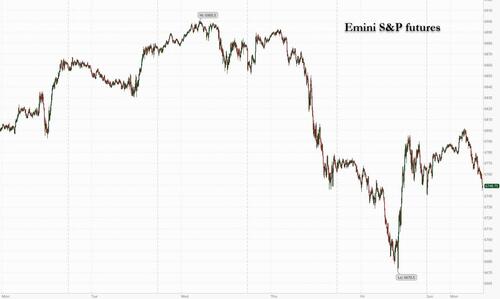

US equity futures are slightly higher led by Tech, but well off overnight highs, while stocks around global markets slide. As of 8:00am ET, S&P and Nasdaq futures are up 0.1%, having previously been as much as 0.6% higher, after both gauges closed above their 50-day moving averages on Friday, a key support level. In premarket trading, Mag7 names are mostly lower led by GOOG +4%, NVDA is down 1% with earnings Wednesday after the close. Bond yields are lower as the curve mostly bull steepens; USD trades near session highs. Commodities are mixed with Energy weaker, Ags stronger, and mixed performance across metals. Airlines are back to full capacity as FAA lift restrictions. Government data releases return this week with the focus on Thursday’s NFP release (Sep data). Earnings will been focused on Retailers. Some of the week’s few key events: Nvidia EPS 11/19 post close ($300bn mkt cap implied move), VIX Expiry 11/19, FOMC Minutes 11/19, Sept NFP 11/20 pre-mkt (Goldman +80k vs 50k cons), Nov Opex 11/21, HD/WMT/LOW/TGT/TJX/WSM/GAP consumer EPS, +10 Fed speakers, and a continued slew of sell-side conferences.

In premarket trading, Mag 7 stocks are mostly lower: Alphabet (GOOGL) rises 4% after a regulatory filing showed that Warren Buffett’s Berkshire Hathaway Inc. acquired 17.9 million shares of the Google parent during the third quarter. Amazon (AMZN) +0.8%, Meta Platforms (META) -0.08%, Microsoft (MSFT) -0.07%, Apple (AAPL) -0.7%, Nvidia (NVDA) -1%, Tesla (TSLA) -0.7%.

- Aramark (ARMK) falls 2% after the food and facilities management company reported revenue and adjusted EPS for the fourth quarter that missed consensus estimates.

- EW Scripps (SSP) rises 19% after Sinclair took an 8.2% stake.

- Expeditors International of Washington (EXPD) gains 1.8% after UBS upgraded its view on the company to buy, expecting growth in the customs/other segment to offset pressure from lower ocean rates in 2026.

- Gap (GAP) rises 2% as Barclays upgrades the apparel retailer’s stock to overweight, seeing “durable brand recovery” when looking past tariff pressures.

- PotlatchDeltic (PCH) falls 2% after being cut by two steps at Bank of America.

- Quantum Computing Inc. (QUBT) climbs 16% after the company reported third-quarter net income of $2.4 million, or 1 cent per share, versus a loss of $5.7 million, or 6 cents per share, in the quarter last year.

- Sealed Air (SEE) falls 3% after Clayton Dubilier & Rice agreed to buy the packaging company that invented Bubble Wrap.

- Zymeworks (ZYME) jumps 35% after the drug developer gave topline results from a late-stage trial of its experimental combination therapy for cancer of the stomach and esophagus. Shares of partner Jazz Pharmaceuticals (JAZZ) are up 21%.

In corporate news, Emirates is placing another major order for Boeing’s flagship 777X airliner, valued at $38 billion. Jeff Bezos has created an AI start-up where he will be co-CEO, according to the New York Times. Peter Thiel’s hedge fund Thiel Macro sold off its holdings in Nvidia during the third quarter, according to a 13F filing.

Stock futures have erased an earlier gain, when sentiment got a modest boost from Morgan Stanley’s Michael Wilson (whose timing has been rather atrocious in recent years), who said a new bull market and earnings cycle is powering on. Wilson predicted a 16% rally for the S&P 500 over the next year, driven by strong company earnings, making him among the most bullish strategists on the Street.

