President Donald Trump said in an early morning Truth Social post that Chinese leader Xi Jinping was “extremely hard” to make a deal with, just days after the president accused Beijing of violating an agreement to roll back tariffs and trade restrictions. This comes after Treasury Secretary Scott Bessent said that U.S.-China trade talks were “a bit stalled.” However, White House Press Secretary Karoline Leavitt said Tuesday that leader-to-leader talk between Trump and Xi “will happen very soon.”

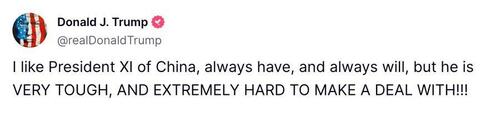

“I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!,” Trump wrote on Truth Social at around 0217 ET.

Washington and Beijing have been bickering over whether either side has violated the May 12 trade agreement, reached in Switzerland, to de-escalate the trade war for 90 days. U.S. trade officials are likely concerned about China choking off the supply of key critical minerals, including rare earth magnets, while Chinese officials are worried about the U.S. restrictions on jet engine parts.

On Tuesday, Leavitt told reporters that U.S. officials were monitoring China’s compliance with the agreement and that leader-to-leader talks would happen very soon: “There will be a leader-to-leader talk very soon.”

Trump signaled last week that he would speak with Xi in the near term: “I’m sure that I’ll speak to President Xi, and hopefully we’ll work that out.” He told reporters that China had violated part of the trade agreement reached in Geneva, which aimed to reduce tensions.

China has yet to confirm leader-to-leader talks, but Trump and the White House have repeatedly insisted those talks are nearing and “likely” at the end of this week.

In markets, U.S. equity futures are flat early Wednesday, and Treasury yields are little changed, even as the U.S. doubled tariffs on steel and aluminum to 50%.

In a post on X late Tuesday, U.S. Ambassador David Perdue emphasized to Chinese Foreign Minister Wang Yi that the U.S.’s top priorities are trade, fentanyl, and illegal immigration.

In a meeting today with Central Foreign Affairs Commission Office Director and Foreign Minister Wang Yi, I emphasized President Trump’s priorities on trade, fentanyl, and illegal immigration. Communication is vital to the 🇺🇸-🇨🇳 relationship. pic.twitter.com/RszJpF6ItB

— U.S. Ambassador to China David Perdue (@USAmbChina) June 3, 2025

Trade war headlines change daily and can be hard to track. That’s why UBS analyst Leo He compiled a comprehensive list of the latest developments, sourcing from Bloomberg, Reuters, The Hill, and Business Insider:

New Developments Summary:

The U.S. administration wants countries to provide their best offer on trade negotiations by June 4.

CNBC reports U.S. President Trump and China President Xi are likely to speak this week. U.S. extended the exclusion of Section 301 tariffs on some Chinese goods until August 31.

The U.S. will increase global tariffs on steel and aluminum to 50% from 25%, effective June 4.

Regarding the Court of International Trade’s ruling on reciprocal tariffs, the Appeals court gave deadlines of June 5 for the plaintiffs to respond and June 9 for the U.S. administration to reply.

Trade Negotiations:

Overall:

Reuters reports The U.S. administration wants countries to provide their best offer on trade negotiations by June 4 as officials seek to accelerate talks.

U.S. President Trump said he will set tariffs rates for U.S. trading partners over next few weeks due to a lack of capacity to negotiate deals with all.

The U.S. administration has laid out a framework to negotiate with 18 countries six every week, over three weeks, in a rotation until the reciprocal tariffs pausing deadline (July 8).

Finance ministers and central bank governors from the G7 nations pledged to address “excessive imbalances” in the global economy aiming to create a level playing field and increase transparency.

China:

CNBC reports U.S. President Trump and China President Xi are likely to speak this week, citing a senior White House official. Previously, U.S. Treasury Secretary Bessent said trade talks with China are moving slowly and talks between top leaders are needed to facilitate the negotiations.

