The GENIUS Act moved through a procedural vote on Monday (66-32), and has just passed its latest hurdle (69-31) allowing Senate Republican leaders to bring the legislation to the floor for debate and a final vote, as soon as this week

A challenging amendment pricess awaits as the Senate bill, if passed, would need to be reconciled with a version approved by the House Financial Services Committee, and then both chambers of Congress must agree on a single bill before sending a final version to President Donald Trump for his signature.

“There are still a lot of moving pieces,” said Jennifer Schulp, director of financial regulation studies at the Cato Institute, a libertarian think tank.

Republican Senator Cynthia Lummis, one of the bill’s key backers, said on May 15 that she thinks it’s a “fair target” to have the GENIUS Act passed by May 26 – Memorial Day in the US.

* * *

As CoinTelegraph’s Zoltan Vardai detailed ahead of the vote, stablecoin adoption among institutions could surge as the United States Senate prepares to debate a key piece of legislation aimed at regulating the sector.

After failing to gain support from key Democrats on May 8, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act passed the US Senate in a 66–32 procedural vote on May 20 and is now heading to a debate on the Senate floor.

The bill seeks to set clear rules for stablecoin collateralization and mandate compliance with Anti-Money Laundering laws.

“This act doesn’t just regulate stablecoins, it legitimizes them,” said Andrei Grachev, managing partner at DWF Labs and Falcon Finance.

“It sets clear rules, and with clarity comes confidence. That’s what institutions have been waiting for,” Grachev told Cointelegraph during the Chain Reaction daily X spaces show on May 20, adding:

“Stablecoins aren’t a crypto experiment anymore. They’re a better form of money. Faster, simpler, and more transparent than fiat. It’s only a matter of time before they become the default.”

Source: Cointelegraph

Senate bill seen as path to unified digital system

The GENIUS Act may be the “first step” toward establishing a “unified digital financial system which is borderless, programmable and efficient,” Grachev said, adding:

“When the US moves on stablecoin policy, the world watches.”

Republican Senator Cynthia Lummis, a co-sponsor of the bill, also pointed to Memorial Day as a “fair target” for its potential passage.

Grachev said regulatory clarity alone will not drive institutional adoption. Products offering stable and predictable yield will also be necessary. Falcon Finance is currently developing a synthetic yield-bearing dollar product designed for this market, he noted.

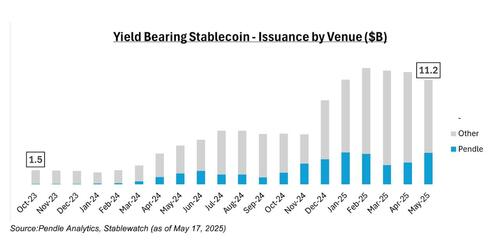

Yield-bearing stablecoins issuance. Source: Pendle

Yield-bearing stablecoins now represent 4.5% of the total stablecoin market after rising to $11 billion in total circulation, Cointelegraph reported on May 21.

GENIUS Act regulatory gaps don’t address offshore stablecoin issuers

Despite broad support for the GENIUS Act, some critics say the legislation does not go far enough.

Vugar Usi Zade, the chief operating officer at Bitget exchange, told Cointelegraph that “the bill doesn’t fully address offshore stablecoin issuers like Tether, which continue to play an outsized role in global liquidity.”

He added that US-based issuers will now face “steeper costs,” likely accelerating consolidation across the market and favoring well-resourced players that can meet the new thresholds.

Still, Zade acknowledged that the legislation could bring greater “stability” to regulated offerings, depending on how it is ultimately worded and enforced.

Loading…