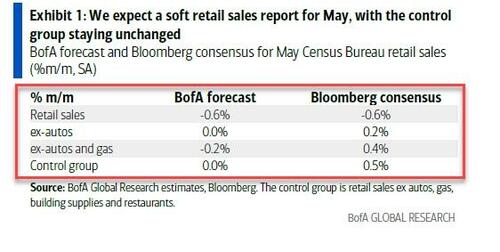

BofA’s omniscient analysts warning ahead of this morning’s retail sales data from the US is simple: Brace!

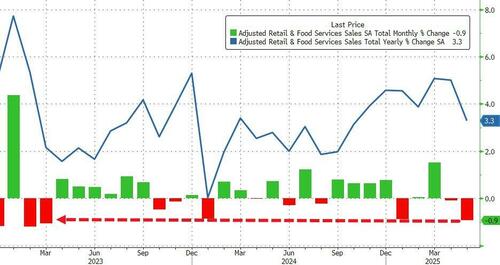

And after the small 0.1% MoM rise the prior month was revised to a 0.1% MoM decline, BofA was right again with Retail Sales tumbling 0.9% MoM in May – the biggest drop since March 2023…

Source: Bloomberg

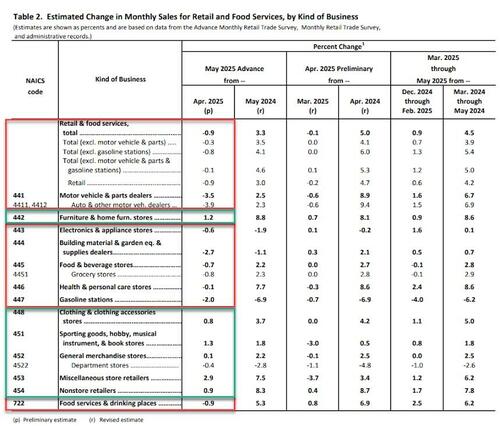

The big driver of downside was a drop in Gasoline Station sales – which makes some sense as gas prices have tumbled – and an even bigger drop in Auto Sales (as the tariff front running surge evaporates)…

The tariff front-running hangover hits…

Source: Bloomberg

Ex Autos and Gas, sales fell 0.1% MoM (worse than the +0.3% expected) and Ex-Autos sales dropped 0.3% MoM (worse than the +0.2% MoM expected).

So an ugly set of data reflecting sentiment’s slump?

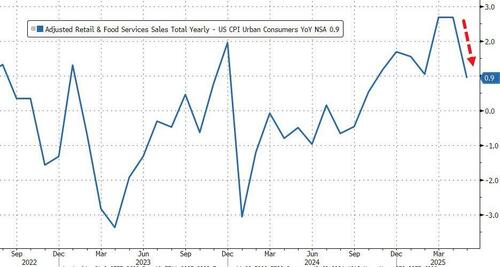

As a reminder, this data is nominal, so adjusting (very roughly) for inflation, retail sales rose 0.9% YoY, back to its lowest since Oct 2024… but still positive…

While the seasonally-adjusted sales print was down, unadjusted sales were higher in May (as they have been seasonally for years)…

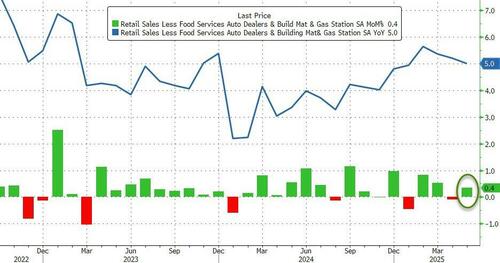

However, there is a silver lining as the Control Group – which feeds directly into GDP – rose 0.4% MoM (better than expected) and considerably stringer than the upwardly revised 0.1% MoM decline in April…

So, the bad news is Americans seem to be spending less… but top-down GDP will be positively impacted in Q2.

Loading…