With roughly 50% of the S&P 500’s market capitalization having reported results so far this earnings season, we are focusing on what companies are saying about artificial intelligence on earnings calls.

To do that, we lean on Goldman analysts led by Ben Snider, who track executive commentary focused on AI adoption.

“AI adoption has remained a popular topic on earnings calls this quarter, but only a handful of companies have quantified their productivity gains from AI use,” Snider said.

Those companies include:

Bank of America (BAC):

“We have 18,000 people on the company’s payroll who code – using the AI techniques, we’ve taken 30% out of the coding technique – the coding part of the stream of introducing a new product or service or change, that saves us about 2,000 people… And I use an example, our audit team has built a capability they think a series of prompts around doing audits and stuff to allow them to shape the head count back down that they had to grow during the regulatory onslaught over the last few years.”

C.H. Robinson Worldwide (CHRW):

“Our fleet of AI agents is growing quickly as we continue to pioneer new ways to automate manual tasks and supercharge our industry-leading freight experts to solve for complexity and deliver high-quality service to our customers and carriers… This includes an expectation that we will generate double-digit productivity improvements in both NAST and Global Forwarding in 2026, as we continue to implement agentic AI across our quote-to-cash lifecycle of an order… These digital capabilities also enabled us to continue delivering double-digit productivity increases in NAST in 2025. Since the end of 2022, we have delivered a more than 40% increase in shipments per person per day, and this is measured across the entirety of our NAST organization… Additionally, 95% of our checks on missed LTL pickups are now automated, saving over 350 hours of outsourced manual work a day… Take the example we give often around our request for freight quote operation… Previously, we were only getting to 60% of those requests; today, we get to 100%. Previously, it was taking a cycle time of 17 to 20 minutes; today, it takes less than 32 seconds… These new AI agents are tracking down missed pickups and using advanced reasoning to determine how to keep freight moving… As a result, shippers’ freight moves up to a day faster and return trips to pick up missed freight have been reduced by 42%… the growing automation across our quote-to-cash lifecycle enables us to decouple head count growth from volume growth and to create greater operating leverage and operating margin expansion… Our average head count was down 12.9% year-over-year in Q4 and was down 3.8% sequentially…”

Costco Wholesale (COST):

“An early use case has involved integrating AI into our pharmacy inventory system… autonomously and predictably reorders inventory, improving our end stocks to more than 98%. This change has played an important role in helping us achieve mid-teens growth in pharmacy scripts filled and has improved margins while lowering prices to our members. We are now in the process of deploying AI tools in our gas business, which we expect will improve inventory management and drive incremental sales by ensuring we’re always delivering the best value to our members.”

Meta Platforms (META):

“Since the beginning of 2025, we’ve seen a 30% increase in output per engineer with the majority of that growth coming from the adoption of agentic coding, which saw a big jump in Q4. We’re seeing even stronger gains with power users of AI coding tools, whose output has increased 80% year-over-year. We expect this growth to accelerate through the next half.”

Northern Trust (NTRS):

“You heard me mention our productivity for 2025 was about 4% of our expense base. And this year, we bumped that up. It’s going to be closer to 5%. And a lot of that is because of the impact we’re seeing of AI… we are simplifying processes, upgrading platforms, and applying AI to reduce friction in service delivery.”

Paychex (PAYX):

“We are excited to share that our first agentic AI pilots were a success this quarter. They autonomously handled thousands of payroll calls and emails with nearly 100% accuracy, decreasing payroll processing time and enabling our service teams to focus on higher value strategic advisory support.”

ServiceNow (NOW):

“AI is also driving significant cost efficiencies that have resulted in full-year profitability beats on top of our recently raised guidance… We expect an operating margin of 32%, up 100 basis points year-over-year driven by OpEx savings enabled by AI efficiencies.”

Travelers Companies (TRV):

“We’ve recently rolled out Gen AI agents to efficiently mine both internal and external data sources to better understand and synthesize the risk characteristics and ensure appropriate business classification. This capability both accelerates the underwriting process and results in improved risk classification and segmented pricing… In extensive testing, we achieve significantly improved engineering output and meaningful productivity gains… the efficiency gains in our claim organization come through loss adjustment expense, benefiting the loss ratio. As just one example, our claim call center population is down by a third. And this year, we’ll be consolidating four claim call centers down to two… Our AI investments to automate submission intake for new business reduced our time to ingest submissions from hours to just minutes… our renewal underwriting platform leverages generative AI… with early results showing more than a 30% reduction in average handle time.”

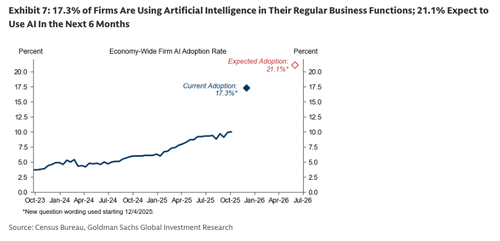

In a separate note, Goldman analyst Sarah Dong reported that the AI adoption tracker through December stood at 17.3%, with an expected target of 21.1% over the next six months.

Related:

We expect 2026 to be a year when AI-related layoffs accelerate as AI adoption gains traction across corporate America.

Loading recommendations…