“We’re in the midst of a new bull market and earnings cycle, especially for many of the lagging areas of the index,” Wilson wrote in a note.

Others are less optimistic. Bond king Jeffrey Gundlach is worried about “garbage lending” in private credit and unhealthy valuations across asset classes, saying the US stock market is “among the least healthy in my entire career.” Among speculative assets, the steep drop in Bitcoin stabilized on Monday but smaller, riskier tokens are more fragile: A basket of the smallest digital assets fell to lows not seen since the pandemic on Sunday.

For the biggest tech stocks, Bloomberg’s analysis of 13F filings showed that hedge funds pared positions in Mag 7 stocks last quarter. Still, tech stocks accounted for the biggest weighting in portfolios, at 26%. The value of investments in consumer staples fell by the most for any industry.

“Despite being dated, the September US payrolls matter as delayed data has left uncertainty for markets and policymakers,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “The report will help clarify economic momentum and Fed rate-cut expectations.”

Uncertainty over the possibility of a hawkish pivot by the Fed has heightened fears that this year’s gains have gone too far. Traders have pushed the odds of a quarter-point rate cut in December below 50% after some officials signaled that further easing is far from assured. The Fed will release minutes from its Oct. 28-29 meeting on Wednesday to shed light on an unusual split among policymakers. Fed voting members including Philip Jefferson, Christopher Waller and John Williams are due to speak later on Monday.

“I do believe that the Fed still has the potential to cut in December, but that brings volatility,” Adrian Zuercher, co-head of Global Asset Allocation at UBS Global Wealth Management, told Bloomberg TV. “But overall, I do think markets are quite healthy and could actually go further up from here.”

In strategy, Deutsche Bank said that equity positioning has slipped back to neutral with discretionary investors turning underweight and positioning in mega-cap growth and tech trimmed. Meanwhile, investors are focused on ever-shortening windows of volatility to manage risks, such that the influence of contracts expiring from zero to five days away has surged, according to JPMorgan strategists. And RBC said that data shows some deterioration and slowing flows into passive investment for retail investors.

European stocks dip, tracking modest declines in Asia. Retail, travel and chemical shares are the worst performers on the Stoxx 600 while utilities and energy equities are the biggest underperformers. Here are the biggest movers Monday:

- Saab surges as much as 7.1% after the Swedish defense group rounded a major week for new contracts with a keenly anticipated deal to supply Colombia with new fighter jets in a contract worth €3.1 billion ($3.6 billion)

- SIG Group AG surges as much as 12% after the Swiss food packaging maker appointed Mikko Keto as CEO. Vontobel says the appointment is a first step toward boosting investor confidence

- WPP shares gain as much as 6.7% as advertising agency Havas has expressed interest in the London-listed company, the Times reported over the weekend

- Ninety One declines as much as 4.6% in Johannesburg, the most since June 13 after the asset management firm reported pretax profit for the first half-year that missed the average analyst estimate

- Genuit Group falls as much as 14%, after the provider of water and ventilation products warned it expects the market to remain subdued for the remainder of 2025 and into next year due to the economic and political backdrop

- Pluxee shares fall, after the French employee-benefits firm revised its guidance to incorporate the potential impact of changes to Brazil’s meal voucher system, news of which sent the stock tumbling last week

In rates, treasuries climb, pushing US 10-year yields down 1 bps to 4.14%. Treasury yields are richer by 1bp to 3.5bp across the curve, the 10-year around 4.12%, with 2s10s spread flatter by nearly 2bp, 5s30s by 2bp about. Gilts pare some of Friday’s slump, with UK 10-year borrowing costs falling 2 bps to 4.55%.

In FX, the Bloomberg Dollar Spot Index rises 0.1%. The Aussie dollar is the weakest of the G-10 currencies, falling 0.3% against the greenback.

In commodities, bitcoin rises over 2% and back above $95,000, erasing its weekend fall. Spot gold is steady near $4,088/oz. WTI crude futures are little changed near $60 a barrel.

Today’s US economic calendar includes November Empire Manufacturing (8:30am) and August construction spending (10am); September employment data delayed by US government shutdown is slated for Thursday. Fed speaker slate includes Williams (9am), Jefferson (9:30am), Kashkari (1pm) and Waller (3:35pm).

