Vaccine stocks slumped Monday after an explosive memo from FDA vaccine chief Vinay Prasad surfaced late Friday, signaling the agency is preparing to roll out tough restrictions on new vaccines for children. Prasad described a “profound revelation” linking Covid shots to at least ten deaths in children.

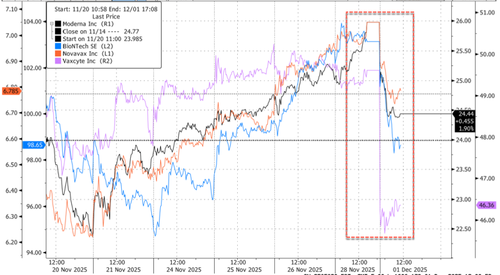

By late morning, Vaccine makers dropped on the memo: Moderna -6%, BioNTech -4.3%, Novavax -4%, Vaxcyte -6.6%.

“This is a profound revelation,” Prasad wrote in the memo. “For the first time, the US FDA will acknowledge that COVID-19 vaccines have killed American children.”

He added, “It is horrifying to consider that the US vaccine regulation, including our actions, may have harmed more children than we saved. This requires humility and introspection.”

Wall Street analysts weighed in on the memo, and all agreed it introduces a new regulatory overhang for vaccine stocks.

Here’s what the research desks told clients:

William Blair, Myles R. Minter (rates the MRNA market perform)

“Our interpretation of the memo is that CBER will focus its efforts on the younger 12- to 24-year-old male population for newly approved Covid-19 vaccines where the myocarditis risk is highest”

If new regulatory restrictions were to be implemented in the higher myocarditis risk population, analysts see further headwinds toward Moderna’s declining Covid-19 franchise “alongside further negative sentiment that this memo and subsequent actions may generate”

Analyst says Pfizer, BioNTech, Novavax and Sanofi could also be impacted

“The memo also indicates several upcoming reforms to the CBER vaccine regulatory pathway, most notably the “demand” for pre- market randomized trials assessing clinical endpoints, not just immunogenicity, for most new vaccine products”

Mizuho, Salim Syed (rates PCVX outperform)

Says the memo notes “pneumonia vaccine makers will have to show their products reduce pneumonia (at least in the post- market setting), and not merely generate antibody titers”

However, “what investors are missing here is this is already in-line with the current standard” and poses no material change to Vaxcyte

Cantor, Carter Gould (rates PCVX overweight)

Says not surprised to see selloff in PCVX shares “on the back of the return of perceived regulatory risk after a period of relative calm, particularly with key data weighted to late 2026”

However, analyst says there wasn’t much in the actual memo language on pneumococcal vaccines (PCVs) that’s concerning

Reminds investors that “this all needs to continue to be viewed in the context of the likely timelines for VAX-31 adult and infants efforts against the backdrop of the time remaining in the current administration’s term”

“We appreciate that there’s plenty within the memo that’s controversial or worrisome regarding Covid-19 vaccine policy, but the actual language on PCVs shows little evolution vs. prior guidance”

Leerink Partners, Mani Foroohar (rates MRNA underperform)

Says the memo’s inflammatory tone highlights how agency policy/communications continue to contribute to vaccine skepticism and US vaccination rate decline

“We view this as a continued negative for mRNA vaccine manufacturers in our coverage– especially as it relates to Moderna’s recently updated short-to-mid-term revenue guidance”

The memo comes months after the Trump administration signaled it would link Covid shots to children’s deaths. Remember, anyone who questioned the vaccines in the early days of the pandemic was demonized by Democrats and “trust the science” regime, which unleashed big-tech and state-sponsored censorship cartel against anyone asking questions.

Loading recommendations…