U.S. and China accused each other of violating the recent trade deal. The U.S. accused China of restricting rare-earth exports while China accused the U.S. of technological controls.

U.S. extended the exclusion of Section 301 tariffs on some Chinese goods until August 31.

On May 15, U.S. Trade Representative Greer spoke to Chinese Vice Commerce Minister Li during the APEC meeting .

U.S. Treasury Secretary Bessent met China Vice Premier He during May 10-11 and reached a de-escalation agreement. The U.S. lowered tariffs on China imports to 30% including 10% universal tariffs and 20% Fentanyl tariffs. Other universal tariffs including 25% on steel and aluminum and 25% on autos and auto parts have remained in place. Meanwhile, 24% reciprocal tariffs will be suspended for 90 days to allow for further negotiations with a deadline on August 12.

The U.S.’s weighted average tariff on China imports is lowered to 43.5% from 96%, considering Trump’s first term tariffs on China.

Next meeting between Bessent and He will be in next few weeks.

Vietnam:

The U.S. has sent Vietnam a list of requests as part of tariff negotiations that could force the Southeast Asian country to reduce the use of Chinese materials and components in its factories.

Vietnam is expected to sign deals with the United States to buy more than $2 billion worth of agricultural products. Previously, Vietnam trade minister Nguyen Hong Dien urged companies to buy more U.S. energy, mining, telecommunications and aviation.

Vietnam PM Chinh asked officials to speed up negotiations, aiming to sign a purchase deal of methanol worth $6bn from the U.S. in May.

Japan:

On June 2, Japan trade Negotiator Akazawa said Japan’s stance of removing all tariffs hasn’t changed. Akazawa will head to the U.S. on June 5 for the 5th round of negotiations, aiming for a trade deal during the G7 meeting during June 13-15.

On May 29, Japanese Prime Minister Ishiba held a 25-minute phone call with Trump, and expressed the view that investing in the U.S. is more important than tariffs.

The U.S. agrees to Nippon Steel’s acquisition plan on the United States Steel Corp, conditional on receiving a “golden share” of the company.

After meeting with U.S. Treasury Secretary Bessent, Japan Finance Minister Kato said they agreed FX should be determined by market and specific FX levels were not discussed. Previously, Japan Finance Minister Kato said Plaza Accord 2.0 hasn’t come up for discussion.

On May 9, Japan Finance Minister Kato said Japan is not considering to the U.S. Treasuries holding for negotiation. Previously, Kato said Japan’s U.S. Treasury Holdings is a card in trade negotiations and whether Japan will use that card is a different decision. Japan Democratic Party for the People leader Tamaki said buying super-long UST in return for concessions on tariffs should be a possible bargaining chip. The party is a small but influential opposition party.

Previously, Japan PM Ishiba said Japan will not accept a trade agreement with the U.S. that excludes an accord on autos. Previously, Nikkei reported the U.S. proposed a framework under which Washington would maintain its 25% tariffs on Japan’s auto industry, as well as steel and aluminum. Japan pushed back, saying the negotiations should be comprehensive, the paper said. Tokyo suggested reviewing its non-tariff barriers and expanding imports of U.S. farm products. On May 5, Kyodo reported the U.S. has rejected Japan’s full exemption from not only the 10% “reciprocal” tariff but also its country-specific tariff in recent negotiations

Japan government is discussing the possibility of leveraging shipbuilding in tariff negotiations (source)

Media reports Japan plans to increase imports of U.S. rice and soybeans as a potential bargaining chip in the trade negotiation. Also, Japan is considering into reviewing its car safety standards (read more).

EU:

On June 2, the EU has sent a technical team to Washington for trade negotiations. Also EU Trade Commissioner Sefcovic will meet U.S. Trade Representative Greer on June 4.

EU Trade Commissioner Sefcovic said he has calls with Commerce Secretary Lutnick every other day, and they have discussed aviation and semiconductor cooperations.