Key events this week include Nvidia earnings on Wednesday and the release of long-delayed economic data. Another key event this week is the release of FOMC minutes of the Oct. 28-29 meeting, when Fed Chair Powell was unusually hawkish. Markets will be looking for any details on what Powell called a “growing chorus” of officials who think the Fed should pause for at least one meeting.

Market Movers:

- S&P 500 mini unch

- Nasdaq 100 mini +0.1%

- Russell 2000 mini little changed

- Stoxx Europe 600 -0.3%

- DAX -0.4%

- CAC 40 -0.3%

- 10-year Treasury yield -3 basis points at 4.12%

- VIX +0.4 points at 20.18

- Bloomberg Dollar Index little changed at 1217.38

- euro -0.1% at $1.1607

- WTI crude -0.2% at $59.96/barrel

Top Overnight News

- US President Trump posted that House Republicans should vote to release the Epstein files, via Truth Social.

- Trump signaled support for Senate legislation to sanction countries doing business with Russia, potentially targeting major consumers like China and India. BBG

- China slow-walks U.S. soybean purchases as stockpiles hit multi-year highs, undermining Trump’s trade deal claims. CNBC

- China escalated tensions with Japan over PM Sanae Takaichi’s Taiwan remarks. The state broadcaster warned of “substantive retaliation” including sanctions and trade curbs as Beijing cautioned against travel to Japan. BBG

- Japan moved on Monday to tamp down an escalating row with China over Taiwan that has prompted Beijing to urge citizens to halt travel to its East Asian neighbor. The dispute erupted after Prime Minister Sanae Takaichi told Japanese lawmakers this month that a Chinese attack on Taiwan threatening Japan’s survival could trigger a military response. RTRS

- New York Federal Reserve President John Williams met with Wall Street banks this week to discuss a key short-term lending facility: Reuters.

- Trump administration officials, including Health Secretary Robert F. Kennedy Jr., discussed scaling back the role of FDA Commissioner Marty Makary; RFK Jr. also considered installing a new leader to manage the agency day to day: WSJ.

- Japan’s economy shrank at an annualized rate of 1.8% in the latest quarter, as US tariffs hit exports and housing investment plunged ahead of a major stimulus package expected this month to boost the struggling economy. The decline in real GDP for July to September period was less severe than economists’ median forecast of 2.5%. FT

- The euro-area economy will maintain its moderate expansion, with output rising 1.3% in 2025, 1.2% in 2026 and 1.4% in 2027, European Commission forecasts showed. Inflation is seen sticking close to the ECB’s 2% target over the next two years. BBG

- The UK will today unveil proposals to make it easier to remove migrants with no rights to stay in the country. BBG

- The Federal Aviation Administration said it would lift its flight restrictions related to the government shutdown, clearing the way for normal operations to resume at U.S. airports after weeks of delays and cancellations. WSJ

- GOOGL +430bps pre mkt after regulatory filings show Berkshire Hathaway acquired 17.9 shares during 3rd quarter and ahead of release of Gemini 3.0 AI model which may arrive as soon as this week. BBG

Trade/Tariffs

- US Treasury Secretary Bessent said the China rare-earths deal will “hopefully” be done by Thanksgiving, according to Fox News. Treasury Secretary Bessent said he is confident China will honour the agreement after the upcoming meeting between Presidents Trump and Xi, and emphasised that Washington has “many levers” if Beijing does not comply.

- US President Trump said he does not think more tariff rollbacks will be necessary; he said top US officials spoke with their Chinese counterparts on Friday and that he is speaking to China about soybeans, according to Reuters.

- US Treasury Secretary Bessent said US President Trump’s proposal to send USD 2,000 “dividend” payments from tariffs to US citizens would require congressional approval, according to Reuters.

- Tesla (TSLA) is now reportedly requiring its suppliers to exclude China-made components in the manufacturing of its cars in the US, a fresh example of the fallout from Washington–Beijing tensions, according to the WSJ.

