Authored by Lance Roberts via RealInvestmentAdvice.com,

There is a rising market risk in 2026 that is largely overlooked as we wrap up this year. As discussed in the “Fed’s Soft Landing Narrative,” optimism about 2026 is running high.

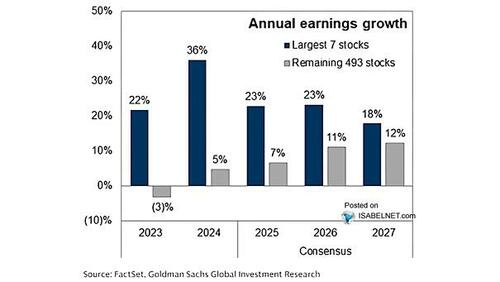

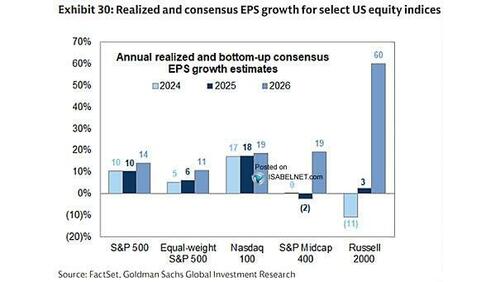

Currently, investors are pricing in strong economic growth, robust earnings, and a smooth path of disinflation. Notably, Wall Street estimates suggest a significant acceleration in corporate profits, particularly among cyclical stocks and small- to mid-cap sectors. To wit:

“Wall Street currently expects the bottom 493 stocks to contribute more to earnings in 2026 than they have in the past 3 years. This is notable in that, over the past three years, the average growth rate for the bottom 493 stocks was less than 3%. Yet over the next 2 years, that earnings growth is expected to average above 11%.”

“Furthermore, the outlook is even more exuberant for the most economically sensitive stocks. Small and mid-cap companies struggled to produce earnings growth during the previous three years of robust economic growth, driven by monetary and fiscal stimulus. However, next year, even if the Fed’s soft landing narrative is valid, they are expected to see a surge in earnings growth rates of nearly 60%.”

There is nothing wrong with having an optimistic outlook when it comes to investing; however, “outlooks can change rapidly,” which is a significant market risk, particularly when expectations and valuations are elevated.

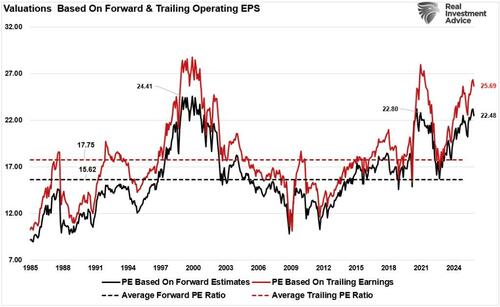

Notably, these forecasts rest on an assumption that the economy will not only avoid recession but reaccelerate in the face of waning inflation. As noted, equity markets have responded by pushing valuations higher across major indexes, with price-to-earnings ratios well above historical medians. Simultaneously, investors have rewarded narratives built on the idea of a soft landing and a return to pre-pandemic trends.

