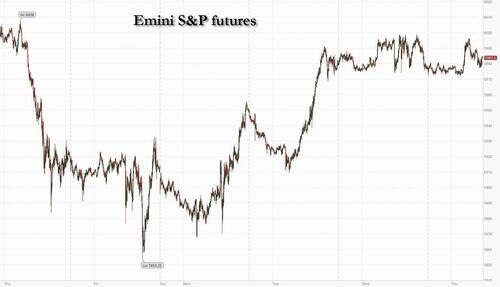

US equity futures are unchanged, as they struggle for direction ahead of Friday’s payrolls report, following a series of data releases that offered mixed signals on the health of the economy. As of 8:00am, S&P futures are flat, having traded on either side of the unchanged line during the overnight session and followed a slurry of weak macro data releases which saw Wednesday’s gains erase and recover, with the S&P ultimately ending the day flat. Nasdaq 100 futs are down 0.1% with Mag 7 stocks mostly higher except for TSLA (-1.6%). Stocks and bonds in Europe gained ahead of the ECB’s expected 8th consecutive interest rate cut. The yield on 10-year US Treasuries steadied as Wednesday’s bond rally faded. The dollar reversed earlier losses even as gold surged to briefly top $3400. Commodities are mostly mixed with notable outperformance in silver (+3.1%). News flow since yesterday’s close has been largely muted: headlines continue to focus on trade negotiation development, particularly implication on rare earth curbs (BBG and CNBC) and upcoming Trump-Xi call.

In premarket trading, the Mag 7 stocks are mixed (Alphabet +1.3%, Amazon +0.7%, Meta +0.2%, Microsoft 0%, Tesla -2.6%, Nvidia -0.5%, Apple -0.3%). Broadcom shares rise 1% in premarket ahead of earnings due after the bell. Chewy shares (CHWY) are down 2.4% premarket after Jefferies analyst Kaumil Gajrawala cut the recommendation on the online retailer of pet products to hold from buy, writing that valuation appears “primed” for a first-quarter beat and raise that’s unlikely to happen. Dollar Tree Inc. shares (DLTR) are up 1.6% in premarket trading, after JPMorgan upgraded the discount retailer to overweight from neutral. Here are some other notable movers:

- Five Below (FIVE) gains 6% in premarket trading after the discount stores company reported first-quarter results that beat expectations and guided for net sales in the second quarter that are above estimates.

- Nebius shares (NBIS) gain 5.6% in US premarket trading after the AI infrastructure software provider is initiated with a buy rating at Arete Research, while peer CoreWeave declines 2% after getting new neutral rating.

- PVH shares (PVH) drop 7.9% in premarket trading after the Calvin Klein owner cut its full-year adjusted earnings guidance, and noted that the outlook reflects an estimated net negative impact in relation to tariffs placed on goods coming into the US.

- Planet Labs shares (PL) jump 20% in premarket trading after first-quarter revenue beat estimates. Analysts at Citizens said the satellite data provider had a “stellar quarter” and the stock remains an opportunity for long-term capital appreciation.

- Visa shares (V) rise 1% in premarket trading on Thursday as Mizuho Securities raises the stock to outperform from neutral, saying the cash-to-card runway in the US still has room to grow.

The wild swings in stocks that were sparked by the Trump administration’s tariff announcements in April — and subsequent rebound — have given way to more subdued daily moves in recent weeks. The US benchmark has remained largely flat since mid-May as traders assess the impact of the trade war on economic activity.

Friday’s jobs report is expected to show that growth in nonfarm payrolls slowed and the unemployment rate remained steady. While the figures would chime with Wednesday data that showed a contraction in US services and a deceleration in private hiring, separate data earlier in the week unexpectedly showed a fairly broad advance in US job openings.

“Consensus is for lower job creation,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “I think there must be a big surprise to the downside for volatility to increase.”

Some investors are warning that the current period of relative market calm could once again give way to volatility, as uncertainty lingers over the outcome of trade negotiations between the US and its biggest trading partners — and the full economic impact remains unclear.

“Our bias remains to sell any rallies” in US bonds, said Mohit Kumar, chief European strategist at Jefferies International. “We are concerned over the fiscal deficits and the willingness of the rest of the world to continue financing US fiscal deficits.”