- Brazil’s Vice President Alckmin said Brazil will continue working to reduce US tariffs further; he noted that progress has been made but there is still a long way to go, expressed optimism about further progress, and said the US government has taken a step in the right direction to reduce costs for its consumers, according to Reuters.

- USTR Greer has warned the EU that trade remains a “flashpoint” with Washington, according to the FT.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly lower after the mixed lead from Wall Street, with sentiment in the region subdued as US President Trump over the weekend said he does not think further tariff rollbacks will be necessary. The Nikkei 225 saw modest losses on either side of 50k, while South Korea’s KOSPI (+1.5%) stood out as a clear outperformer amid strong gains in chip names after reports that Samsung is raising chip prices, whilst China’s tourist warning to Japan was seen as a positive for South Korea. Focus remains on the tech sector this week in the run-up to NVIDIA earnings midweek. ASX 200 was subdued with sectors mixed. Telecoms, Healthcare, and Consumer Discretionary lagged, while IT and Energy outperformed. Nikkei 225 was choppy and briefly slipped under 50k following Japan’s GDP contraction — the first in six quarters, albeit shallower than feared. Rising tensions between Japan and China added pressure, with Japanese travel-related names hit after Beijing warned citizens against travelling to and studying in Japan. KOSPI was the outperformer, driven by gains in Samsung Electronics and SK Hynix after reports that Samsung raised server memory chip contract prices by up to 60% in November due to shortages – the former also plans to add a new chip production line as demand rises. Broader gains were also supported by China’s warning against travel to Japan. Hang Seng and Shanghai Comp both traded with modest losses, broadly in line with regional moves (ex-South Korea). Over the weekend, US Treasury Secretary Bessent said the China rare-earths deal will “hopefully” be completed by Thanksgiving, but stressed that Washington has “many levers” if Beijing does not comply. President Trump added he does not think further tariff rollbacks will be necessary, noting senior US officials spoke with Chinese counterparts on Friday and that discussions on soybeans continue.

Top Asian News

- Samsung Electronics (005930 KS) will build a new chip production line in Pyeongtaek, South Korea, with mass production slated to begin in 2028; the company also said FläktGroup is considering building a factory in South Korea, according to Reuters.

- Alibaba’s (9988 HK) Qwen has entered public beta as a direct challenge to ChatGPT.

- Japan’s government is reportedly considering compiling a stimulus package of around JPY 17tln, with a supplementary budget likely to be sized around JPY 14tln, according to Nikkei.

- Japan’s Key Government Panel member Kataoka says the government must compile a stimulus package of up to JPY 23tln, funded with JPY 10tln in net bond issuance and JPY 13tln with tax and non-tax revenues. Adds: BoJ should move cautiously with policy normalisation. Should wait until March or April 2026 to raise rates. Should not rule out FX intervention in addressing excessive yen weakness.

- India Trade Official says India and US could soon agree to address reciprocal tariffs as part of first part of the agreement. India and USA are likely to address broader trade issues in the second part of the agreement.

- Japanese PM Takaichi to meet with BoJ Governor Ueda on Tuesday at 06:30 GMT.

European bourses (STOXX 600 -0.4%) began the morning around the unchanged mark, with trade tentative, though recently sentiment has soured a touch with most European bourses slipping into the red. Nothing really behind the latest bout of pressure, but does continue the subdued mood seen overnight. European sectors also opened with a positive bias, but now holds a negative bias. Utilities and Real Estate marginally top the pile whilst Retail lags. Dassault Aviation (+6.2%) bucks the broadly lower mood in Europe, after Ukrainian President Zelensky said Ukraine had ordered 100 Rafale fighter jets.

Top European News

- ECB’s Rehn said the risk of inflation slowing shouldn’t be overlooked, according to Helsingin Sanomat. He added that “low energy prices, a stronger euro, and easing wage and services inflation pose a risk that total inflation slows excessively relative to our 2% target.”

