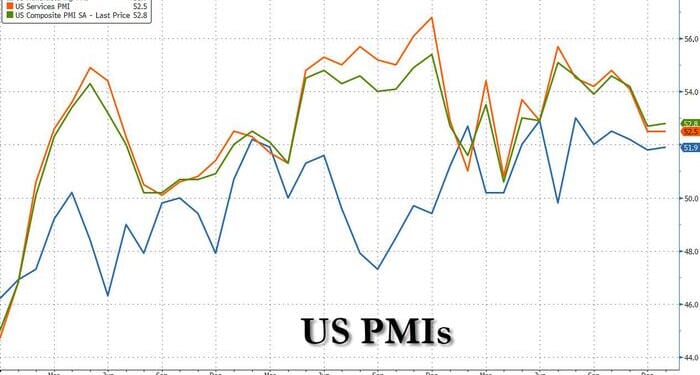

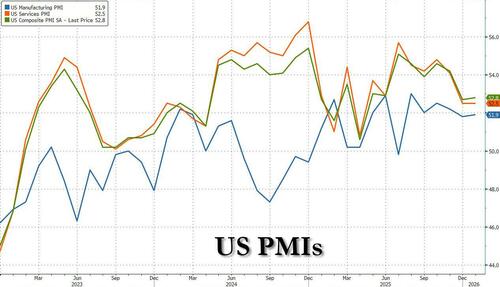

With global PMIs today printing on the softer side (especially in France where the service PMI tumbled to 47.9 on expectations of a 50.3 print), moments ago it was the US’ turn to join the parade of soggy prints. Here is what S&P Global reported for the January Prelim PMIs:

- Manufacturing PMI: 51.9, up from 51.8 in Dec, but missing estimates of 52.0

- Services PMI: 52.5, unchanged from December’s 52.5, and also missing estimates of 52.9

- Composite PMI Output Index: 52.8, up from December’s 52.7), and also missing estimates of 53.0

While US business activity growth ticked higher in January, it remaining subdued compared to the typical rate of expansion seen in the second half of 2025, according to the PMI report. Manufacturing growth accelerated to outpace that of services, but the January survey brought further signs that underlying order book growth has softened in both sectors recently, led by falling exports. Job numbers consequently remained little changed in January.

Curiously, when taking a closer look at the data, we find improvement across both employment and inflation:

Employment rose in January following a similarly weak increase reported in December. The near-stalled job market reflected concerns from companies over rising costs and softer sales growth in recent months. Only a marginal rise in payroll numbers was reported across the service sector while manufacturing jobs growth weakened to a sixmonth low. Some companies also continued to report difficulties finding staff, often struggling to fill vacancies and meet demand. These capacity issues contributed to the largest rise in backlogs of work since last August, albeit largely confined to the service sector.

Also, so much for inflation: input costs moderated from December’s seven-month high to sit at the weakest since last April. The moderation reflecting a cooling of input cost inflation in the service sector, as manufacturing input prices rose at the fastest pace since last September, once again widely blamed on tariffs.

Commenting on the report, S&P GMI chief economist, Chris Williamson, said that “The flash PMI brought news of sustained economic growth at the start of the year, but there are further signs that the rate of expansion has cooled over the turn of the new year compared to the hotter pace indicated back in the fall.”

“The survey is signalling annualized GDP growth of 1.5% for both December and January, and a worryingly subdued rate of new business growth across both manufacturing and services adds further to signs that first quarter growth could disappoint.”

“Jobs growth is meanwhile already disappointing, with near stagnant payroll numbers reported again in January, as businesses worry about taking on more staff in an environment of uncertainty, weak demand and high costs.”

“Increased costs, widely blamed on tariffs, are again cited as a key driver of higher prices for both goods and services in January, meaning inflation and affordability remains a widespread concern among businesses.”

Confidence in the year ahead outlook meanwhile remained positive but dipped slightly lower, as hopes for sustained economic growth and favorable demand conditions were somewhat offset by ongoing worries over the political environment and higher prices.

While elevated rates of input cost and selling price inflation were again commonly attributed to tariffs, especially in the manufacturing sector, where price pressures intensified in January, service sector inflation moderated, linked in part to intensifying competition.

Loading recommendations…