The US convened officials from 55 countries on Wednesday for a critical minerals summit focused on stabilizing supply chains and reducing reliance on China, according to Bloomberg. The Trump administration promoted price floors and expanded private investment to secure reliable access for American manufacturers.

The European Union, Japan, and Mexico agreed to work with Washington on new policies, including possible price floors, and toward a binding multilateral trade agreement, according to the US Trade Representative. These moves signal closer coordination among allies to address supply vulnerabilities.

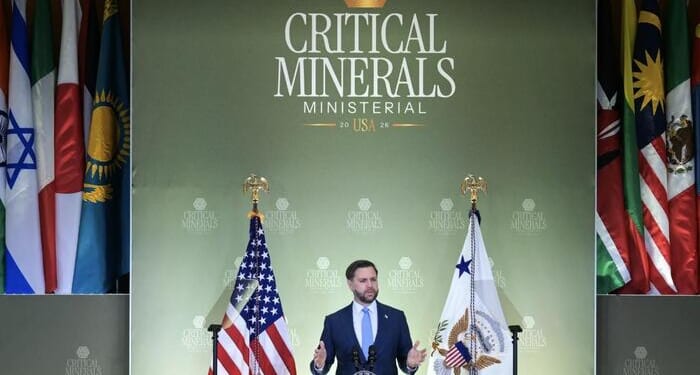

“Today, the international market for critical minerals is failing,” Vice President JD Vance said. “Consistent investment is nearly impossible, and it will stay that way so long as prices are erratic and unpredictable.” He called for stable investment conditions and proposed a “preferential trade center for critical minerals protected from external disruptions.”

Bloomberg writes that price floors have long been seen as a way to shield non-Chinese producers from market flooding. Recent public commitments suggest partners are edging toward a coordinated approach.

The US and EU aim to finalize a memorandum of understanding within 30 days to strengthen supply security. The US and Mexico will identify priority minerals and explore price guarantees ahead of a review of the US-Mexico-Canada trade pact. Vance also cited the administration’s $100 billion lending authority.

The summit followed President Donald Trump’s plan for a nearly $12 billion national stockpile. “We’re crowding in, most importantly, US private equity participation,” said Ex-Im chief John Jovanovic, citing strong repayment assurances and physical collateral.

Concerns over China grew after Beijing announced rare earth export restrictions last year. Trump said Wednesday that he and Xi Jinping had a “long and thorough call” on trade and that he plans to visit China in April.

Officials avoided naming China directly at the summit. Secretary of State Marco Rubio said supply is “heavily concentrated in the hands of one country,” creating geopolitical and economic risks. He also announced FORGE, a new partnership to succeed the Minerals Security Partnership.

China criticized the effort, with spokesman Lin Jian opposing “small groups” that could disrupt global trade.

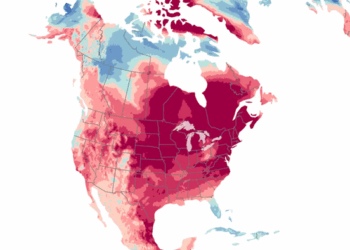

China controls more than 90% of global rare earths and magnet refining capacity, while demand is rising with artificial intelligence and advanced computing. As Under Secretary Jacob Helberg noted, “Everything is geographically concentrated in China… countries want to diversify and de-risk the supply chain.”

The initiative builds on earlier programs under both Trump and Biden. The summit, hosted by Rubio, drew mainly foreign ministers and diplomats, with Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer also involved.

Recall, the Trump administration is preparing to launch a major initiative aimed at protecting US manufacturers from disruptions in the supply of critical minerals, committing about $12 billion in initial funding to build a strategic stockpile of essential materials. The project, known as Project Vault, is designed to reduce America’s dependence on China for rare earths and other strategically important metals. By creating a centralized reserve for civilian industries, officials hope to cushion companies against sudden shortages and sharp price swings that can disrupt production and strain finances.

More than a dozen major companies have joined Project Vault, including General Motors, Stellantis, Boeing, Corning, GE Vernova, and Google. Three large trading firms – Hartree Partners, Traxys North America, and Mercuria Energy – will handle sourcing and purchasing materials for the stockpile.

Loading recommendations…