Authored by Nick Giambruno via InternationalMan.com,

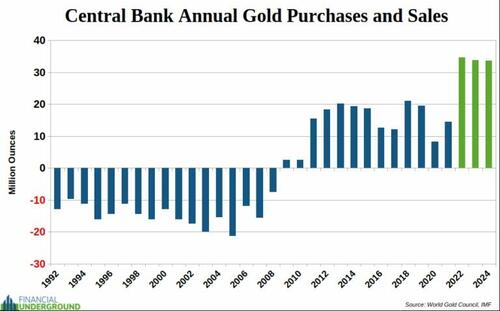

Last year, central banks purchased approximately 34 million ounces of gold, marking the third consecutive year of near-record buying.

We’re witnessing the acceleration of a long-term trend that began around the 2008 financial crisis, when central banks shifted from net sellers to net buyers of gold. That trend has exploded in recent years, with gold purchases surging to record-breaking levels, as shown in the chart below.

All signs indicate that 2025 will be another massive year for central bank gold buying.

Central banks and governments are the largest single holders of gold in the world. Together, they officially own over 1.2 billion troy ounces—out of the 6.9 billion ounces humans have mined throughout history.

However, these are just the official numbers that governments report. The actual gold holdings could be much higher, as governments tend to be secretive about their reserves, treating gold as a strategic financial asset.

Russia and China—the US’s top geopolitical rivals—have been the biggest gold buyers over the last two decades.

It’s no secret that China has been stashing away as much gold as possible for many years.

China is the world’s largest producer and buyer of gold. Russia is number two. Most of that gold enters the Chinese and Russian government’s vaults.

The trend of central bank gold accumulation is gaining momentum. If the rest of the world is moving back toward gold, the US will not want to be left behind.

Yet, officially, the US has not added a single ounce to its 261 million ounces of gold reserves in decades.

Unofficially? That may be a different story.

Since Trump’s victory in the 2024 presidential election last November, a sudden flood of physical gold has flowed into the US from major gold hubs like London, Switzerland, and elsewhere.

The gold market is typically dominated by paper trading, with large-scale physical deliveries being rare. However, CNBC and the World Gold Council report that more than 19 million ounces—possibly much more—of physical gold has entered the US since November.

That’s roughly 13% of the total alleged gold holdings in Fort Knox flowing into the US in less than six months.

This is not normal market action.

This strongly suggests that a non-market entity—most likely the US government—is behind this massive gold movement.

That’s why Trump’s recent comments about Fort Knox are so interesting.

Trump recently brought Fort Knox into the national conversation, something no US president has done in decades.

Would he have even mentioned the possibility of auditing Fort Knox if the vaults were empty? I doubt it.

Instead, there’s a good chance that the enormous inflow of physical gold into the US is happening in anticipation of an audit.

Connecting the Dots—Something Big Is Coming

So, here’s what we know:

-

Trump has put Fort Knox’s gold holdings back in the national spotlight for the first time in decades.

-

Central bank gold purchases are accelerating at record-breaking levels.

-

An unusually large influx of physical gold is flowing into the US, far beyond regular market activity.

Follow the Gold. It Always Leads to the Truth

Central banks are hoarding gold at record levels. The US government is likely pulling in millions of ounces. And Trump is talking about Fort Knox.

This isn’t coincidence.

Find out what they’re preparing for and how you can be ready in our urgent dispatch:

The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now

Loading…