The NY Fed published its Quarterly Report on Household Debt and Credit.

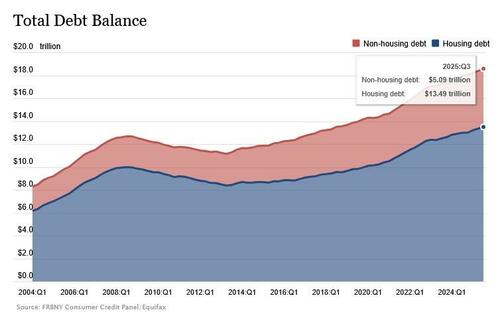

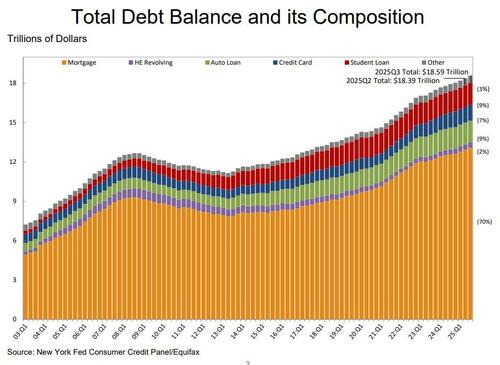

Surprising exactly no-one, the report showed that total household debt increased by $197 billion (1%) in Q3 2025, to a new record high of $18.59 trillion. split between $13.5 trillion in housing debt and $5.1 trillion in non-housing debt.

“Household debt balances are growing at a moderate pace, with delinquency rates stabilizing,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “The relatively low mortgage delinquency rates reflect the housing market’s resilience, driven by ample home equity and tight underwriting standards.”

Some details:

- Mortgage balances grew by $137 billion in the third quarter and totaled $13.07 trillion at the end of September 2025.

- Mortgage delinquency rate rose to 0.83% from 0.82% prior quarter

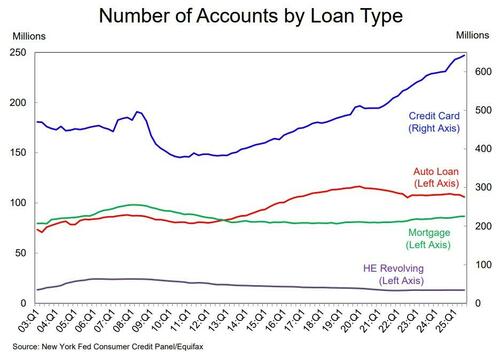

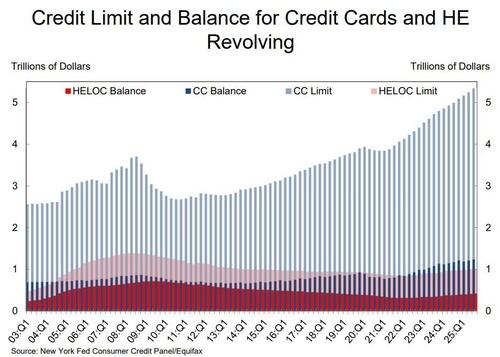

- Credit card balances rose by $24 billion from the previous quarter and stood at $1.23 trillion.

- Delinquency rate at 12.41%, highest since 2011

- Auto loan balances held steady at $1.66 trillion.

- Home equity line of credit (HELOC) balances rose by $11 billion to $422 billion.

- Student loan balances rose by $15 billion and stood at $1.65 trillion.

In total, non-housing balances rose by $49 billion, a 1.0% increase from Q2 2025.

Taking a closer look we find that…

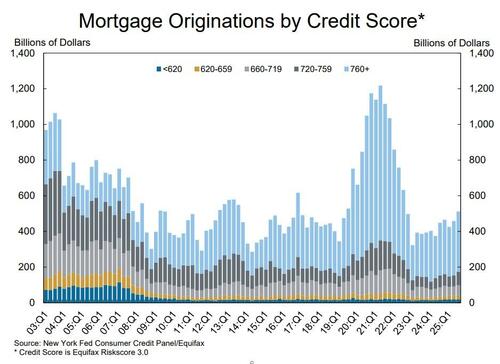

- The pace of mortgage originations increased with $512 billion newly originated in Q3 2025.