The European Central Bank is set to cut rates for an eighth time later on Thursday. Another reduction is expected in September, when trade talks with the US should have concluded and fresh forecasts will reveal the full implications of the tariffs. And speaking of Europe, the Stoxx 600 is up 0.4%, rising for a third day ahead of a widely anticipated interest-rate cut by the European Central Bank. European stocks were on track for the highest close in more than two weeks. Technology, construction and health care stocks are leading gains while travel and retail provide a drag. Here are the biggest European movers:

- Bayer shares rise as much as 5.1% after Goldman Sachs upgrades the German chemicals and pharmaceutical company to buy from neutral, saying it sees earnings as having bottomed out and thinks risks around litigation and pharma data are overdone.

- Dr. Martens surges as much as 17%, the most since November, after the UK bootmaker releases its full-year results and outlines its new ‘Levers For Growth’ strategy update.

- Redcare shares rise as much as 2.3%, paring some of Wednesday’s 14% drop that was spurred by a rating downgrade at Kepler Cheuvreux. Concerns about structural challenges related to the anticipated phaseout of the CardLink system are “unwarranted and lack concrete support,” according to Deutsche Bank analysts.

- Wise shares rise as much as 9% to a record high after the money-transfer firm said it intends to seek a primary listing in the US to enhance visibility to the investment community and the stock’s trading.

- Burckhardt shares gain as much as 6%, to the highest level since February, with Vontobel analysts saying the Swiss compressors manufacturer delivered significant margin progress compared to last year, driven by a good product mix.

- Wizz Air shares fall as much as 27%, the steepest drop since the early days of the pandemic, after the airline’s cost guidance and fourth-quarter results disappointed analysts.

- CMC Markets shares tank as much as 18% after reporting annual pretax profit below expectations after disappointing investors on costs, according to analysts at Shore Capital, while the dividend was also lower than hoped.

- Akzo Nobel falls as much as 2.5% as UBS cuts the recommendation on the coatings and Dulux paint maker to neutral from buy.

- Avolta shares drop as much as 7.9% after one of its investors sold shares at a discount to Wednesday’s close.

- Hemnet falls as much as 8.4% to its lowest since Jan. 31 after Nordea double-downgraded its view on the Swedish real estate listings platform to sell from buy, saying recent monetization pushes for premium offerings “may have crossed a line where user price elasticity begins to invite disruption.”

Earlier in the session, Asian stocks edged higher, as South Korean shares extended a rally on hopes of improved corporate governance under the new president. The MSCI Asia Pacific Index rose as much as 0.4%, heading for its highest level in more than three years. Korea’s Kospi Index jumped 1.5% after the ruling party said it will propose a revision to Commercial Act again, a key step in improving corporate governance. Benchmarks in Hong Kong and Taiwan also gained, with US economic data starting to soften and supporting the case for an interest-rate cut by the Federal Reserve. Japanese shares fell. Demand at the country’s 30-year bond auction was weaker than the average over the past year. The regional benchmark’s gain in recent weeks is in tandem with global peers, which closed at a record high Wednesday on expectations that the worst of higher tariffs may be over. Still, uncertainty remains high around the progress of US-China trade talks, with Chinese leader Xi Jinping making clear that a phone call doesn’t come without a price. That’s even as Trump is seeking a personal discussion with Beijing to prevent further escalation in trade tensions.

In FX, the Bloomberg Dollar Spot Index is unchanged. The Japanese yen is the weakest of the G-10 currencies, falling 0.3% against the greenback. The kiwi tops the leader board with a 0.4% gain. The euro traded steady after advancing more than 10% against the dollar year-to-date.

In rates, treasuries are mixed with gains only seen at the longer end of the curve. US 30-year yields fall 2 bps to 4.86%. European government bonds advance across all maturities, with UK and German 10-year yields falling 3-4 bps each. Japanese government bonds rose after an auction of 30-year debt was better than many investors had feared. Still, a bid-to-cover ratio of 2.92 at the offering pointed to a general lack of appetite for longer-maturity debt.

Markets

In commodities, oil prices are steady with WTI near $63 a barrel. Spot gold rises $12 to around $3,385/oz. Silver rises 3% and above $35/oz for the time since 2012.

