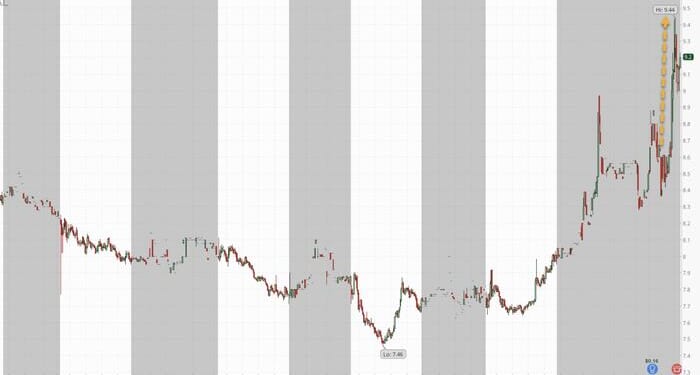

Venture Global Inc. has signed a 20-year deal to supply 1 million tons of liquefied natural gas annually to Spain’s Naturgy Energy Group starting in 2030, according to the company, which reported on Monday morning. Shares spiked over 15% on the news before the cash open on Monday.

The agreement is Spain’s first long-term U.S. LNG contract since 2018 and, importantly, will positively benefit the United States’ balance of trade with Spain.

Mike Sabel, CEO of Venture Global commented: “Venture Global is honored to expand our long-term partnership with Spain through this new agreement with Naturgy, a leading global LNG company.”

He continued: “This contract will positively impact the U.S. balance of trade with Spain and enhance energy security across the region. Our unmatched speed and execution have made Venture Global a trusted, reliable supplier to the global market. The signing of this agreement, along with the strong commercial momentum we’ve achieved over the past six months, reflects the continued customer confidence in our company and the robust demand for LNG globally. Venture Global remains committed to meeting that demand with flexible, fast, affordable, and dependable long-term supply.”

On Monday morning the company also reported Q3 revenue of $3.33 billion, more than triple a year earlier.

Venture Global said it has delivered 35 cargoes to Spain this year from its Calcasieu Pass and Plaquemines facilities in Louisiana. Including the Naturgy deal, along with contracts with Greece’s Atlantic-SEE LNG, Petronas, SEFE Energy, and Eni, total long-term commitments now stand at 5.25 million metric tons per year in H2 2025.

The company exported a record 100 cargoes in Q3 totaling 372 trillion BTU, up 237% year over year, and said 34 of 36 liquefaction trains at its Plaquemines project are producing LNG, while its CP2 project received final export authorization from the U.S. Department of Energy. Venture Global lowered its full-year adjusted earnings outlook to $6.35 billion–$6.5 billion from $6.4 billion–$6.8 billion, citing natural gas price changes.

The agreement supports U.S. plans to double LNG export capacity as producers lock in contracts ahead of a potential supply glut driven by rising output from the U.S. and Qatar.

Based in Arlington, Virginia, Venture Global operates two Louisiana export plants—Calcasieu Pass and Plaquemines—and is building a third, CP2. Last week, it also agreed to supply 500,000 tons a year to Greece’s Atlantic SEE LNG Trade SA.

For Naturgy, the deal helps offset future losses from an EU ban on Russian LNG starting in 2027, which will end its existing 20-year contract with Russia’s Yamal LNG.

Loading recommendations…