The only silver lining in the report is that housing debt levels and delinquencies have stabilized: “Household debt balances are growing at a moderate pace, with delinquency rates stabilizing,” Donghoon Lee, an economic research advisor at the New York Fed, said in a press release accompanying the figures. “The relatively low mortgage delinquency rates reflect the housing market’s resilience, driven by ample home equity and tight underwriting standards.”

While that is true, let’s see what happens to the US housing market once the avalanche starts, tipped off the by scramble to sell everything in the mecca of Capitalism, New York City, which is now controlled by a communist.

Moving on:

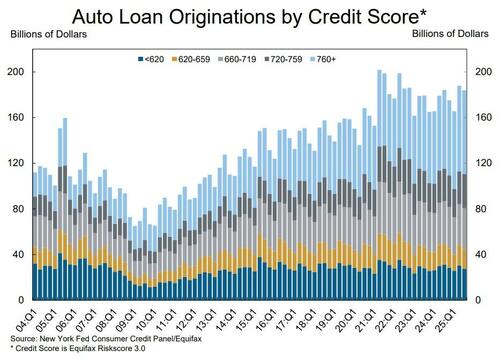

- There was $184 billion in new auto loans and leases appearing on credit reports during the third quarter, a small dip from the $188 billion observed in Q2 2025.

- Aggregate limits on credit card accounts continued to rise by $94 billion, representing a 1.8% increase from the previous quarter.

- Home equity lines of credit (HELOC) limits rose by $8 billion, continuing the growth in HELOC limits that began in 2022.