- ECB’s de Guindos says expect inflation to converge towards target. Uncertainty has abated but still a defining feature of out times. FSR will focus on 3 big risks, first is about risk of financial market corrections. There’s a risk of abrupt shift in sentiment. Fiscal challenge also a key vulnerability. Banks may face deterioration of credit quality. Banks resilience is underpinned by profits and capital. Adverse economic shocks could lead to rising corporate defaults, valuation corrections and losses for private funds and their investors. Upholding the macroprudential, measures for banks implemented in recent years. Closer monitoring and strengthening the macroprudential framework for the non-bank sector. Slightly more optimistic re. growth. Wage dynamic are going in the right direction.

- UK Chancellor Reeves is reportedly considering a nightly levy for British holidaymakers and foreign tourists on hotel stays and Airbnb-style rentals, via The Times.

- EU Commission President von der Leyen, in a letter to member states, says the scale of Ukraine’s financing gap is significant. They have identified three main options. According to Reuters sources, the three options in the Ukraine financing are not mutually exclusive and can be combined or sequenced.

FX

- DXY is flat/modestly firmer and trades in a busy 99.29 to 99.47 range, given the lack of pertinent newsflow this morning but ahead of a packed weekly docket, which includes; the release of the delayed September NFP report, FOMC Minutes and a number of Fed speakers. Today’s docket is a bit more on the quiet side with only really the NY Fed Manufacturing report and comments via Fed’s Williams, Jefferson, Kashkari and Waller.

- EUR is a little lower today and trades just around the 1.1600 mark, within a 1.1596 to 1.1624 range. Newsflow for the region is relatively quiet ahead of the European Commission Autumn forecasts; there were some comments via ECB’s de Guindos who suggested that he is slightly more optimistic regarding growth, and expects inflation to converge towards target. Back to the Commission it raised its 2025 growth forecast for the bloc but cuts its view for 2026 to 1.2% (prev. 1.4%), while the inflation forecast was maintained for the year but increased in 2026. No significant EUR move seen, as such the single currency remains around the 1.16 mark.

- JPY is modestly lower vs the USD, and as is the case with peers, trade has been contained within a narrow 154.41 to 154.83 range. Overnight, price action was also lacklustre, and was ultimately little moved by a less-than-feared contraction in headline GDP – largely due to weak exports and lower tourism. Analysts at OxEco write that the dip in GDP will likely prove to be temporary, suggesting that consumption should modestly improve. On the fiscal side of things, Japan’s Key Government Panel member Kataoka said that the Government must compile a stimulus package of up to JPY 23tln, funded with JPY 10tln in net bond issuance and JPY 13tln with tax and non-tax revenues.

- GBP is flat/slightly lower and trades towards the midpoint of a 1.3136 to 1.3180 range. Traders remain solely focused on the Budget developments, albeit updates over the weekend have been lacking on that front. This morning, The Times reported that Reeves is considering a nightly levy for British holidaymakers and foreign tourists on hotel stays and Airbnb-style rentals.

- Antipodeans are pressured, with the Aussie the marginal laggard across G10 pairs. Nothing really driving things for the currencies this morning, but follows on from subdued price action overnight, following the APAC risk tone.

Fixed Income

- A contained overnight session for USTs. Meandered within a narrow 112-15 to 19 range early doors with specifics light and participants preparing for a week of delayed data to finally start hitting and a substantial amount of Fed speak; into this, the odds of a cut in December have slipped to c. 40% vs the ~50% seen last week. Thereafter, the early European morning saw a modest deterioration in the region’s risk tone (though, US futures remained strong), which provided some modest support to benchmarks generally. Lifting USTs further into the green and to a 112-22+ peak. If the move continues, we look to 112-23 from Friday before 112-31 and 113-00 from the two sessions prior. Today’s docket is dominated by Fed speak, where Williams (voter), Jefferson (voter), Kashkari (2026) and Waller (voter) are all due. From those, we expect Jefferson and Waller to provide texts, Jefferson and Kashkari to partake in Q&A’s while Williams is not expected to provide either.

- Bund overnight action was contained and similar to that outlined in USTs. Until the arrival of European participants, where a bout of upside occurred as the European risk tone deteriorated. Newsflow is relatively light and the move isn’t a particularly pronounced one, with Bunds firmer by just over 10 ticks at most at a 128.79 peak. If this continues, we look to 128.97 from Friday after which there is a gap until the figure and then levels between 129.19-40 from last week.