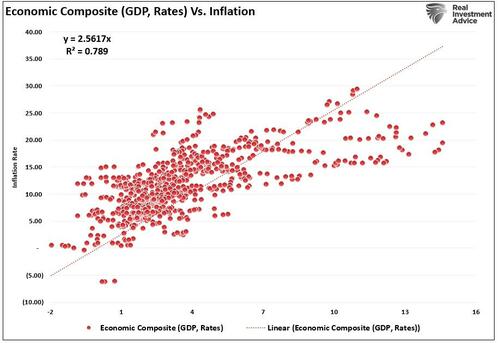

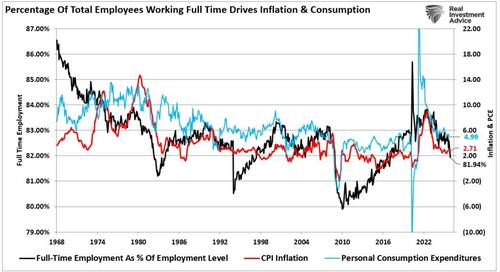

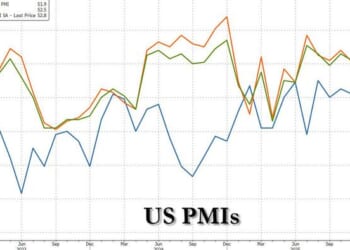

However, this narrative appears to overlook the trends in recent economic data. Inflation expectations have moderated, not because of increased demand, but due to weaker consumption and cooling labor dynamics. As recent economic data indicate, disinflation has accompanied slower GDP growth and a decline in personal consumption momentum. If the economy were indeed set to reaccelerate, these trends should be increasing rather than returning to historical averages.

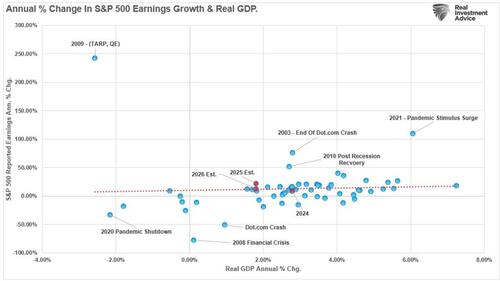

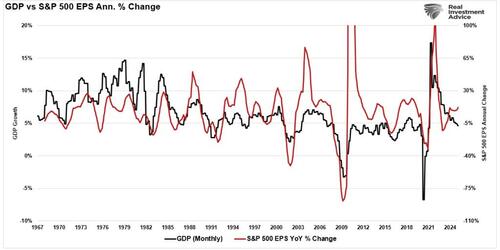

The soft landing thesis posits a benign cycle in which inflation declines, growth remains stable, and earnings increase. Yet, that outcome would be historically rare. When inflation falls this quickly, it typically reflects a slowdown in demand rather than policy success. Additionally, the strong relationship between economic growth and earnings should not be dismissed. That disconnect exposes investors to market risk if growth does not materialize as expected and valuations are reconsidered.

With analysts expecting strong revenue growth and margin expansion despite rising input costs, global uncertainty, and declining employment, a market priced for perfection leaves little room for earnings misses or growth shocks. If those optimistic assumptions fail, market risk could rise abruptly.

Let’s dig in.

Structural Headwinds

As noted above, earnings growth is fundamentally tied to economic growth. When demand exceeds supply, companies expand output, raise prices, and increase profits. As discussed recently, this is why, without inflation, there can not be economic growth, increasing wages, and an improving standard of living. In other words, for there to be stronger economic growth and rising prosperity, prices must increase over time. Such is why the Fed targets a 2% inflation rate, thereby supporting 2% economic growth and stable employment levels.

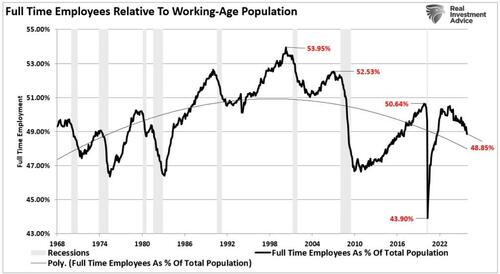

However, the employment data over the last year doesn’t tell a story of substantial employment, rising wages, or a trend suggesting a more robust economic outlook. Instead, the latest data confirmed a deceleration in economic activity, as full-time employment (as a percentage of the population) declined.

The importance of full-time employment should not be readily dismissed. Full-time employment pays higher wages, provides family benefits, and allows for an expansion of consumption. The decline in full-time employment currently is normally associated with recessions rather than expansions. Economic growth, inflation, and personal consumption are trending lower, given that employment, particularly full-time employment, supports economic supply and demand.

Furthermore, economic growth relies heavily on consumer spending, which accounts for nearly 70% of U.S. GDP. For that consumption to persist or grow, consumers must have rising incomes, which come from employment and wage growth. Without job creation or real wage increases, consumption growth stagnates, and the earnings narrative breaks down. As shown, when economic growth declines, so do earnings growth rates.

