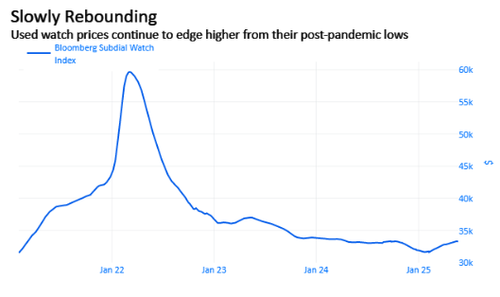

Trade war uncertainty has sparked a surge in buying in the secondary watch market, driven by a sharp increase in demand in April amid a multi-year downturn. Luxury timepiece prices, which peaked in early 2022, have since been halved, making the recent surge all the more notable, and hope that the used watch market may have found a bottom.

The Bloomberg Subdial Watch Index, which tracks prices for the 50 most-traded watches by value on the secondary market, recorded a surge in buying activity in April following end-of-month paychecks.

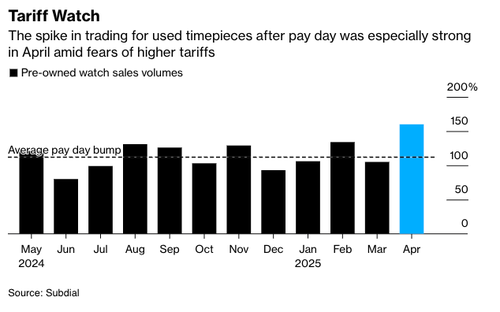

Last month’s post-payday watch buying spike was 160% above normal trading levels, far surpassing the 112% average seen on other paydays over the past year, according to a Bloomberg report.

Christy Davis, founder of London-based Subdial, told Bloomberg that used watch sales surged last month across the U.S. and U.K. because “people heard about the tariffs and went, ‘Oh shoot, let’s buy now’… and waited for payday and then sales volumes just went through the roof.”

Here’s more context about the tariff-fueled buying spike:

The phenomenon echoed another trend seen in Switzerland, where watch exports jumped by nearly a fifth in April — with shipments to the U.S. more than doubling ahead of expanded tariffs threatened by Trump. Watches made from precious metals, steel and bimetallic materials, products also targeted by Trump, saw the most growth, according to the Federation of the Swiss Watch Industry.

The question now is whether the Bloomberg Subdial Watch Index has finally found a bottom after plunging from its $60,000 peak during the Covid-era cheap money bubble in early 2022 to around $30,000 earlier this year.

Vontobel analyst Jean-Philippe Bertschy told clients that the spike in buying was driven mainly by exporters rushing to avoid tariffs rather than actual structural demand entering the market.

Additionally, we should note that watch demand is sensitive to interest rates, which are expected to remain elevated in the U.S. throughout the year. Interest rate swaps are currently pricing in 2 25bps cuts through year’s end.

Despite a gradual rebound in the Bloomberg Subdial Watch Index, many investors tracking the secondary timepiece market are questioning whether this marks a bottom—and if so, what kind of recovery shape might follow. On the other hand, lingering risks are elevated interest rates that may thwart a sustainable recovery.

Loading…