President Trump and President Xi of China met in South Korea and discussed a framework trade deal. China, which recently tightened controls on rare earth minerals used to make electric cars, smartphones, wind turbines, and military equipment, would postpone the new rules that were to take effect on November 8, for a year, removing a pressure point on global supply chains. The initial restrictions on rare earths that China unveiled in April, however, appear to remain in place. Trump agreed to halve the 20% tariffs he imposed to pressure China to curb fentanyl trafficking, because Xi had vowed to work “very hard” to stop the flow of ingredients used to make opioids. That would bring overall tariffs on Chinese goods to around 47%, according to President Trump.

More specifically:

Alaska LNG Project

It is likely that Trump is looking for China to become a customer for a $44 billion LNG project in Alaska. Buyers in Japan and Taiwan have signed preliminary agreements for the project. Via Bloomberg, in 2017, during a Trump visit to China, several Chinese entities, including state-owned oil giant Sinopec, signed a joint development agreement with Alaska for a gas export project. But nothing developed.

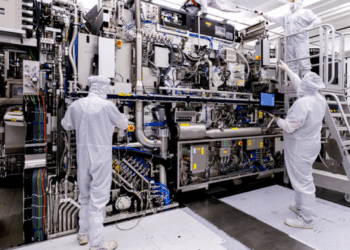

China’s Rare Earth Dominance

China is the world’s dominant producer and processor of rare earths and has used its position as leverage in trade talks, as 69% of mined rare earth production came from China in 2024, and the country controls 92% of the global output in the processing stage. On October 9, China announced additional export controls on rare earths and their products. According to CNN, China added five rare earth elements — holmium, erbium, thulium, europium, ytterbium, and related magnets and materials — to its existing control list, requiring export licenses, increasing the number of restricted rare earths to 12. China also required licenses to export rare earth manufacturing technologies out of the country. Foreign entities must obtain a license from China to export any products containing over 0.1% of domestically-sourced rare earths, or manufactured using China’s extraction, refining, magnet-making, or recycling technology.

Trade Deal with South Korea

While on his trip to Asia, President Trump finalized a framework agreement with South Korea made in July. According to Reuters, the United States will lower tariffs on South Korean goods to 15%, from 25%. South Korea will invest in the United States up to $200 billion over a decade in installments of up to $20 billion cash payments each year. It will also set aside another $150 billion for its American shipbuilding operations. Via ABC News, it agreed to buy 103 planes from Boeing valued at $36.2 billion, and the Republic of Korea Air Force agreed to invest $2.3 billion to develop its aircraft with an American technology company.

The Korea Gas Corporation signed agreements to purchase about 3.3 million tons per year of U.S. LNG via long-term agreements. LS Group pledged to invest $3 billion by 2030 in U.S. power-grid infrastructure, including undersea cables, power equipment, and winding wires. LS Cable’s U.S. subsidiary, LS Greenlink, is building a $681 million manufacturing facility in Virginia.

Analysis

President Trump secured a framework trade deal with China earlier this month, but its effect on rare earths is still up in the air. The suspension of some tariffs and export restrictions on both sides is a good step towards improving U.S.-China trade relations; however, it remains to be seen whether these suspensions will be permanent or if they are a small blip in a long trend towards greater protectionism. Either way, the fact remains that, as Economist Arthur Laffer explained, “Tariffs are not a good economic solution to anything.”

For inquiries, please contact [email protected].