By Michael Every of Rabobank

Think a 2-G, not a G-2 world

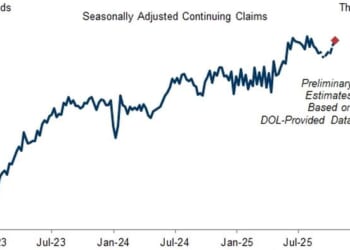

The Fed briefly made the market headline this morning after doing what was expected – cutting 25bps to 4%; and what markets had wanted – stopping QT; but also what markets hadn’t expected and didn’t want – calling into question how much further rates will fall. As such, markets, who netted a peak-to-trough $6.5 trillion in Fed balance sheet expansion in the ‘it’s just an asset swap that will be reversed’ QE > QT > (QE?) cycle, were not happy, though we see 25bps cuts in December (if not a done deal), and March, June, and September 2026: see here for more. While looking at that $6.5trn, consider the unironic Washington Post op-ed that ‘This Supreme Court decision [on the Fed’s Cook] could basically guarantee higher inflation’.

As some focus on how politics and central banks can fuse one way, Europe displayed another. ECB President Lagarde repeated a call for the EU to move to majority voting, following former ECB President then unelected Italian PM Draghi, and Bank of Italy Governor Panetta. Without taking a stance, is this in the ECB’s remit other than it indirectly involves the economy? What would markets think if Powell got involved over House redistricting? Regardless, it underlines the pressure for structural, market-moving change in Europe.

In the geopolitical world the EU is struggling to keep up with, Russia tested a nuclear torpedo that can flood cities with “radioactive tsunamis”; the US will undertake nuclear tests in response to those of others; Western intel said Iran is rearming despite UN sanctions, with China’s help; Venezuela’s “creaking military” is preparing for US strikes; Brazil saw dozens die in Rio in police-drug gang clashes, which included the Ukraine-war tactic of drone-dropped bombs; and the US plans a “show of force” against “Chinese aggression” in the South China Sea.

In related geoeconomics, Nvidia hit a $5trn market cap – as its CEO just said it doesn’t matter if the US or China wins the global AI race(!); the BOJ ignored US Treasury Secretary’s Bessent advice and left rates on hold again at 0.5% with no more dissenters than the previous two; Saudi Arabia will refocus its $925bn sovereign wealth fund from real estate towards critical minerals, logistics, and AI, which sounds US-linked; Trump said South Korea will build a nuclear submarine in the US, transferring its highest defense tech, as he struck a deal to lower auto tariffs to 15% from 25% in return for $150bn for US shipbuilding, $20bn annual FDI for a decade, and major energy purchases; and Oslo reported Chinese made EV buses can be disabled remotely via software updates, allowing direct access to their battery.

Yet the Atlantic notes as of now, ‘The US Is on Track to Lose a War With China’ as “modern warfare is decided by production capacity and technological mastery, not by individual valor”; new US rare earths processing tech may help it leapfrog China, as the quest for rare earth elements is sparking a Texas mining revival; Australia’s Lynas will build a heavy rare earth plant in Malaysia; but Malaysia, which just signed such a rare earths deal with the US, will only export processed products; as three Indian companies received the first set of licenses for importing rare earth magnets from China – which cannot be used for defence purposes.

The latter underlines Europe may not be able to rearm either, whatever funds it allocates to it, unless it develops alternative supply, with a parallel issue threatening the chips need for auto production. For chips, that will take time to ramp up; for rare earths, far more so given Europe lacks key resources, which the FT just noticed in ‘Europe and the curse of geography.

Meanwhile, Beijing is lobbying Europe not to side with the US as France’s parliament voted to raise their tech tax, potentially setting up a clash with Trump, and Macron called for social media that won’t declare its bias to be banned, perhaps setting up a clash with VP Vance.

Summarising the zeitgeist, the Economist pens ‘A letter to investors from the White House Opportunities Fund’, on “How the shift to state capitalism is panning out for America LLC.” It’s rather early to be making that call – but the description of the new (geo)political economy is not, as we called as imminent immediately that Trump was re-elected. Indeed, underlining how wrongly that is still being read by some, @Eurobriefing notes: “Remember the investment flows from the US to Europe – after Trump’s tariffs and the election of Merz? It’s all reversing now. US investors are slowing waking up to a political reality of political perma-gridlock in Europe. And Europeans investors are starting to realise the macroeconomic gains from AI are far more likely to arise in the US and China than in Europe.”

Of course, all the preceding news was just a warm-up for today’s critical Trump – Xi meeting, before which Trump posted, “THE G2 WILL BE CONVENING SHORTLY!”, worrying the other 193. The early words in front of the media in Busan were win-win: Xi stated China’s development does not contradict the vison of “Make America Great Again.” However, as China expert Matt Pottinger asks, ‘Is Trump Getting Played by Xi?’, and “If so, America’s agrarian past may be its future” –something I pointed out was the trend in relative import-export rations by sector in 2017’s The Great Game of Global Trade– tariffs, fentanyl, AI chips – where the Chair of the House Select Committee on China states selling Nvidia Blackwell chips to China would be “akin to giving Iran weapons grade uranium”, rare earths, soybeans, Taiwan, and even Russia-Ukraine were all rumored to be in the mix – if you aren’t at the table, you are likely on it.

Trump said it was “amazing” and “outstanding” meeting, and agreed a rolling one-year deal that can be extended where: “tremendous” US soybean purchases will “start immediately”; China “agreed to work to stop fentanyl,” so a 10% US tariff reduction has gone into effect, but “many other tariffs remain”; USTR Greer said China will not be imposing rare earth controls – but does that only apply to the US?; Blackwell AI chips were not discussed, though China is going to talk about others with Nvidia; US nuclear tests are aimed at others; Taiwan was not discussed; and Trump will visit China in April. We are still waiting for official readouts, but this seems a short-term ceasefire, not any long-term settlement – and no TACOs were on the menu.

So, ‘stability’ until April on one front – unless China doesn’t keep its end of the bargain, in which case tariffs go up (110%?). Meanwhile, the US will target onshoring and rare earths while China targets high-end chips. That, and other developments, still say that rather than a US-China G-2 CoDominium, we are drifting to a 2-G world, one US-centric, another Chinese.

In what would otherwise be major news today, Trump conceded that it’s “pretty clear” that he can’t tun for a third term, which would be actual news to Steve Bannon.

UK Chancellor Reeves is reportedly considering a 2% increase in income tax in the upcoming budget, as she joins the list of government ministers having to alert the official ethics adviser after an “inadvertent mistake” with a London property licence and the rental of her family home; and

The liberal D66 party looks to have won the same number of seats as the right wing PVV in the Dutch election with 97.7% of the vote counted, and D66 leader Jettens looks in pole position to be the next Prime Minister; he will inherit the Nexperia, rare earths, Russia-Ukraine, and EU-US issues as he looks to build closer cooperation with Europe – just as the EU may be set for major changes(?)

To conclude, the Fed cut as expected but could now see a pause; the Trump-Xi meeting also saw a tactical pause. Both were welcome, but neither mean much in the bigger picture

Loading recommendations…