Having noted yesterday that holiday retail spending (December) was up significantly (via the NRF), today we get the official (US Census Bureau) look at Retail Sales from November… so don’t get too excited.

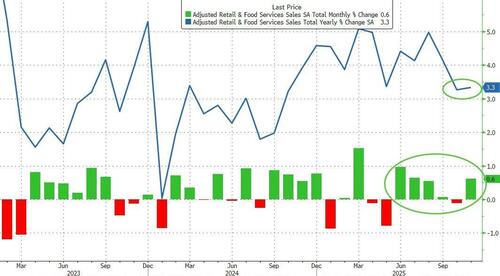

But, amid the growing specter of the ‘k-shaped’ economy, expectations were for a sizable 0.5% MoM jump in retail sales (after October’s 0.0% nothingburger)… but the headline print beat expectations with a 0.6% MoM surge… leaving sales up 3.3% YoY…

Source: Bloomberg

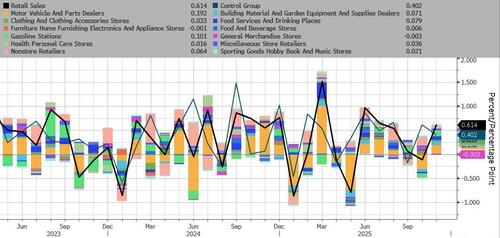

Additionally, Ex-Autos, and Ex-Autos and Gas also both beat expectations.

General Merchandise stores saw sales decline in November (along with Furniture), while Motor Vehicles and Gas Station sales surged the most…

Real retail sales (a rough approximation against CPI) remained positive on a YoY basis…

Source: Bloomberg

Finally, things look even better for the broad economy as the Retail Sales Control Group (which excludes food services, auto dealers, building materials stores and gasoline stations) – which feeds into the GDP calc – jumped 0.4%% MoM – in line with expectations…

Source: Bloomberg

That MoM jump leaves sales up a strong 5.1% YoY and while the ‘k-shaped’ economy continues to weigh on market sentiment, it is not evident in the aggregate data and supports solid Q4 GDP growth.

Loading recommendations…