doesn’t respond to macroeconomic data in any way that resembles reality anymore, so why would it suddenly morph into a disciplined, data-driven adult after the Fed fires a liquidity hose the size of the Hoover Dam at it? Is the market going to patiently wait for ISM surveys or manufacturing reports to bottom out? Hell no. It doesn’t wait now—why would it start waiting once $20 trillion in new liquidity is lighting a fire under everything?

And then this morning I see the headline about Michael Dell tossing $6 billion toward building investment accounts for children—$250 a pop. Bill Ackman then chimes in approvingly, saying “compounding can save us all”. And it hits me again: we’ve surrendered, fully and unapologetically, to the religion of compounding and the passive bid. The belief that markets must always go up isn’t just an article of faith—it’s a structural necessity. The Fed, the economy, and the stock market are now fused into one giant nominally priced Ponzi machine extracting life force from the lower and middle classes. It only reveals its true nature when the Fed tilts the scales too sharply in either direction. So far, it hasn’t done it badly enough to spark genuine civil unrest. But eventually, it might.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life: Get 50% off forever

So let me be my own biggest critic for a moment. While I still believe a sharp 12- to 18-month deleveraging is coming, there is a very real chance I’m wrong. And even though I do have some short exposure, most of my strategy these last couple of years has focused more on where it’s still smart to be bullish. Last year in my 25 Stocks I’m Watching For 2025, that meant gold and silver miners, plus uranium. As of last check, my 25 Stocks I’m Watching For 2025 are beating the S&P by a little more than 45% this year still. Going forward for my 26 Stocks I’m Watching For 2026, I’ll keep hunting for ignored, undervalued sectors—because the opportunities will always be there, even in a warped market.

And working through these scenarios reminds me of something else: whenever we do get the sharp downturn I expect, the bottom will almost certainly form earlier than I think. That was the case in the COVID crash—my timing was better than expected, but even then, the bottom came fast. The next big crash probably won’t wait around for a dramatic “everything is burning” 2008-style catharsis before reversing. I’m also not convinced we’re going back to old-school valuation norms. Expecting P/Es to revert to 8x or 10x like they did in past eras might be a fool’s errand. The market structure has mutated.

Ever since Greenspan, the liquidity spigot has effectively been left on, and comparing today’s market to the 1980s is like comparing turtles to Teenage Mutant Ninja turtles. Today’s market isn’t a measured, professional forum for guys in suits to hash out conservative deals and discover true prices. It’s that market, which once existed in the 1980s, but then super-saturated in radioactive goo for 40 years and reborn at a post-apocalyptic Rammstein concert being performed live from Satan’s asshole.

Which is to say, thinking this market is the same as it ever was — and will act accordingly — may be a huge mistake.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

or whatever the f*ck it’s going to wind up being

Loading recommendations…