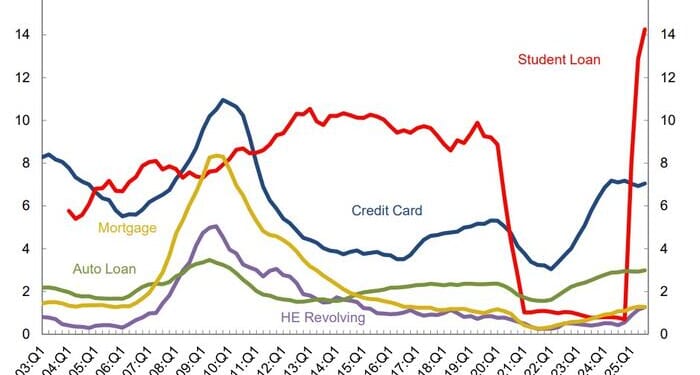

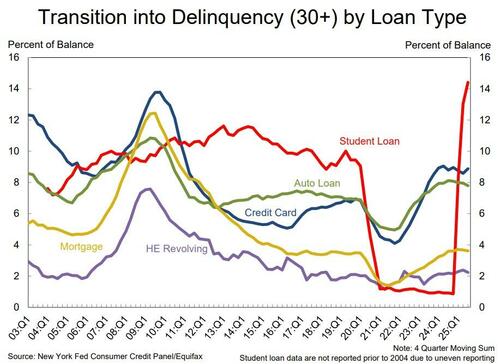

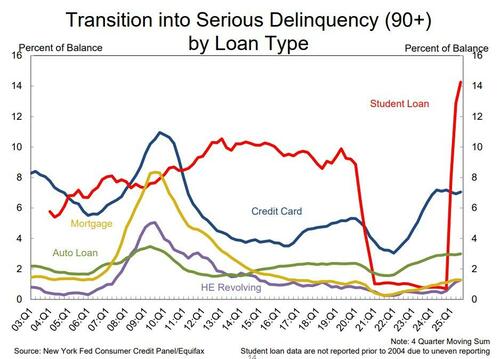

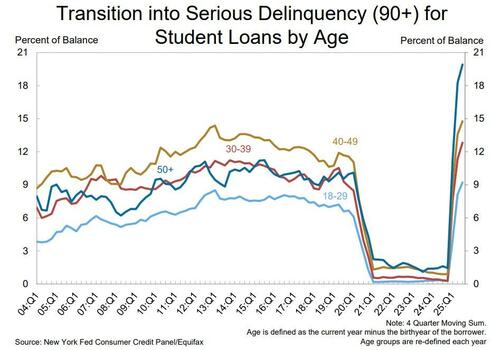

Of course, with rising debt, come rising delinquencies, and in the case of student debt, absolutely explosive ones.

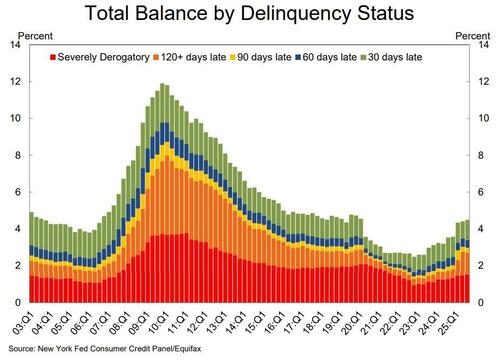

As the NY Fed writes, aggregate delinquency rates remained elevated in Q3 2025, with 4.5% of outstanding debt in some stage of delinquency. Transitions into early delinquency were mixed with credit card debt and student loans increasing, while all other debt types saw decreases.

Transitions into delinquency (30+ days)…

… and serious delinquency (90+ days) increased across all debt types.

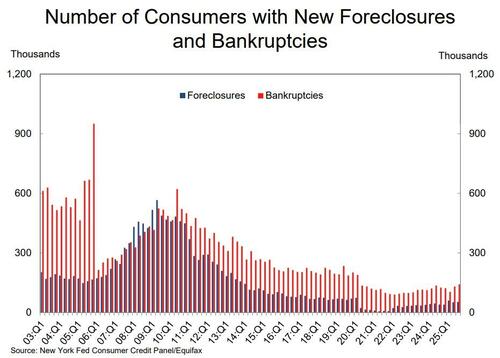

Total consumer bankruptcies jumped to 141,600 in Q3, the highest since the covid crash year of 2020.

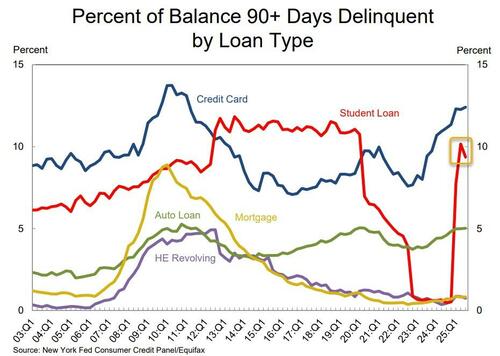

Taking a closer look at the ground zero of the current consumption crisis, namely student Loans, where outstanding debt stood at $1.65 trillion in Q3 2025.

And the punchline: missed federal student loan payments that were not previously reported to credit bureaus between Q2 2020 and Q4 2024 are now appearing in credit reports. Consequently, student loan delinquency rates have continued to surge after a sharp rise in the first half of 2025. In Q3 2025, 9.4% of aggregate student debt was reported as 90+ days delinquent or in default, as compared to 7.8% in Q1 2025 and 10.2% in Q2 2025. Also of note in the chart below, the credit card serious delinquency rate is actually creeping up even faster, and hit 12.41%, the highest since 2011.

And the most remarkable observation: over 20% of all student debt by those aged 50 and over (!) is effectively in default (technically it is still delinquent, but if millions haven’t made even a token effort to repay it in 90 days, one can safely classify it as in default).

That’s millions of potential consumers whose credit rating is about to get obliterated and who will not have access to credit cards or other debt forms for a long time.

More in the full New York Fed presentation.

Loading recommendations…