Aside from Friday’s sudden net outflow, the month of Ethereum’s tenth anniversary was celebrated by an almost unstoppable wave of net inflows into ETFs…

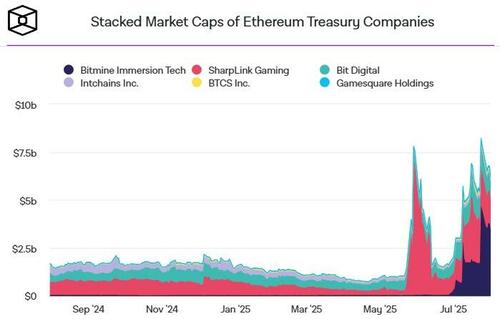

And, perhaps even more notably, an ongoing demand from Altcoin Treasury Strategy companies is also gaining momentum with Ethereum treasury firm BitMine Immersion Technologies (BMNR) said its ether holdings have climbed to about 833,000 tokens currently worth more than $2.9 billion, making the Tom Lee–backed company the world’s largest public holder of ETH.

Fundstrat co-founder Tom Lee, who is now the Chairman of BitMine’s board of directors, says the firm is pushing to acquire 5% of the circulating supply of Ethereum, which would be about 6,035,480 ETH.

“BitMine moved with lightning speed in its pursuit of the ‘alchemy of 5%’ of ETH growing our ETH holdings to over 833,000 from zero 35 days ago.

We have separated ourselves among crypto treasury peers by both the velocity of raising crypto NAV per share and by the high liquidity of our stock.”

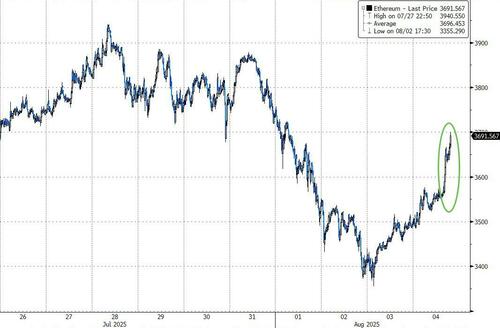

Ethereum is surging higher this morning on the heels of this news…

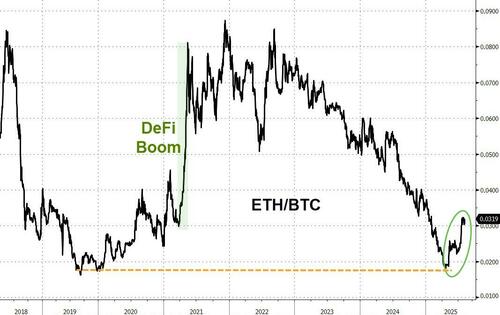

Continuing its recent strong outperformance trend over bitcoin…

As a reminder, Standard Chartered forecasts Ethereum Treasury holdings to top 10% of supply:

For ETH this is likely to happen more quickly, as the broader concept of corporate holdings of digital assets is already accepted.

Publicly listed Bitcoin mining company, BitMine Immersion Tech (BMNR), is currently the largest Ether treasury firm, holding 0.5% of the circulating ETH supply.

If BMNR can achieve its goal of increasing its ETH holdings to 5% of the total in circulation, then it is fair to assume that ETH treasury companies as a whole will end up holding more than 10% of all ETH in circulation. This would be a 10x increase from today’s corporate treasury holdings.

Ether-focused treasury firms have more growth potential compared to Bitcoin treasury firms from a “regulatory arbitrage perspective,” according to Standard Chartered.

“…this buying of digital assets by corporates makes sense due to inefficiencies in financial markets, mostly stemming from regulation.

Specifically, restrictions on investor access to the asset class, which remain significant in a large number of jurisdictions, mean that investors seek alternative vehicles (in this case publicly listed companies) through which to gain exposure to the underlying asset.

As a result, these companies’ market cap tends to trade above the net asset value (NAV) of the assets held, at a so-called positive NAV multiple.”

Ether treasury firms can “capture both staking rewards and decentralised finance (DeFi) leverage opportunities, which US Ethereum ETFs currently cannot.”

In terms of next potential catalysts, we will be looking at the upcoming Fusaka protocol upgrade in Q4’25.

Loading recommendations…