Looking to the day ahead, and the main highlight will be the ECB’s latest policy decision and President Lagarde’s subsequent press conference. Otherwise, we’ll hear from the Fed’s Kugler, Harker and Schmid, BoE Deputy Governor Breeden, and the BoE’s Greene. Data releases from the UK include the weekly initial jobless claims and the April trade balance. Meanwhile in Europe, there’s German factory orders for April, and the May construction PMIs for Germany and the UK.

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.1%

- Stoxx Europe 600 +0.4%

- DAX +0.4%

- CAC 40 +0.4%

- 10-year Treasury yield -1 basis point at 4.35%

- VIX little changed at 17.58

- Bloomberg Dollar Index little changed at 1208.49

- euro little changed at $1.142

- WTI crude +0.1% at $62.94/barrel

Top Overnight News

- White House official said Elon Musk’s opposition is one disagreement in an otherwise harmonious relationship and it will not consult every policy decision with Elon Musk, while the official added that President Trump is committed to getting the bill passed, despite opposition from Musk.

- The ECB looks all but certain to cut rates by 25 bps to 2% today. Another reduction is expected in September, but constantly changing US trade threats will cloud new economic projections and President Christine Lagarde’s press conference. BBG

- Donald Trump and Republican senators discussed ways to scale back the $40,000 state and local tax deduction cap in the House version of the president’s tax-cut bill, Senate Majority Leader John Thune said. BBG

- Treasuries edged higher as traders got a boost from Japan, where government bonds rose after a 30-year auction was better than feared. BBG

- “There’s no resolution yet on SALT, which Senate Republicans want to change significantly. We’re told Trump didn’t object when GOP senators reiterated their desire to water down the House’s USD 40,000 deduction cap.”: Punchbowl

- Senate Republicans on Wednesday discussed the need to cut out waste, fraud and abuse in Medicare to achieve more deficit reduction in President Trump’s landmark bill to extend the 2017 tax cuts, provide new tax relief, secure the border and boost defense spending. The Hill

- US Senate Majority Leader Thune said Senate Republicans had a positive budget bill talk with President Trump and feel good about where they are on the Trump tax bill, while GOP Senator Crapo said Republicans have very strong support and unity on the Trump tax bill.

- OMB chief Vought said the White House doesn’t support the debt ceiling being removed from the reconciliation bill and that the Trump spending bill will improve the deficit, while he added they are having very good conversations with the Senate on the Trump spending bill and opposing views from outside aren’t hurting bill’s prospects.

- Trump signed a proclamation to ban travel from certain countries whereby the proclamation fully restricts and limits the entry of nationals from 12 countries, including Afghanistan, Burma, Chad, Republic of Congo, Equatorial Guinea, Eritrea, Haiti, Iran, Libya, Somalia, Sudan, and Yemen, while Trump said travel ban list is subject to revision and new countries could be added as threats emerge around the world. Furthermore, President Trump signed a proclamation to restrict foreign student visas at Harvard University.

- Wall Street’s top regulator took a step toward toughening rules for foreign companies listed on American stock markets on Wednesday, saying many Chinese firms in particular unduly benefited from having to make fewer regular disclosures to investors. The regulator warned that foreign firms, especially ones from China, could face stricter disclosure rules. SCMP

- US business optimism moved sharply lower, with only 27% of executives polled in May by the AICPA confident about the economic outlook for the 12 months ahead. BBG

- A private gauge of China’s services sector signaled that activity picked up in May, despite a renewed fall in new export orders. The Caixin services purchasing managers index rose to 51.1 last month from 50.7 in April, Caixin Media and S&P Global said Thursday. That marked the 29th month above the 50-mark separating expansion from contraction. WSJ

- China warned major EV makers including BYD, Geely and Xiaomi to stop unsustainable price wars, people familiar said. Officials urged self-regulation but gave no formal orders. They also raised concerns over unpaid supplier bills. BBG

- German factory orders unexpectedly kept rising in April after Trump’s announcement of US reciprocal tariffs, defying expectations for a setback. BBG

Tariffs/Trade

- US President Trump is to meet with German Chancellor Merz at 11:45EDT/16:45BST today.

