“This is still only the beginning of something much larger and, we believe, even more significant,” Palantir Technologies CEO Alex Karp wrote in a letter to shareholders following the positive earnings release on Monday evening.

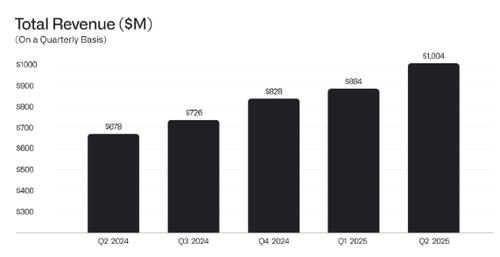

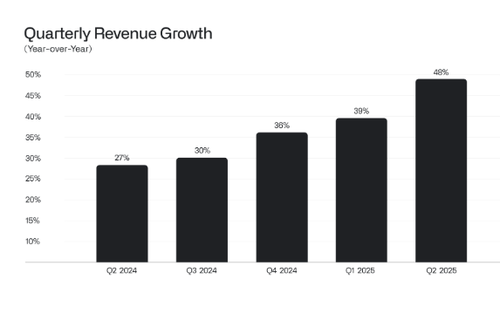

Karp continued, “Our overall business generated more than $1 billion in revenue for the second quarter of the year, a stunning 48% increase over the same period the year before, as we reach an annual run rate of more than four billion dollars.”

Palantir’s growth rate “accelerated radically“, as per Karp’s letter, because of three mega trends unfolding:

-

Custom AI application demand

-

Data infrastructure investment

-

Defense tech modernization

Here’s that acceleration…

Bold statement by Karp:

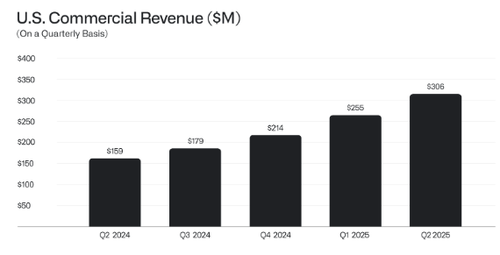

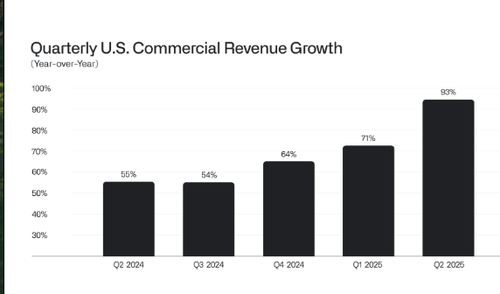

And our U.S. commercial business—the emerging core of Palantir and the seed of what an entire industry will become, perhaps the world’s most dominant, in the years to come—nearly doubled in twelve months, generating $306 million in revenue last quarter, representing a 93% increase from $159 million the year before.

And that acceleration.

Karp’s comments on the American empire:

Similarly, in the United States, the most consequential country in the West, it is the culture that enables companies like ours to come into existence—and excel. It must be protected. The United States is not, and should not be permitted to become, a soft compromise and amalgam of global values and tastes.

Summary: Palantir Q2 2025 – Key Financial Results (Blowout Beat Across the Board):

-

Revenue $1.00 billion, +48% y/y, estimate $939.3 million

-

Operating profit $269.3 million vs. $105.3 million y/y, estimate $172.2 million

-

EPS 13c vs. 6.0c y/y

-

Cash and cash equivalents $929.5 million, estimate $1.31 billion

-

Adjusted operating profit $464.4 million, +83% y/y, estimate $404.4 million

-

Adjusted EPS 16c, estimate 14c

-

Adjusted Ebitda $470.9 million, estimate $410.4 million

-

Adjusted free cash flow $568.8 million vs. $148.7 million y/y

-

Adjusted operating margin 46% vs. 37% y/y, estimate 42.8%

The data-analysis software company co-founded by Peter Thiel raised its full-year forecast after the earnings beat.

Palantir Q3 2025 Forecast (Blowout Guidance):

-

Sees revenue $1.08 billion to $1.09 billion, estimate $985.4 million

-

Sees adjusted operating profit $493 million to $497 million, estimate $417.2 million

Palantir FY25 Outlook (Raised Across the Board):

-

Sees revenue $4.14 billion to $4.15 billion, saw $3.89 billion to $3.90 billion, estimate $3.91 billion (Bloomberg Consensus)

-

Sees adjusted operating profit $1.91 billion to $1.92 billion, saw $1.71 billion to $1.72 billion, estimate $1.72 billion

-

Sees adjusted free cash flow $1.8 billion to $2.0 billion, saw $1.6 billion to $1.8 billion

-

Sees U.S. Commercial revenue above $1.30 billion

Commenting on the earnings report is UBS analyst Karl Keirstead. He stated there are “no big cracks in the story” and raised the price target for the firm from $110 to $165.

Keirstead’s first take on the earnings:

Summary: Palantir reported its 8th straight quarter of revs growth acceleration, a turnaround that we’ve never seen before, from 13% growth in 2Q23 to a just-reported 2Q25 growth rate of 48%, while at a $4 billion revs scale. Palantir raised the full year 2025 total growth guidance to 45% from 36%, without compromising on the non-GAAP margin target, which was inched up to 46%. Palantir is benefiting from a confluence of mega-trends in AI application development, investments at the data layer and the modernization of defense tech, but valuation at 136x CY26E FCF remains our key hurdle and we remain Neutral rated.

Thoughts on the Fundamentals: Both the commercial (45% of revs, +47% growth) and the government (55% of revs, +49% growth) segments were very strong, with no evidence of U.S. Fed/DOGE-related pressure, evidence that Palantir is on the right side of DoD spending mix shifts. Palantir described the U.S. commercial segment (+93% growth at a $1.2 billion revs run-rate) as its “emerging core” and while it may not be formal guidance, the CEO said that he’d like to see this segment 10x over the next 5 years. This would put the U.S. Commercial segment at a $12 billion run-rate and implies a 58% 5-year CAGR. For 2025, Palantir raised its full year revs guide by ~$250 million (the 2Q25 beat was $66 million) to +45% growth, this time with no tempered language about 2H-weighted Fed deal linearity. The only flaw was the -3% y/y growth rate in the Intl Commercial segment. Net, we’re raising our 2025 revs growth estimate to 47% from 38%.

Readthrough to Software/Tech Peers: We’d note: 1. The results strengthen the now-consensus Street view that enterprise demand for custom-built AI apps and data modernization remains very strong, a positive readthrough to data software peers Snowflake and Databricks. 2. The resiliency of Palantir’s U.S. Fed business is likely idiosyncratic to defense tech and is NOT a good readthrough to software firms with high Fed exposure. 3. The cleanest/best 2Q25 software sector prints have now come from Microsoft and Palantir, likely bolstering investor confidence to stay long the infra/data/AI stocks rather than rotate into seat-based SaaS/apps stocks.

Valuation: On our CY26 estimates Palantir trades at 136x FCF. We roll our valuation to CY27 and raise our PT to $165 from $110 based on a CY27E FCF multiple of 105x (previously 120x our CY26E FCF), a significant but deserved premium given PLTR’s growth/margin profile is one of the strongest in Software.

Meanwhile, analysts at Jefferies noted that even with Palantir’s strong results and clearly accelerating U.S. commercial growth, its valuation is “on a different planet” and disconnected from even the most optimistic growth scenarios.

Loading recommendations…