- Gilts are firmer, just about outperforming peers but the magnitude of action is also modest thus far. Gapped higher by 20 ticks to above the 92.05 mark before briefly losing the figure and then conformed to peers and lifted to a 92.29 peak, with gains of 14 ticks at most. Newsflow remains firmly focussed on the budget, and while there have been several scoops and reports around what Chancellor Reeves may do, there has not been anything of the magnitude seen last Friday. This week, the main focus point is Wednesday’s CPI, a series that provides early insight into the December deliberations, where Bailey may have to play the tie-breaking role once again.

Commodities

- Crude benchmarks were muted to start the European session amid continued attacks on Russian oil infrastructure. WTI and Brent initially dipped USD 0.40/bbl on the open following the resumption of oil loading at Russia’s Novorossiysk Black Sea port. After dropping to a low of USD 59.32/bbl and 63.66/bbl respectively, benchmarks slightly rebounded, before a heftier bout of buying which sent WTI and Brent to a peak of USD 60.19/bbl and 64.48/bbl. Nothing really for it, but appeared to coincide with reports that Israeli warplanes targeted areas in southern Lebanon. This upside briefly pared, before then catching another bid back towards highs.

- Spot XAU is oscillating in a tight USD 4050-4106/oz band as the European session gets underway and the market steadies itself following Friday’s selloff.

- Base metals have traded rangebound throughout the APAC session and into the European session amid a lack of drivers to start the week. 3M LME Copper continues to trade well-within Friday’s range in a tight USD 10.79k-10.85k/t band as markets await fresh catalysts.

- India’s October gold imports at USD 14.7bln.

- Russia’s Kremlin says they have the capacity to eliminate the consequences of the Ukrainian attack on Novorossiysk in a short period of time and recommenced all export activity.

- Indonesia is finalising a plan to impose export taxes of 7.5-15% on gold product shipments; designed to be effective from some point in 2026.

- All operations on intake and transfer of Kazakh oil has resumed at the Novorossiysk port, via IFX.

Geopolitics: Middle East

- Israeli warplanes have targeted areas in southern Lebanon, via Iran International citing Al-Mayadeen Network.

- Israeli forces raided the city of Dura south of Hebron in the West Bank, according to Reuters.

- Israel’s Defence Minister said the multinational force led by the US will take charge of disarming Hamas in Gaza, according to Reuters.

- US Central Command said Iran’s use of military force to seize a commercial vessel in international waters is a violation of international law, according to Reuters. US Central Command said that on Friday it detected Iranian forces boarding an oil tanker flying the Marshall Islands flag in international waters, and that the tanker Talara was seized after Islamic Revolutionary Guard Corps forces boarded it via helicopter.

- Iran’s foreign minister said the nation is no longer enriching uranium at any site in the country, via AP.

- Israeli PM Netanyahu said there will be no Palestinian state and that Hamas will be disarmed — by force, if necessary, according to Reuters.

- Iran’s Foreign Minister Araqchi said the current US approach in no way indicates readiness for equal and fair negotiations; he added that Iran will always be prepared to engage in diplomacy but not negotiations meant for dictation, according to state media.

- Lebanon will file a complaint to the UN Security Council against Israel for constructing a concrete wall along Lebanon’s southern border that extends beyond the “Blue Line”, according to the Lebanese presidency.

- US President Trump warned that countries doing business with Russia will face sanctions under new legislation and said Iran may be added to that list, according to Reuters.

- US President Trump is reportedly considering a “bilateral security agreement pledging to defend Saudi Arabia in the event of any attack”, via Politico citing sources.

Geopolitics: Ukraine

- Russia’s Novorossiysk Black Sea port resumed oil loadings on November 16, according to Reuters sources and LSEG data.

- Ukraine’s military says it struck an oil refinery in Russia’s Samara region, according to Reuters.

- Russia’s Defence Ministry said Russian forces took control of Yablukove in Ukraine’s Zaporizhzhia region, according to TASS.

Geopolitics: China-Japan

- Japan is to send a senior diplomat to ease tensions with China, according to NHK.