- US auto supplier group said immediate and decisive action is needed to prevent widespread disruption and economic fallout across the vehicle supplier sector on the Chinese rare earth issue.

- Vietnam sent a document with replies to US requests on trade and the Trade Minister met with USTR Greer to discuss the main points in Vietnam’s replies to the US’s requests on trade.

- Chinese Foreign Ministry says there is no information to share on a US President Trump/Chinese President Xi call, via Bloomberg.

- EU Trade Commissioner Sefcovic says China’s “impressive” rise must not come at the expense of the European economy “Our objective is straightforward, to identify real and highest vulnerability across political areas. I am talking about advanced semiconductors, AI and quantum tech”.

- EU Businesses are lobbying Beijing to set up a “special channel” to fast track Chinese approval of rare earth export licenses for “reliable” companies, according to FT sources; proposal was made at a meeting with European companies and MOFCOM officials.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed after the choppy performance in US where markets digested disappointing data and a drop in yields. ASX 200 struggled for direction following mixed data including the latest trade figures and household spending for Australia. Nikkei 225 retreated amid headwinds from recent currency strength and following softer-than-expected Labour Earnings. Hang Seng and Shanghai Comp were somewhat varied as tech and property names led the outperformance in Hong Kong, while the mainland was contained following mixed Caixin PMI data and as participants wait and see if a Trump-Xi call will materialise this week.

Top Asian News

- China’s Commerce Minister met with the OECD Secretary General at the WTO meeting in France and said China is willing to share experience with the OECD in trade and investment, digital economy and green developments. China is willing to carry out personnel exchanges and promote practical cooperation with the OECD and hopes that the OECD will firmly stand on the side of international fairness and justice.

- China warns BYD and rivals to self regulate as the price war heats up, according to Bloomberg.

European bourses (STOXX 600 +0.4%) opened on either side of the unchanged mark, but soon after the cash open, indices caught a bid to depict a mostly positive environment. Nothing behind the move higher, but it occurred alongside a pick-up in US equity futures. Indices are currently trading at highs. Focus now turns to the ECB, where a 25bps cut is widely expected. European sectors are mixed, with the breadth of the market fairly narrow today. Construction takes the top spot, joined closely by Tech and then Healthcare. Travel & Leisure sits at the foot of the pile, with the downside stemming from very poor FY results from Wizz Air (-22%).

Top European News

- UK is to unveil pension reform aimed at boosting retirement savings with the parliamentary bill to be presented on Thursday set to include a reserve power that could force schemes to invest more in Britain, according to FT

- Times Political Editor Swinford posts UK Chancellor Reeves will next week set out plans to restore winter fuel payments and then claw them back from millions of better-off pensioners through higher tax bills.

- BoE Monthly Decision Maker Panel data – May 2025: Expectations for year-ahead CPI inflation remained unchanged at 3.2% in the three months to May. Expectations for three year-ahead CPI inflation remained unchanged at 2.8% in the three months to May. Expected year-ahead wage growth fell by 0.1 percentage points to 3.7% on a three-month moving-average basis in May. Across all questions on sales, prices and investment over 70% of firms reported that changes to US trade policy would have no material impact on their firms. US trade policy was reported to be one of the top three sources of uncertainty for 12% of businesses, significantly lower than the 22% who reported it to be a top-three source of uncertainty in April.

FX

- DXY is a touch higher with the USD showing a mixed performance vs. peers (weaker vs. antipodeans, firmer vs. havens). This follows a session of losses on Wednesday which were triggered by soft outturns for US ADP and ISM services PMIs. Newsflow since has been on the quiet side, aside from President Trump calling for a scrapping of the debt limit; something that appears to be very unlikely to be implemented. As such, focus will remain on the labour market for now (pending any major trade updates) with weekly claims, Challenger Layoffs due on today’s docket, with Fed speak also due. DXY currently in a 99.68-94 range.

- EUR flat vs. the USD as markets await the latest ECB policy announcement which is widely expected to see the GC deliver a 25bps cut in the Deposit Rate to 2.0%. With the decision itself nailed on, focus will be on any hints over future easing plans. Lagarde is unlikely to offer any explicit guidance on this front given the uncertainties presented by the trade war. EUR/USD briefly matched Wednesday’s best at 1.1435 before ebbing lower as a beat on German Industrial Output failed to support the currency.

