The Interior Department’s Bureau of Safety and Environmental Enforcement has reopened the Santa Ynez Unit of the Pacific oil-producing region, which holds an estimated 190 million barrels of recoverable potential — 80% of residual Pacific reserves and about 3% of the total U.S. production potential. In just five months, the Interior Department navigated a number of permitting, environmental, and regulatory roadblocks from California to restart the Pacific oil reserve, which has been offline for a decade. Santa Ynez has been off-limits since 2015, when an aging pipe broke and caused about 500 barrels of oil to flow into the ocean from an estimated release of 2,900 barrels. Houston-based Sable Energy purchased the site from ExxonMobil in February 2024 and is reopening several platforms. Three oil platforms are expected to be online by the end of the year, bringing output in the Pacific from zero for the past 10 years to near-full production in a matter of months. The three platforms (Harmony, Heritage, and Hondo) could each generate up to 10,000 barrels of oil per day.

Production is underway at Sable’s Platform Harmony. Preproduction inspections for Platform Heritage are set to begin soon, with production expected to begin in October 2025, followed by Hondo by the end of the year. Rather than produce its own oil, California prefers to import oil from foreign nations with weak labor protections and poor environmental standards compared to the United States. IER has shown that the United States has one of the highest Environmental Performance Indices among top oil-producing countries, noting that the average barrel of non-U.S. petroleum is produced in a country with an environmental score that is 23.6% lower than that of the United States.

Background

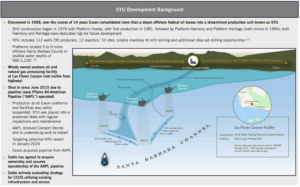

In February of 2024, ExxonMobil sold the existing oil infrastructure, including 114 wells, three offshore platforms, and an onshore oil and gas processing facility at Las Flores Canyon, collectively called the Santa Ynez Unit, to Sable Offshore for $625,000,000. Sable secured a $622,000,000 loan from Exxon to fund the purchase, and it submitted a Change of Owner, Operator, and Guarantor application with the County of Santa Barbara’s Planning Commission. On October 30, 2024, the Santa Barbara County Planning Commission held a public hearing on the application and voted three to one to approve the lease transfers. The permit transfer helped allow Sable to restart oil extraction from the three offshore platforms, transportation through associated pipelines, and the refinery facility.

On the same day that the Interior Department announced restarting oil production, a federal court allowed five local environmental groups to intervene in a lawsuit between Sable Offshore and the County of Santa Barbara regarding the lease transfer needed to restart oil production at the Santa Ynez Unit. Sable is engaged in a lawsuit against regulatory hurdles and penalties imposed by the California Coastal Commission regarding work done in the Coastal Zone necessary to restart oil production. A warning was also issued that public claims of restarting oil production may have violated leases issued by the California State Lands Commission.

California’s Oil and Gasoline Situation

California has the highest gasoline tax in the nation and the highest gasoline prices, about $1.35 more a gallon compared to the nation’s average gas price. According to AAA, California’s gasoline price is around $4.50 a gallon, compared to a national average of $3.15 a gallon. Despite the higher prices, California has repeatedly set policy and regulations to lower oil production in the state and to drive refineries out, despite having a unique environmental requirement for its gasoline.

Two refineries are exiting the state, beginning with Phillips 66’s announced closure of its L.A. refinery. Phillips 66 announced in October 2024 it would shut down its 139,000-barrel-per-day, Los Angeles-area refinery, which employed about 600 workers and 300 contractors. Valero also announced the closure of a massive refinery capable of 145,000 barrels of oil output per day — about 9% of the state’s gasoline capacity. Valero will finalize its plan by April 2026.

The number of refineries in California processing oil has been shrinking, with companies citing increased regulation. Six plants have shut since 2008. Two of those have converted from producing petroleum-based diesel to renewable diesel, for which refiners can make an additional $3.70 per gallon in California via subsidies. The result of California’s anti-oil and gasoline policies is that it will need to import more of both and likely see even higher gasoline prices.

Analysis

California’s energy policies, driven by strict environmental regulations like AB 32 and SB 100, have made it an “energy island,” heavily reliant on in-state renewable energy (37% from solar and wind in 2023) and imports for 30% of its electricity, while phasing out natural gas and nuclear power. As a result, Californians pay some of the highest gas prices in the country, and its supply of oil and natural gas is at risk. The rapid reactivation of Santa Ynez — achieved in just five months — demonstrates efficient regulatory navigation, signaling a pragmatic approach to balancing environmental concerns with energy needs. The potential output of 30,000 barrels per day from the Harmony, Heritage, and Hondo platforms could help stabilize local energy markets.

For inquiries, please contact [email protected].