- China’s Coast Guard said a Chinese coastguard ship formation cruised past the Senkaku Islands and that the cruise was to protect rights and in accordance with international law, according to Reuters.

Geopolitics: Other

- US aircraft carrier has arrived in the Caribbean in a major build-up near Venezuela, via AP.

- US President Trump said he could have discussions with Venezuela’s President Maduro, according to Reuters.

- Russian President Putin held a phone call with Israel’s PM Benjamin Netanyahu, according to the Kremlin.

- US President Trump said the US will test nuclear weapons like other countries, according to Reuters.

US Event Calendar

- 8:30 am: Nov Empire Manufacturing, est. 5.75, prior 10.7

- 10:00 am: Aug Construction Spending MoM, est. -0.1%, prior -0.07%

DB’s Jim Reid concludes the overnight wrap

After the resolution of the US government shutdown, markets face a packed calendar of delayed and scheduled releases this week. Although maybe the most important event will be Nvidia’s earnings after the closing bell on Wednesday. One of the most interesting developments last week in the world of tech was the widening out of AI related CDS spreads. For example, Oracle 5yr CDS widened +18bps to 105bps and CoreWeave around +100bps to 630bps last week even as a volatile week for the Mag-7 ended in only a small -1.19% loss. The tights for the year for both were 33bps and 360bp respectively with the CoreWeave contract only starting trading in September. Some of this is concern about AI corporate bond supply over the next few quarters after a surprise surge in recent weeks. However, it seems that they are also being used as a general hedge for all sorts of positive AI positions. There aren’t many credit names to use to hedge AI lending (private and public), or general exposure, so these are bearing the brunt.

The US calendar dominates this week as agencies work through the backlog caused by the 43-day shutdown. The headline event is Thursday’s September employment report. DB’s economists expect payrolls to rebound sharply, with headline and private payrolls both forecast at +75k versus prior readings of +22k and +38k respectively, leaving unemployment steady at 4.3%. Average hourly earnings should rise 0.3%, while hours worked edge up to 34.3. If realised, these figures would lift annual nominal compensation growth to 4.9%, though quarterly growth may slow to 3.7%, its weakest pace since the pandemic.

Beyond jobs, several delayed releases will inform Q3 US GDP estimates: August construction spending (today), factory orders (Tuesday), and the trade balance (Wednesday). Earlier data suggested 2.8% annualised growth for Q3 GDP, but this week’s numbers could tilt forecasts higher. More timely indicators include the Empire State manufacturing index (today), NAHB housing market index (tomorrow), Philadelphia Fed survey and October existing home sales (both Thursday). Consumer sentiment from the University of Michigan rounds out Friday, with inflation expectations within that survey remain a key watchpoint for policymakers.

Fed communication will be another major theme. A broad slate of officials speaks throughout the week, including Vice Chair Jefferson, Governor Waller (both today), and regional presidents Williams, Kashkari (today), Barkin and Collins. Markets will scrutinise these remarks for clues on the pace of rate cuts. Jefferson may be the most interesting to see whether he continues to suggest a slowing of rate cuts as the Fed approaches neutral.

The October FOMC minutes, due Wednesday, should shed light on internal debates and the conditions for a potential December move. Recent commentary suggests a more cautious tone, with some officials signalling that a December cut is far from assured, and on Friday December futures priced in a less than a 50% chance of a cut for the first time. ECB President Lagarde also speaks on Friday, adding a European angle to the policy debate.

Globally, attention will centre on flash November PMIs due Friday. Canadian (today) and UK (Wednesday) CPI figures are released, with UK retail sales and consumer confidence rounding out Friday. In Asia, Japan reports October CPI on Thursday, while China announces lending rates the same day. Corporate earnings will also feature prominently, with Nvidia in the spotlight on Wednesday, joined by Palo Alto Networks and major US retailers such as Walmart, Home Depot and Target. Chinese tech names Baidu and Xiaomi will also report. See the day-by-day week ahead for more at the end as usual.