- JPY softer vs. the USD and at the bottom of the G10 leaderboard alongside the other notable haven, CHF. Losses were spurred alongside a pick-up in risk sentiment in early European trade as the pair attempted to atone for Wednesday’s USD-led losses. 143.39 is the high water mark thus far which is a point below Wednesday’s best.

- GBP is a touch firmer vs. the USD with UK-specific newsflow remaining on the light side as has been the case throughout the week. From a fiscal standpoint, Times Political Editor Swinford posts UK Chancellor Reeves will next week set out plans to restore winter fuel payments and then claw them back from millions of better-off pensioners through higher tax bills. Cable is yet to test Wednesday’s best at 1.3580. If breached, the YTD peak from 26th May at 1.3593.

- Antipodeans are holding onto recent spoils with both currencies underpinned by a pick up in sentiment in early European trade. AUD digested mixed Australian data overnight including the latest trade figures and household spending.

Fixed Income

- JGBs were contained through much of the APAC session before selling off on the 30yr JGB auction. A sale that featured a softer cover than the prior and a wider price tail, pushing JGBs lower by around 20 ticks to a 139.01 base. Then move did mostly pare given the outing was not as bad-as-feared.

- USTs are higher by a handful of ticks and within a 110-12 to 111-07 parameters. Specifics light in the European morning and no catalyst behind it but US equity futures, and European peers, saw a jump just after the European cash equity open. This weighed on USTs slightly to a 111-00+ base. From a US standpoint, Fed speak, Jobless Claims and Challenger Layoffs are all due.

- Bunds are on a stronger footing, a small bout of pressure following German Industrial Orders, which was a little better than expected. Pressure which then accelerated around the cash open when stocks caught a bid but this was short lived. Thereafter, a strong set of auctions from both France and Spain has, alongside a pullback in the risk tone, fuelled the upside. Currently trading at the upper end of a 130.79 to 131.35 parameter, going into the ECB where the Bank is expected to deliver a 25bps cut.

- Gilts are heading into the resumption of trade, the bias for Gilts was for a contained to slightly softer open. As the benchmark closed towards highs on Wednesday and while USTs were contained Bunds had come off slightly after Industrial Orders. However, an announcement from the ONS that the most recent inflation headline was being revised lower by 0.1pps offset this and provided modest bullish impetus for Gilts, causing them to open higher by eight ticks and then extend a few more.

- Spain sells EUR 5.5bln vs exp. EUR 4.5-5.5bln 2.40% 2028, 2.70% 2030 & 0.70% 2032 & EUR 0.563bln vs exp. EUR 0.25-0.75bln 2.05% 2039 I/L.

- France sells EUR 12bln vs exp. EUR 10-12bln 3.20% 2035, 1.25% 2036 & 3.75% 2056 OAT.

- Japan sells JPY 604.8bln 30-yr JGBs; b/c 2.92x (prev. 3.07x), and average yield 2.904% (prev. 2.941%). Lowest accepted price 91.45 vs prev. 91.10; Average accepted price 91.94 vs prev. 91.40; Tail in price 0.49 vs prev. 0.30.

Commodities

- Crude is slightly firmer and trading attempting to claw back Wednesday’s hefty energy specific losses, most notably the Bloomberg reports that Saudi Arabia wants more super size OPEC+ cuts. WTI and Brent reside within narrow USD 62.50-63.15 and 64.60-65.25/bbl bounds.

- Spot gold is trading on a firmer footing but underperforming vs spot silver, which has caught a bid in recent trade. Nothing fundamental for the recent surge in silver prices, instead the move appears to be more of a technical breakout with perhaps some impetus coming from the risk tone easing from initial highs in recent trade. XAU/USD currently trades towards the upper end of a USD 3,361.27-3,390/oz parameter; Spot silver outperforms, just off a USD 35.80 peak.

- Copper looks to build on the prior session’s gains, despite mixed Caixin PMIs, which showed the composite slip into contractionary territory, and services remain afloat, ticking up moderately. 3M LME Copper trades in a USD 9,622.65-9,692.2/t range.

- Peru’s government restored formal mining operations in violence-affected areas in northern Peru.