The U.S. and EU have agreed to accelerate trade talks after President Trump’s threat to impose 50% tariffs on the EU.

Previously, U.S. Treasury Secretary Bessent said the EU is very difficult to deal with and the EU proposals have not been of the same quality that from other trading partners. U.S. Treasury Secretary Bessent said the EU suffers from a “collective action problem” that’s hampering trade negotiations. Also, he said the EU needs to resolve “internal matters” before entering trade negotiations with the U.S., specifically citing a digital service tax imposed by some EU countries.

Previously, the EU shared a revised paper with the U.S. that includes proposals on international labor rights, environmental standards, economic security and gradually reducing tariffs to zero on both sides for non-sensitive agricultural products as well as industrial goods.

Previously, EU trade commissioner Maros Sefcovic said the EU is ready to offer EUR50 bn purchases of U.S. gas and agricultural products to address the problem in the trade relationship.

The U.S. government is pushing back against the EU’s AI code of practice.

UK:

The UK government said they were engaging with the U.S. on the implications of the latest tariff announcement and working to provide clarity for industry.

The UK will hold talks with the U.S. next week to speed up implementation of a trade pack between two sides.

On May 8, the US-UK trade framework was announced. Final details are still under negotiations.

The UK framework includes:

UK car makers will be allowed to export 100k cars to the U.S. with a 10% tariff, down from 27.5%.

UK farmers will be given a tariff-free quota for 13,000 metric tons of beef exports.

Tariffs on UK steel and aluminum are removed.

10% tariffs on other UK goods remained.

The UK will purchase $10 bn of Boeing procurement.

The UK will remove its tariff on U.S. ethanol to zero.

The UK will open access to ethanol, beef, machinery, and agricultural markets.

There will be a “fast-track” entry for U.S. goods and vice versa for UK goods.

The UK said the digital services tax remains unchanged, which U.S. Senior Trade and Manufacturing Counselor Navarro said it is still under negotiation

The U.S. and the UK “intend to promptly negotiate significantly preferential treatment outcomes on pharmaceuticals and pharmaceutical ingredients.

India:

U.S. Commerce Secretary Lutnick said the US-India trade deal is coming soon. Previously, India Commerce Minister Goyal said he had a constructive meeting with U.S. Commerce Minister Lutnick on trade deals.

U.S. officials will visit India on June 5-6 to speed up reaching a trade agreement.

U.S. President Trump threatened to impose 25% tariffs on Apple if iPhones are not made in the U.S. Previously, Apple aimed to import most of the iPhones it sells in the U.S. from India by the end of 2026.

On April 21, the U.S. and India announced they had agreed to broad terms of negotiation for a potential bilateral trade deal. The U.S. will seek increased market access, lower tariffs and non-tariff barriers, and a robust set of additional commitments

A US-India trade agreement under discussion covers 19 categories, including market access for farm goods, e-commerce, data storage, and critical minerals.

Negotiators will discuss contentious issues like agricultural tariffs, e-commerce market access, data storage, and critical minerals, with the goal of boosting bilateral trade to $500 billion by 2030 from $127.6 billion last year.

U.S. President Trump said India offered to remove tariffs.

India is reviewing a U.S. request to lift restrictions on ethanol imports

Modi and Trump aim to conclude the first phase of the deal by the fall of this year.

Mexico:

Mexican Economy Secretary Marcelo Ebrard expects the United States-Mexico-Canada Agreement (USMCA) review to begin between late September and early October.

Mexico President Sheinbaum said she will wait to know the full scope of U.S. court ruling on tariffs.

Sheinbaum said she discussed U.S. steel and aluminum tariffs with Trump.

Sheinbaum said she welcomed the decision by U.S. lawmakers to reduce a proposed tax on remittances to 3.5% from 5% but will continue fighting for these payments to be tax free.

