Amazon’s big move to roll out same-day grocery delivery across 1,000 new cities – on track for 2,300 by year-end – puts Instacart and traditional grocery chains squarely in the crosshairs. But the real shocker isn’t Amazon’s new expanded reach; it’s that Walmart still reigns supreme as the lowest-cost grocer, setting the stage for an intensifying last-mile grocery war.

News last week (read here) of Amazon expanding its same-day grocery delivery across a thousand more cities by the end of the year sent Instacart (CART) and DoorDash (DASH) shares tumbling. Goldman analysts forecast that millions of Prime members will flock to the service as it becomes available in their respective areas.

It’s increasingly clear that the last-mile grocery battlefield in the U.S. is shaping up as a two-horse race between Amazon and Walmart. There are other players, but none with the scale or firepower to compete seriously.

Goldman analysts, led by Eric Sheridan, forecasted last week that Amazon can capture a low single-digit percentage of its 129 million Prime members for weekly grocery orders, potentially creating a “potential gross revenue opportunity of ~$30–200 billion.”

Prime members new to ordering groceries on the platform will undoubtedly be hunting for deals … unless their priority is more convenience.

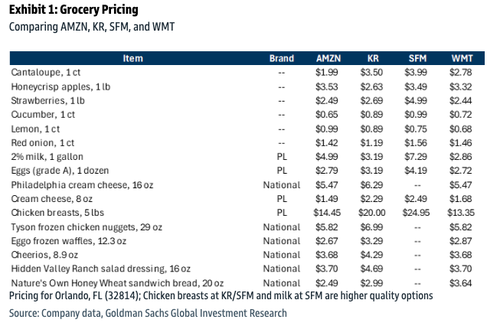

In a separate note, Goldman analyst Kate McShane ran a pricing survey across broadline retailers (BJ’s, Walmart) and grocery chains (Kroger, Sprouts) on select items.

The results: Walmart had the most affordability for shoppers, with prices 9.8% below the group average, followed closely by Amazon at -9.3%. Sprouts had the highest markups at +19.2% (limited SKU availability noted), while Kroger landed modestly above average at +2.2%. In a direct comparison, BJ’s undercut Amazon with prices averaging 7.9% lower.

Comparing AMZN, KR, SFM, and WMT

Comparing AMZN and BJ

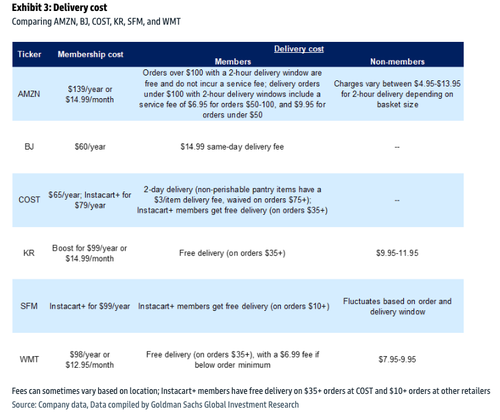

Comparing delivery costs between AMZN, BJ, COST, KR, SFM, and WMT

The last-mile grocery race is already crowded, with most major retailers offering same-day delivery directly or through Instacart. Walmart holds a big advantage, with stores within 10 miles of 90% of the U.S. population, and now Amazon’s aggressive push into the space ensures the battle will only intensify.

The only issue for Amazon: Walmart still owns the pricing advantage.

Loading recommendations…