Asian equity markets are mixed this morning even if US futures are strong. As I check my screens, Chinese risk is soft with the Hang Seng (-0.84%) leading losses followed by the CSI (-0.70%) and the Shanghai Composite (-0.47%) amid a renewed diplomatic row between Beijing and Tokyo as relations between the two countries sour further over Taiwan. Japanese stocks are also slightly weaker with the Nikkei (-0.11%) and the Topix (-0.37%) edging lower with the rising geopolitical tensions. Elsewhere, the KOSPI (+1.80%) is rebounding sharply driven chiefly by outsized gains in chipmakers SK Hynix and Samsung Electronics. S&P 500 (+0.43%) and NASDAQ 100 (+0.67%) futures are fairly strong for this time of the day higher.

Returning to Japan, the economy shrunk at an annualised rate of -1.8% in the July-September period (v/s -2.4% expected), as US tariffs sent the nation’s exports sharply lower. On a q/q basis, GDP slipped -0.4%, the first contraction in six quarters, but smaller than the -0.6% drop the market had expected. A big decline during the quarter came in exports, which were -1.2% down from the previous quarter. Yields on the 10yr JGBs are +2.3bps higher, trading at 1.73% as we go print.

Recapping last week now and markets saw initial optimism about the end of the longest government shutdown in history reverse as hawkish Fed commentary raised doubts that the Fed will cut rates in December. In the end, the S&P 500 was little changed (+0.08% on the week; -0.05% Friday), with a +1.54% gain on Monday offset by a -1.66% fall on Thursday. The small weekly gain was led by defensive sectors such as healthcare (+3.87% on the week) as Congress passed legislation funding most government agencies through January 30, which ended the shutdown after 43 days. By contrast, tech stocks struggled with the NASDAQ down -0.45% (+0.13% Friday) and the Mag 7 -1.19% weaker (+0.17% Friday). Those declines were led by a -5.86% drop for Tesla, though Nvidia managed to bounce back +1.07% (+1.77% Friday) despite Softbank announcing that it had sold its entire stake for $5.83bn to focus on other AI investing.

Struggles in momentum trades were also visible with Bitcoin, which fell -8.53% (-3.83% Friday) and is now -24% down from its early October peak and back to levels last seen in May (it’s bounced back a couple of percent this morning). By contrast, credit had a resilient week with US IG spreads flat and HY spreads -5bps tighter respectively.

In the rates space, hawkish comments from Fed officials pushed Treasury yields higher. On Friday, Dallas Fed President Logan said “I think it would be hard to support another rate cut unless we were to get convincing evidence” from the data. Other officials had earlier also sounded sceptical about a December cut, such as Boston Fed President Collins saying that “it will likely be appropriate to keep policy rates at the current level for some time”. All the comments saw the pricing of a December rate cut decline from 67% on Tuesday to 43% by Friday’s close, with 2yr Treasury yields climbing +4.5bps to 3.61% (+1.6bps Friday) and 10yr yields +5.1bps to 4.15% (+2.9bps Friday).

Over in Europe, the French National Assembly supported the suspension of the pension age increase until after 2027 to keep the budget process on track, leading to a rally in CAC 40 of +2.77% (-0.76% Friday). The Swiss market also outperformed (+2.73%, -0.84% Friday) as the US and Switzerland reached a preliminary trade deal lowering tariffs from 39% to 15%, in exchange of $200bn direct investment in the US by the end of 2028. Both the Stoxx 600 (+1.77%, -1.01% Friday) and the DAX (+1.30%, -0.69% Friday) also saw decent gains. On the bond side, 10yr bunds (+5.4bps) and BTPs (+4.0bps) matched the weekly move in Treasuries, while OATs (-0.4bps) outperformed on the budget news.

Finally, the UK came into the spotlight after the FT reported on Thursday night that PM Keir Starmer and Chancellor Rachel Reeves ditched plans to increase income tax rates at the upcoming budget. Further reporting on Friday suggested this was in part as more optimistic projections reduced the size of the fiscal gap. Still, the news weighed on UK assets, with 10yr gilts (+13.7bps Friday, +11.3bps on the week) seeing their biggest daily sell off in four months, while the FTSE 100 fell -1.11% Friday, underperforming European peers over the week (+0.16%).

Loading recommendations…