According to Irina Slav, the global energy transition cost $4 trillion through 2023 and reduced fossil fuels by just 1%. As she put it, “we’ve paid trillions to still depend on hydrocarbons for most of our energy supply.” According to the Statistical Review of World Energy, in 2024, fossil fuels supplied 86.6% of world energy. Thirteen years prior, in 2011, the Statistical Review found that fossil fuels supplied 89.6% of the world’s energy. The difference is three percentage points. While that is slightly better than the 1% that Ms. Slav calculated using two different sources, the picture is still the same — the world is still relying on fossil fuels for almost 87% of its energy.

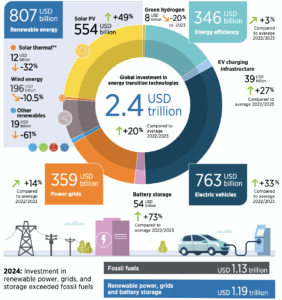

So, in 13 years, between 2012 and 2023, the global economy spent $4 trillion on moving away from fossil fuels, but still gets almost 87% of its energy from them. Slav also points out that spending on renewable and “clean” energy continued in 2024 to the tune of $2.4 trillion, covering investment in renewable energy, electric vehicles, energy efficiency, and power grids. At the same time, coal supplied a record amount of energy in 2024. The world is learning very little from its exploits into mostly intermittent renewable energy (wind and solar power) that require expensive backup when the wind does not blow, and the sun does not shine, as politicians continue to force them upon consumers despite skyrocketing energy costs.

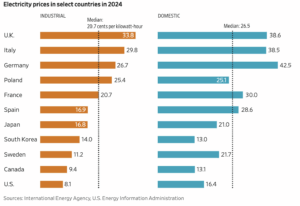

The system cost of the energy transition is causing record high electricity prices that has industries moving offshore. Germany, for example, risks “deindustrialization” as high energy costs threaten to send new factories and high-paying jobs elsewhere. According to ZeroHedge, Germany lost $75.8 billion in direct investment last year, and this year, the figure could exceed $117 billion. It has bet big on renewable energy as it undertook “Energiewende,” or “energy turnaround,” which sought to replace nuclear and hydrocarbon-based energy with intermittent wind and solar energy. To make the change, it heavily subsidized renewable energy, raising the costs of electricity. Residential electricity prices in Germany are almost three times those of the United States, and industrial prices are over three times as high.

Britain now has higher industrial electricity prices than Germany, despite its proximity to oil and gas reserves in the North Sea. Industrial power prices in the U.K., which are the highest in Europe, are about 4.2 times those paid by U.S. manufacturers. More than half of a typical U.K. household’s electricity bill reflects the cost of generating and delivering power. The remainder comes from levies and carbon charges used to finance renewable-energy subsidies and grid upgrades. Over the past decade, those surcharges have risen faster than wholesale electricity prices.

Business leaders and some economists attribute much of the increase to the expansion of renewable generation, particularly wind and solar. Because these sources are intermittent, they require backup generation or large-scale battery storage to ensure reliability, increasing overall system costs. Wind and solar projects are also often built far from population centers, necessitating new transmission lines and other infrastructure. Those additional grid costs, critics say, are being added on top of existing charges as governments accelerate the transition to renewable energy.

The rise in European electricity prices is not over, as more spending is required to reach climate goals. The Wall Street Journal reports that Goldman Sachs Research expects Europe will have to invest up to $3.48 trillion in power generation and infrastructure over the coming 10 years, roughly double what European countries spent in the past decade, while electricity prices exploded

In the United States, President Biden made climate a major part of his policy goals, moving the country in the direction of Europe’s policies. As a result, electricity prices are increasing. Under Biden’s term, residential electricity prices increased 25%, and they have continued to increase this year by 10.5% through August. Industrial electricity prices have also increased by 6.7% from September 2024 to September 2025. The Trump administration is working on securing reliable energy that does not require the redundancy that wind and solar power need by keeping existing coal and nuclear plants on line and promoting more gas-fired generation. But many blue states, such as California and New York, have mandates for renewable power. Some also have “cap and tax” policies that add to the cost of electricity, similar to what is being experienced in Europe. Those states bring the national average electricity price higher. Artificial intelligence data centers and rising electricity demand due to Biden administration policies are also helping to increase prices as more capacity is needed to meet rising demand.

Analysis

Investments in reducing the share of natural gas, oil, and coal in the world’s energy supply have not had a substantial impact, only reducing their share by three percentage points. This failure reflects the reality that the energy transition is too often attempting to replace energy-dense fuels deeply ingrained in our economies with less competitive technologies.

Furthermore, “green” investment does not have the electricity-price-depressing effect that many advocates claimed it would have. The need for additional transmission infrastructure and backup power and/or batteries add to the cost of solar and wind, while anti-nuclear policies force politicians to make a decision between “greening” the grid and providing reliable power.

For inquiries, please contact [email protected].