Recent employment data show cracks in this cycle. While headline job numbers suggest continued hiring, the quality and composition of those jobs are weakening. Today we see part-time workers filling full-time positions, often with lower pay and fewer benefits. Labor force participation remains below pre-pandemic levels, and many prime-age workers are not returning. Most notably, the negative revision of every monthly employment report in 2025 further undermines the “strong economy” narrative.

Even where wages are rising nominally, inflation-adjusted wages tell a different story. Real wage growth has been flat or negative in several key sectors. As housing, energy, and service prices remain high, the squeeze of disposable income increases. As such, consumers compensate by drawing down savings or using credit, both of which are unsustainable long-term strategies.

The market risk in 2026, is that for corporate earnings to accelerate and meet Wall Street’s expecations, the consumer must be healthy. That means rising real wages and broad-based job creation. Without those pillars, top-line revenue growth slows, and margin pressures increase. Analysts projecting double-digit earnings growth into 2026 are assuming a demand-driven economy without the income growth needed to support it. That assumption is increasingly fragile. Without real economic growth, earnings become a product of financial engineering or cost-cutting, not organic expansion. Markets are pricing in a demand surge that the employment data do not confirm.

If this disconnect persists, Wall Street will revise earnings expectations lower.

Valuation Fragility

That last sentence is the most crucial. With valuations near cycle highs, (the S&P 500 trades at over 22x times forward earnings, which is well above its long-term average), such assume strong earnings growth and low discount rates. Yet both assumptions are vulnerable. If economic growth undershoots, earnings revisions will follow. Historically, earnings have tended to lag behind the economic cycle. As consumption softens, revenue growth stalls. Margins then compress, especially for companies with high labor or financing costs, and with narrow market breadth and concentration in mega-cap names, the market risk is a sudden repricing of those expectations.

Credit risk premiums remain compressed across all asset classes, from high-yield to investment-grade, which reflects a belief in Fed control and continued monetary easing. If those beliefs are shaken, volatility will return. Market participants are not expecting a scenario where all risk assets decline simultaneously, including stocks, crypto, precious metals, and international markets.

Implications for Investors

The market risk for investors is not a 2008-style collapse. However, a far more likely scenario is a long period of underperformance. That underperformance will likely be a function of earnings disappointment, weak growth, and multiple compression. Market analysts are currently pricing the market for acceleration. But those views may struggle is stagnation, and the “path of least resistance,” shifts from upward momentum to sideways drift or correction.

As such investors should continually monitor and assess the risk they are taking in portfolios.

-

Reassess exposure to high-multiple equities and overconcentrated sectors. While technologty drives index performance, valuations are high and if growth expectations are too high, tech earnings will likely fail to meet them. The same applies to consumer discretionary stocks tied to fragile spending.

-

Consider a more defensive position, focusing on free cash flow, balance sheet strength, dividends, and pricing power.

-

Add bonds to your portfolio to protect prinicpal and create income. Furthermore, in the event of a risk-off rotation, investors will seek the safety of bonds to reduce portfolio risk. Being there before the correction occurs can be beneficial to outcomes.

-

Liquidity should always be a priority. If risk aversion returns, liquidity conditions can tighten quickly. Investors consider a scenario where risk assets (stocks, commodities, metals, and cryptocurrencies) decline sharply as risk resets

A prudent approach is to reduce exposure to narrative-driven assets and increase allocations to quality. Investors should favor sectors with consistent earnings, low leverage, and stable dividends. Cash remains underappreciated as a strategic tool, and with real yields positive and volatility likely to rise, liquidity is a source of optionality.

The next two years will test the soft landing thesis. If growth falls short, earnings disappoint, or inflation returns, markets will face a reset. That reset may not be dramatic, but it will be painful for those overexposed to the current consensus.

The best defense is valuation discipline, risk awareness, and a willingness to question the prevailing narrative.

Loading recommendations…