One hallmark of the presidencies of Donald Trump is surging budget deficits. Another is repeatedly claiming that drastic deficit reduction is just around the corner. During his 2016 presidential campaign, Trump famously promised to pay off the entire $19 trillion national debt within eight years. Instead, the debt jumped by $8 trillion, thus missing his target by a mere $27 trillion.

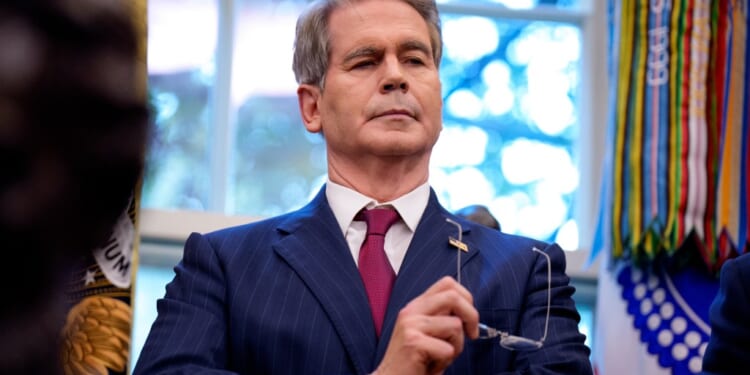

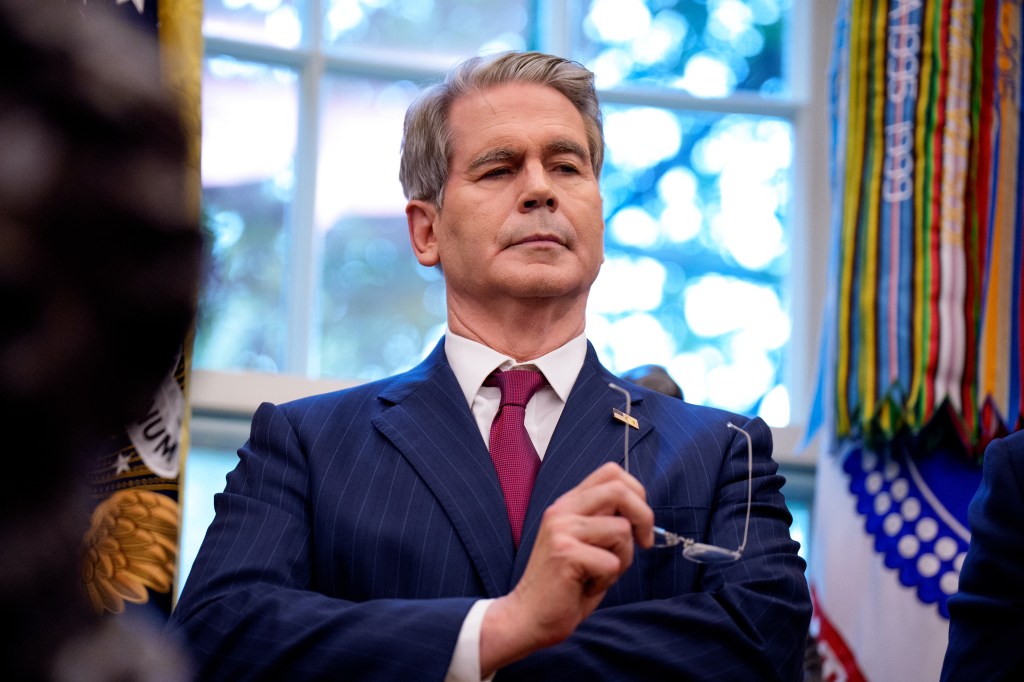

A new Trump presidency has brought additional empty deficit reduction boasts. Before the election, he suggested that the budget deficit (and Social Security) could be fixed by selling oil and gas reserves. In a March address to Congress, Trump pledged to eliminate the entire $1.8 trillion budget deficit while offering no path to accomplish such a monumental task. Not to be outdone, DOGE director Elon Musk initially pledged to save $2 trillion from administrative reductions in waste, fraud, and abuse. Over the summer, Trump promised that tariff revenues would leave federal coffers so awash in money that tax rebates would be necessary. And now, Treasury Secretary Scott Bessent is claiming the budget is on “solid footing” toward his deficit target of 3 percent of GDP, thanks to substantial deficit reduction.

Unfortunately, Bessent’s deficit reduction boasts continue the trend of propaganda over progress. Tariffs are providing modest fiscal savings, although the deficit remains on track to continue rising steeply.