Geopolitics

- US President Trump has told people he met with in recent days that the Ukraine drone attack likely would push Russian President Putin to retaliate very significantly, according to Axios sources.

- US President Trump said he spoke with Russian President Putin in which the conversation lasted 15 minutes and they discussed Ukraine’s attack on Russia’s docked aeroplanes, as well as various other attacks that have been taking place by both sides. Trump added it was a good conversation, but not a conversation that will lead to immediate peace, while Trump noted that Putin said very strongly, that he will have to respond to the recent attack on the airfields.

- US is redirecting critical anti-drone technology from Ukraine to US forces in a move that reflects the Pentagon’s waning commitment to Kyiv’s defence, according to WSJ.

- Ukrainian drone attacks hit energy targets in Russian-held areas of Zaporizhzhia and the Kherson region, with tens of thousands without power, according to Russian-installed officials.

- Ukraine’s Economy Minister said the first meeting of the Ukraine minerals fund is expected in July and Ukraine has discussed with the US about how to make the minerals fund operational by year-end.

- China’s Guangzhou Public Security Bureau issued a bounty for cyber attack suspects that it said are linked to the Taiwan authorities.

US Event Calendar

- 7:30 am: May Challenger Job Cuts YoY, prior 62.7%

- 8:30 am: Apr Trade Balance, est. -66b, prior -140.5b

- 8:30 am: 1Q F Nonfarm Productivity, est. -0.8%, prior -0.8%

- 8:30 am: 1Q F Unit Labor Costs, est. 5.7%, prior 5.7%

- 8:30 am: May 31 Initial Jobless Claims, est. 235k, prior 240k

- 8:30 am: May 24 Continuing Claims, est. 1910k, prior 1919k

Central Banks:

- 12:00 pm: Fed’s Kugler Speaks on Economic Outlook, Policy

- 1:30 pm: Fed’s Harker Speaks on Economic Outlook

- 1:30 pm: Fed’s Schmid Speaks on Banking Policy

DB’s Jim Reid concludes the overnight wrap

Markets put in a strong performance yesterday, after a weak batch of US data led to a massive rally for US Treasuries, which in turn supported risk assets. So investors became a lot more confident that the Fed would still cut rates this year, and the 10yr Treasury yield fell -10.0bps on the day to 4.36%. That decline in yields had the double benefit of easing financial conditions, whilst also relaxing fears about the fiscal situation. So equities held up despite the underwhelming data, with the S&P 500 (+0.01%) narrowly reaching a 3-month high. Indeed, the index is now up +19.83% since its closing low after Liberation Day, leaving it just shy of the 20% mark that would mark the technical start of a bull market.

Of course, even with the rally, the data still raised fears that the US economy lost steam into May. That started off with the ADP’s report of private payrolls, which was the softest in over two years, at just +37k (vs. +114k expected). And shortly after that, we had the ISM services index, which fell to 49.9 (vs. 52.0 expected), and the details from the report weren’t great either. For instance, the new orders component slumped to a two-year low of 46.4, whilst the prices paid indicator surged to 68.7, the highest since 2022.

Nevertheless, investors weren’t too alarmed by these data prints, as the numbers weren’t so bad as to revive fears about a recession. Indeed, it’s worth noting that the ISM services index had a big move lower back in December 2022, at a time when the Fed were aggressively hiking rates, which was then followed up by a strong recovery the following month. So in general, investors were reluctant to over-interpret one day’s data, not least given the big test is coming tomorrow with the US jobs report. Moreover, there was a more positive signal from the final US composite PMI for May, which was revised up from the flash reading to 53.0.

In terms of the market reaction, both the ADP and the ISM services prints led investors to price in more rate cuts this year, with clear moves in response to the two prints. In fact by the close, futures were pricing in 58bps of rate cuts by the Fed’s December meeting, up +8.0bps on the day, and the highest number in over three weeks. And there’s growing confidence that we’ll see the first rate cut by September, with futures now almost fully pricing (97%) one by that meeting. Given the additional rate cuts being priced, that triggered a major surge for US Treasuries yesterday. So at the front end, the 2yr yield was down -8.5bps on the day to 3.87%. And for the 30yr yield, the -10.3bps move was actually the biggest daily decline since February, pushing the yield down to 4.88%. Only a small amount of that rally has unwound this morning, with the 10yr yield up +0.6bps, and the 30yr yield up +0.5bps.