U.S. has suspended imports of live cattle, horses and bison from Mexico due to screwworm.

Mexican President Claudia Sheinbaum said there’s no sign that the USMCA is going to end.

The U.S. and Mexico reached agreements on resolving conflicts over water delivery and the New World screwworm pest, de-escalating the conflict.

Mexico’s President Claudia Sheinbaum said she discussed steel, aluminum and cars with U.S. President Donald Trump, but they did not yet reach a deal. Trade talk continues.

Canada:

Canada Prime Minister Carney said he welcomed the U.S. court ruling on tariffs.

Canada Finance Minister Champagne and U.S. Secretary Bessent spoke on the sidelines of the G7 finance minister meeting.

Canada PM Carney met U.S. President Trump on May 6.

Trump indicated he would strike a friendlier relationship with Canadian Prime Minister Mark Carney, but cast doubt on whether Carney could convince him to lift tariffs on Canada.

Switzerland:

Switzerland will discuss with the U.S. easing market access for some agricultural products and simplifying approval for medical devices in order to avert damaging tariffs on its exports.

SNB President Schlegel said he had a constructive conversation with the U.S. on FX, and Switzerland is not an FX manipulator.

Swiss Confederation President Keller-Sutter said Switzerland might be the next country to sign a U.S. tariff deal, and the letter of intent will be submitted in next 1-2 weeks. And the U.S. would refrain from imposing new tariffs on Switzerland.

South Korea:

South Korea’s finance ministry said they have an ongoing FX talks with the U.S. counterpart, but no decision has been made. Earlier today, Korea Economic Daily reported that U.S. believes the fundamental cause of the massive U.S. trade deficit is due to strong USD.

On May 16, South Korea Trade Minister Inkyo said a US-Korea trade deal is impossible before the election. Inkyo said the U.S. wants to keep its 10% baseline tariffs.

U.S. and Korea agreed to share a mutual understanding of the principles they hold for FX operation and would continue to discuss the FX policy.

South Korean officials have said cooperation on shipbuilding is a “very important card” the country holds, while participation in an Alaska gas project could be part of a negotiation package, but defense costs were not up for negotiations.

Taiwan:

Taiwan Deputy Finance Minister Chen said Taiwan will continue its efforts to secure a trade deal with the U.S., despite the court ruling.

On May 15, Taiwan trade negotiator Yang meet U.S. Trade Representative Greer.

Taiwan central bank governor Yang said the U.S. did not ask Taiwan to increase the value of TWD during trade talk.

Offered zero tariffs.

Thailand:

Thailand has submitted proposals to the U.S. including buying more U.S. goods and encouraging firms to invest in the U.S.

Thailand is interested in co-developing a massive gas pipeline project in Alaska. Thailand is also open to signing a long-term contract to import 3 to 5 mn tons of LNG from Alaska annually.

U.S. wants Thailand to take more steps to prevent certificate of origin misuse by other countries. Also, the U.S. wants Thailand to look into its concerns over FX manipulation.

Brazil:

Brazil President Lula has signed agreements with China on Chinese investment, credit lines and purchasing agricultural products.

Lula said will defend fair trade based on WTO rules.

On May 4, Brazil Finance Minister Haddad met with U.S. Treasury Secretary Bessent to discuss tariffs and efforts to attract investments in green energy and critical minerals..

Saudi Arabia:

Israel: Offered to eliminate its trade deficit with the U.S.

Argentina: “to readjust the regulations so that we meet the requirements of the reciprocal tariffs proposal developed”.

Bangladesh: Offered to substantially increase its imports of U.S. goods.

Cambodia: Offered to cut tariffs on U.S. imports from 35% to 5%.

Tariffs Tracker:

Court of International Trade Ruling:

Ruling:

10% universal reciprocal tariffs, 30% border/fentanyl tariffs on China, 25% border/fentanyl tariffs on Mexico and Canada goods, and de minimus tariffs are ruled illegal as the administration exceeded what authority it has under the 1977 International Emergency Economic Powers Act.

