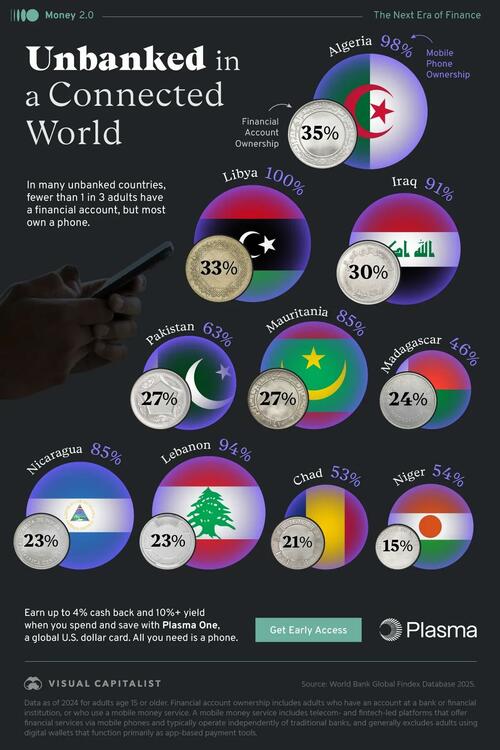

Financial exclusion remains high in many parts of the world. In several countries, more than two out of three adults are unbanked, yet the majority own a mobile phone. This contrast between connectivity and financial access highlights both the persistent gaps in global inclusion and the massive opportunity to close them.

Created in partnership with Plasma, this graphic, via Visual Capitalist’s Jenna Ross, shows how ownership of financial accounts and mobile phones compares across countries. It’s part of our Money 2.0 series, where we highlight how finance is evolving into its next era.

The Unbanked Gap

In low- and middle-income economies, 84% of adults own a mobile phone, while 75% of people have financial accounts. This gap is much wider in some countries, especially in Africa and the Middle East.

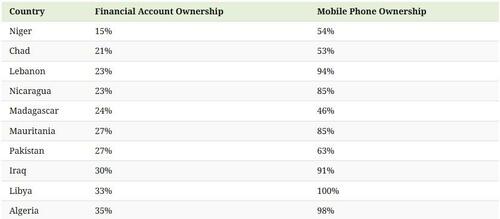

For the most unbanked countries worldwide, here are the percentages of adults who own a financial account and those who own a mobile phone.

Source: World Bank Global Findex Database 2025. Data as of 2024 for adults aged 15 or older. Financial account ownership includes adults who have an account at a bank or financial institution, or who use a mobile money service. A mobile money service includes telecom- and fintech-led platforms that offer financial services via mobile phones and typically operate independently of traditional banks, and generally excludes adults using digital wallets that function primarily as app-based payment tools.

In Niger, a mere 15% of adults have a financial account but more than half of the population owns a phone. The most unbanked countries all show major disparities between phone and account ownership.

Many adults say they don’t have an account because they don’t have enough money, fees are too high, or the account providers are too far away. How can phones help solve these challenges?

Phones: The Key to Financial Access

In low- and middle-income countries, 42% of adults without a financial account own a smartphone. This means that the hardware to reach people already exists, and opens up significant potential for mobile financial solutions.

Plasma One is a mobile solution that tackles the common reasons people remain unbanked. With quick signup on your phone, you can start saving, spending and earning almost instantly in over 150 countries. You can also send USD₮ (Tether stablecoin) anywhere with no fees whatsoever.

Loading recommendations…