By Michael Every of Rabobank

Following what was expected to be a Friday of high geopolitical drama for markets, but wasn’t, today may prove that event instead. Yes, President Trump just failed to get a Russia-Ukraine ceasefire; but today he’s pushing for a full peace deal. The UK PM, key EU leaders (though none who border Ukraine), and NATO’s Rutte will join President Zelenskyy in D.C. to hear (or be told to sign on to?) Trump’s latest proposal.

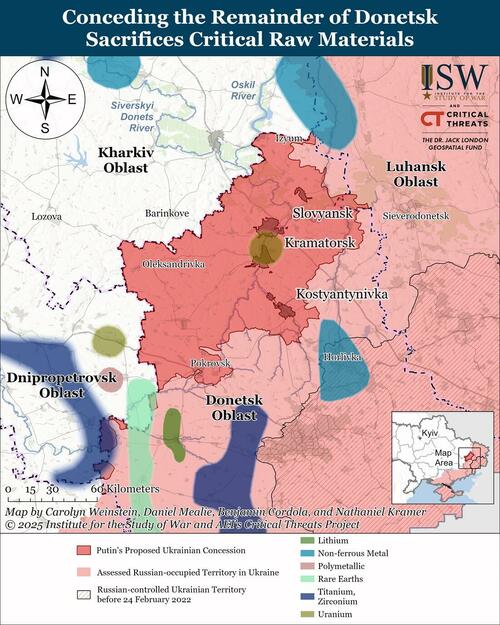

According to most reports, Ukraine will have to cede the land Russia has already taken, with debate over whether Moscow gets all of Donetsk oblast on a plate when it only controls part of it now. Weeks ago, Europe and Zelenskyy were insisting not one inch of land would be ceded: now it looks like 20%, with key resources and a geostrategic location, is gone for good.

That’s a very bitter pill for Ukraine to swallow, for which Kyiv is rightly demanding security guarantees. According to Trump envoy Witkoff, Putin is accepting this will involve troops on the ground in Ukraine, as well as an Article 5 pledge to defend its new borders. But whose troops and whose guarantee?

For those expecting the US to do more on physical support for Ukraine –presumably everyone visiting the White House– the counterargument is Trump won an election specifically on avoiding that outcome, simply put, and the US is not going to fight Russia for Ukraine.

So, on security guarantees, Europe will say, “The US”; the US will say, “Europe’; and the US will win. Just as Trump told Zelenskyy “You don’t have the cards,” the UK and Europe don’t either.

For those expecting the US and Europe to do more economically, i.e., secondary sanctions on buyers of Russian oil and/or action vs. Russian oil at sea, neither is prepared for the pain and geopolitical / geoeconomic escalation it would involve: if they were, such sanctions would have been placed on China already, as one example. Obviously, they haven’t, and Trump just made clear they likely won’t be – Europe didn’t even need to say it.

Indeed, a hypothetical removing of US sanctions on Russian energy ahead, for example, would allow even lower prices, offsetting US tariff inflation now just starting to show, a boon to it; but for Europe/the UK it would mean far less ability to use economic statecraft, so logically then requiring much more military statecraft.

As such, the burden of rearming rapidly, locking themselves into a Cold War with Russia, and the risks of hot war with it, will likely fall on Europe/the UK. Some might think that’s already priced in, but though NATO has (mostly) promised to spend 5% of GDP on defence, that’s a broad umbrella covering things like bridges to Sicily. Moreover, it’s scheduled to be phased in slowly most places, “because markets.” Yet if Russia keeps ramping up military production helped by China’s massive industrial muscle, what is Europe going to do – stick to tough fiscal rules and timid rules of engagement and assume this dissuades Moscow?

Russia will probably be assuming Europe can’t and won’t stick to the painful political-economy and geopolitical risk-appetite changes defending Ukraine against it would require, more so given it has local escalation dominance given its political unity, ruthlessness, location, and interests.

Meanwhile, US grand macro strategy remains a pivot to Asia while staying top dog in the Middle East, by proxy as much as possible. Ukraine is a secondary issue for them, and a primary one for Europe.

Logically, it suits the US to sell the arms to Europe needs to protect Ukraine to cement Europe’s need to rebuild its military within US value chains; and to accelerate a Reverse Marshall Plan for Europe to pay to build US factories behind tariff barriers to make those weapons. Naturally, this would also make any future European rejection of USD stablecoins that could de facto dollarize its economy much harder, further boosting the US realpolitik hand in ways Europe is just waking up to now, again too late.

A Ukraine deal could also reduce US tensions with Russia –now treated as a Great Power again, one of its key goals— as at least a partial ‘Noxin’ play that gets China worried about where it sits with Moscow longer term.

A Ukraine deal could additionally mean at least a partial US U-turn on tariffs on India, stopping its drift away from the India-Middle East-Europe Corridor (IMEC) back towards the BRICS. Notably, US-India trade talks set to be held before stacked-up 50% tariffs are due to kick in were just delayed past that key date, but may be rescheduled, while New Delhi is this morning reported to be open to allowing Chinese investment back into its manufacturing sector again. (Though there are serious views that China has no desire to allow India to develop this sector at scale to prevent any potential rival emerging.)

Overall, today’s outcome in D.C. could leave the US in a much stronger geostrategic position and Europe seeing how bad it’s is.

Regular readers may recall that a few years ago we warned that Europe was in deep trouble due to balance of power deficits: well, here we are. It may be hard for Western European markets to grasp this harsh reality, but they and their market acronyms are no longer masters of their own destiny. They are geopolitical price takers.

If Europe tries to step up, it will face one huge set of challenges: Who builds? Who pays? Who decides? Who fights?

If Europe decides it can’t or won’t –and rhetoric, platitudes, and pipedreams aside, that’s a real risk— it will mean Ukraine faces a rocky future, and Europe has a huge headache.

After all, if it fails this clear test of collective will and willingness to sacrifice here for its own security interests, what are the odds of it successfully doing so for any other “faraway countries of which it knows nothing?”… some of which may even be in the EU one day? The implications for Europe’s security architecture and so its political unity –forget about strategic autonomy!– would be extremely worrying.

Of course, in the short term markets could ignore all this and just tsk-tsk at the US; but in the longer run does it really make the case for Europe? They should also hope that a 20% piece in our time is not also 20% peace in our time.

Loading recommendations…