When Trump returned to office in January, the Congressional Budget Office was projecting the annual budget deficit to dip slightly, from $1.8 trillion to $1.7 trillion over the next few years, before climbing to $2.5 trillion annually within a decade. The CBO assumed that immediate savings from the scheduled expiration of the 2017 tax cuts, as well as a continued phase-down of pandemic spending, would eventually be overwhelmed by the sharply rising costs of Social Security, Medicare, and interest on the national debt.

Trump’s actions thus far have dramatically worsened these deficit projections. While the pandemic phase-down as well as Trump’s tariffs provided some modest savings, the 2025 deficit still came in at $1.8 trillion—about the level projected at the beginning of the year. Yet the One Big Beautiful Act (OBBBA), which extended those 2017 tax cuts and more, is scheduled to cost a staggering $4.2 trillion over the next decade—or $5 trillion if one assumes that Congress and the White House will once again extend the bill’s purportedly temporary provisions like a $40,000 cap on state-and-local tax deductions and no taxes on tips or overtime. In that likely scenario, the tax bill alone will add $589 billion to the 2034 budget deficit, which even aggressive, permanent tariffs could not come close to offsetting. Thus, the Trump administration has raised—not lowered—current and projected budget deficits relative to the baseline.

Nevertheless, Bessent claims that monthly budget deficits began collapsing in spring because “Revenues are soaring and government spending is under control” in ways that suggest substantial long-term deficit reduction. While it is true that tariffs have provided modest savings, Bessent drastically overstates his case by confusing timing shifts with major policy changes.

For this analysis, we will dive into the Treasury’s monthly budget statements and divide the last three fiscal years into halves. Because each fiscal year lasts from October 1 through September 30, this delineation splits each year into October through March (first half) and April through September (second half).

Such analysis reveals that budget deficits regularly spike in the first half of the fiscal year and fall in the second half. Indeed, the last three years saw budget deficits averaging $1,158 billion in the first half, and $610 billion in the second half. Why would that be? Because the second half includes the April income tax payment deadline—and a tax revenue spike that can exceed $400 billion over the previous month. Moreover, corporate quarterly tax payments are due each year on January 15, April 15, June 15, and September 15, with the final three deadlines occurring within the second half of the fiscal year.

With individual income tax returns as well as 75 percent of corporate tax payments coming due between April and September, it is not surprising that budget deficits typically decline as these tax revenues arrive. Suggestions that the notably lower budget deficits during these months are chiefly driven by some sudden policy change in support of fiscal responsibility are baseless.

That said, Bessent correctly notes that the second-half budget deficit of $468 billion in 2025 is still smaller than the second-half deficits of $768 billion in 2024 and $594 billion in 2023. However, most of these additional “savings” were merely an accounting device. While the recent OBBBA included student-loan reforms estimated to save $320 billion over the decade, government scoring practices meant that $152 billion of those long-term savings were booked in August and September 2025. This is essentially a timing shift—immediately crediting the federal budget with several years of anticipated savings that have not yet materialized. While justifiable as an accounting practice, it is wildly misleading for the Treasury to point to this temporary lump-sum figure as indicative of monthly savings that can be counted on to continue reducing budget deficits.

That leaves $110 billion in higher customs duties in the second half of 2025. While unwise as policy, these tariff revenues do represent a legitimate policy change that can continue to pare back budget deficits. However, the courts may strike down some of these tariffs as illegally bypassing Congress. Even if the tariffs remain in place, the revenues should gradually fall as consumers shift to purchasing American-made goods. Moreover, some customs revenues are offset by lower income and payroll taxes resulting from slower economic growth as well as businesses deducting the cost of the tariffs. Despite these caveats, tariffs may continue to offset a modest portion of the OBBBA even as overall deficits continue to rise.

Note that this analysis does not credit DOGE with notable budget savings during these past six months. Despite promises to save trillions of dollars annually, the monthly Treasury budget statements do not show significant budget savings, at least not relative to the trillion-dollar savings promises. Among the spending functions targeted by DOGE, State Department and foreign assistance spending dipped by $12 billion in the second half of 2025, while public health spending remained roughly unchanged. IRS layoffs may well worsen budget deficits by encouraging tax evasion and reducing audits.

In short, the quest for half-baked, pain-free solutions to soaring budget deficits continues to fail. Presidents and Congress continue to enact runaway spending and tax cuts, all while claiming they are on track to balance the budget through some gimmicky proposal that will not actually cost taxpayers anything. We’re told that DOGE will save trillions by slashing government waste, tariffs will bring in trillions by making China pay, and taking over the Federal Reserve will slice trillions in interest costs. And now, Secretary Bessent claims that smaller deficits in the second half of FY 2025—mostly the mere result of tax and spending timing accidents—actually reflect sustainable deficit reduction. These are the untruths upon which a $38 trillion national debt is built.