Meanwhile, sector tariffs and tariffs under Trump’s first term remain in place.

The administration needs to remove these tariffs within 10 days from May 28.

The ruling avoids about one-third of new tariffs announced this year.

Appeal:

The administration has filed an appeal for the ruling to the Appeals Court for the Federal Circuit, and may eventually go to the Supreme Court.

The Appeals court allows tariffs to stay during the process.

The Appeals court gave deadlines of Thursday, June 5 for the plaintiffs to respond and June 9 for the U.S. administration to reply.

Alternative Ways:

Section 122: The president can impose universal tariffs up to 15% for a maximum period of 150 days, which requires Congressional action to extend afterwards. The law authorizes the president to address a balance of payment deficit or to prevent a significant depreciation in the USD. No formal investigation is needed.

Section 232: Sector tariffs which requires administrative procedures that can take time. No limit on tariff levels or duration.

Section 301: Requires weeks or even months to complete investigations, which is difficult to apply universally. No limit on tariff levels or duration.

Section 338: Allows to impose tariffs up to 50% from countries that discriminate against the U.S. No formal investigation is needed.

Tariffs in Place:

50% global tariffs on steel and aluminum, effective June 4. Previously tariffs were 25% effective March 12.

25% global tariffs on automobile, effective April 3.

25% global tariffs on automobile parts, effective May 3.

3521% tariffs on solar imports from Cambodia, Vietnam, Malaysia and Thailand.

211% tariffs on molded fiber imports from Vietnam.

Tariffs imposed during Trump’s first term.

Tariffs Remain in Place But Pending U.S. Jurisdiction:

10% global tariffs, effective April 5.

De minimus packages shipped to the U.S. from China will no longer be exempted from tariffs starting May 2

Individual reciprocal tariffs will be postponed by 90 days except for countries retaliated, effective July 8 (the full list here)

EU:

The 50% U.S. tariffs on EU goods were postponed until July 9

China:

U.S. extended the exclusion of Section 301 tariffs on some Chinese goods until August 31.

The U.S. Commerce Department asked chip design software companies to halt deliveries to China.

The U.S. Commerce Department had suspended some licenses that allowed U.S. jet engine companies to sell products and technology to China.

The U.S. will start revoking Chinese student visas.

The U.S. Commerce Department said it would issue guidance to make clear that using Huawei’s Ascend AI chips “anywhere in the world violates US export controls.”

The U.S. lowered tariffs on China imports to 30% including 10% universal tariffs and 20% Fentanyl tariffs. Other universal tariffs including 25% on steel and aluminum and 25% on autos and auto parts have remained in place. Meanwhile, 24% reciprocal tariffs will be suspended for 90 days to allow for further negotiations, with a deadline on August 12.

The U.S.’s weighted average tariff on China imports is lowered to 43.5% from 96%, considering Trump’s first term tariffs on China.

Nvidia H20 chips export ban.

From mid-October, Chinese ship-owners and operators will be charged $50 per ton of cargo with the fees increasing each year for the next three years.

Canada: 25% duties on all non-USMCA compliant goods except for energy and energy resources, which are subject to 10% ad valorem duties (about 38% of Canada exports are USMCA compliant). In case of the fentanyl tariffs are removed, non-USMCA compliant goods would be subject to a 12% reciprocal tariff.

Mexico: 25% duties on all non-USMCA compliant goods (about 50% of Mexico exports are USMCA compliant. In case of the fentanyl tariffs are removed, non-USMCA compliant goods would be subject to a 12% reciprocal tariff.

Tariffs Possibly Coming:

Tariffs on electronics including smartphones, computers, laptops, semiconductor devices etc. are temporarily paused. U.S. Commerce Secretary Lutnick said special tariffs on the sector will come soon.

Tariffs on pharmaceuticals may come soon.