The large slide in Treasury yields had the added benefit of reassuring investors about the fiscal situation, which had been in growing focus as the 30yr yield hovered around the 5% mark. So even with the weak economic data, risk assets held up reasonably well with the S&P 500 (+0.01%) narrowly posting a 3-month high in a session that saw the lowest daily trading range for the index since mid-February. The S&P 500 now stands just -2.82% beneath its all-time high in February, although futures this morning aren’t suggesting much momentum, with those on the S&P 500 down -0.05%.

Meanwhile in Europe, there were consistent gains, with the STOXX 600 (+0.47%) advancing for a second day. There was some support from the final PMI numbers, with the Euro Area composite revised up from the flash reading to 50.2 (vs. flash 49.5). So that meant it was no longer beneath the 50-mark pointing towards a contraction. Over in Germany, the DAX (+0.77%) even hit a fresh record, which came as the cabinet approved a new package of corporate tax breaks. For sovereign bonds, there was a steadier performance across the continent, with yields on 10yr bunds (+0.1bps), OATs (+1.3bps) and BTPs (-0.3bps) seeing modest movements.

Yesterday also brought headlines in the geopolitical sphere, although markets weren’t too reactive to the various stories. Before the European open, President Trump said that President Xi was “VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” So that led to a very modest slide in US equity futures. Meanwhile, Trump also posted about a conversation with Russian President Putin, which he said was “not a conversation that will lead to immediate Peace.” Otherwise on the trade front, there were positive noises from the US-EU trade negotiations. EU trade commissioner Maroš Šefčovič tweeted that “We’re advancing in the right direction at pace – and staying in close contact to maintain the momentum.” Similarly, US trade representative Jamieson Greer said that “I am pleased that negotiations are advancing quickly”.

Overnight in Asia we’ve seen a pretty mixed performance from the major equity indices. In Japan, the Nikkei is down -0.46%, which follows a weak auction of 30yr debt, where there was the weakest demand since 2023. However, bond markets haven’t reacted badly, with the 30yr yield coming down -6.6bps this morning. By contrast, South Korea’s KOSPI (+1.05%) has built on yesterday’s +2.66% gain, with the index currently on track to close at its highest level since mid-July. Otherwise, the Hang Seng (+0.42%) is on track for a third consecutive advance, whilst the CSI 300 (+0.07%) and the Shanghai Comp (+0.08%) have also posted modest gains this morning.

Looking forward, central banks will be in the spotlight today, as the ECB are announcing their latest policy decision at 13:15 London time. It’s widely expected that they’ll deliver another 25bp rate cut, taking their deposit rate down to 2%. However, after a succession of consecutive cuts, there’s more doubt on what happens after this meeting into year-end, as this cut would take them broadly into the middle of the neutral range. In their preview (link here), our European economists expect the ECB to keep the meeting-by-meeting, data-dependent approach to setting policy. However, they think getting the hawks to support a June cut might require a hint of conditional patience, including an implicit willingness to pause at the next meeting in July and wait until September.

Staying on central banks, the Bank of Canada left their policy rate on hold at 2.75% yesterday, in line with expectations. Afterwards, Governor Macklem said “there was a clear consensus to hold policy unchanged as we gain more information”. And in future, he said “members thought there could be a need for a reduction in the policy rate if the economy weakens in the face of continued US tariffs and uncertainty, and cost pressures on inflation are contained.” By the close, the Canadian dollar had strengthened +0.31% against the US Dollar to its strongest level since early October. However, that was mainly a function of US dollar weakness, with the US Dollar weakening against every other G10 currency yesterday after the weaker US data.

To the day ahead, and the main highlight will be the ECB’s latest policy decision and President Lagarde’s subsequent press conference. Otherwise, we’ll hear from the Fed’s Kugler, Harker and Schmid, BoE Deputy Governor Breeden, and the BoE’s Greene. Data releases from the UK include the weekly initial jobless claims and the April trade balance. Meanwhile in Europe, there’s German factory orders for April, and the May construction PMIs for Germany and the UK.

Loading…