Tariffs on copper may come soon.

100% tariffs on movies produced outside of the U.S. may come soon.

25% tariffs on Apple if iPhones are not made in the U.S.

25% on countries that purchase oil from Venezuela.

Retaliations:

China:

China has issued export permits of rare earth to four producers including suppliers to Volkswagen, but the approval process is slow.

China has suspended a ban on exports of dual-use items to 28 U.S. companies for 90 days as part of the trade detente with the U.S.

Starting from May 14, China lowers tariffs on U.S. goods to 10% with another 24% reciprocal tariffs suspended for 90 days.

China has removed the ban on airlines taking delivery of Boeing jets.

On May 2, Bloomberg reports China has exempted tariffs on a list of U.S. products covering 131 items like pharmaceuticals and industrials chemicals, worthing $40 bn or 24% of Chinese imports from the U.S. in 2024 (source).

Warmed to take reciprocal countermeasures against other countries negotiating with the U.S. if they make a deal at China’s expense during the trade war.

Halted on U.S. soybean and corn imports.

Halted imports of U.S. oil (source).

EU

The EU is planning to impose additional tariffs on EUR95 bn of U.S. exports if trade talks with the U.S. fail to generate a satisfactory result. The breakdown if U.S. goods targeted by EU includes 12.9 bn of chemicals and plastics, 12bn of machinery, 10.4 bn of aircraft, 10.3 of auto parts, 7.2 of electric goods, 6.4bn of agricultural goods and foods and 2bn of motor vehicles (source).

Postponed its retaliation measures until July 14. The group planned to impose tariffs on EUR21 bn goods with most of the targeted goods face 25% tariffs, and a few categories set to face 10% tariffs. Some of the EU tariffs will take effect in mid-April, while another list will be imposed mid-May and a third will start on December 1.

Penalized Apple for EUR500 mn and Meta for EUR200 mn due to violating antitrust rules.

Considering introducing restrictions on some exports to the U.S. as a possible retaliatory tactic.

Canada

Canada Prime Minister Carney announced a six-month tariff exemption for products used in Canadian manufacturing, processing and food and beverage packaging, and for items related to health care, public safety and national security.

Imposed 25% tariffs on CAD30 bn goods from the U.S., effective March 13.

Imposed 25% tariffs on U.S. cars, which are not compliant with USMCA, effective April 9.

Exempted tariffs on US-assembled automobiles contingent on those automakers continuing to produce vehicles in Canada and on completing planned investments. Automotive News reports that more than 90 percent of vehicles exported from the States to Canada are USMCA compliant. Those vehicles face a 25% tariff on their contents not produced in Canada and Mexico. Finance Canada calculates that the vehicles in question contain 85 percent U.S. content. That math comes out to a 21.25% import tariff on the majority of cars assembled in the U.S. and sold in Canada.

India

On May 13, India proposed to impose retaliatory tariffs on U.S. products in response to the steel and aluminum duties from the U.S., despite two countries signaling to reach a deal soon. India aims to cover an $1.9 bn in duties without specifying which U.S. products will be targeted.

Tariffs Exemptions:

The Trump administration will not enforce the AI diffusion rule when it takes effect on May 15 and instead plans to develop a new rule that would strengthen the control of chips aboard.

On April 29, President Trump signed an executive order to allow automakers to apply for 15% price offsets in the first year of the tariffs and a 10% offset in the second year in a bid to get companies to increase domestic production of automobiles. Also, imported cars will be given a reprieve from separate tariffs on aluminum and steel (detail).

Reciprocal tariffs exemptions:

USMCA compliant goods.

Steel/aluminum articles and autos/auto parts already subject to 25% tariffs.

Copper, pharmaceuticals, semiconductors, and lumber articles.

All articles that may become subject to future Section 232 tariffs (national security related)

Bullion (gold).

Energy and other certain minerals that are not available in the United States.

. . .

Loading…