When the history of the Donald Trump presidency is written, his ill-advised scheme to tariff the world will be seen as one of the most self-destructive acts by a president in the history of the United States. Following up on my article from yesterday, which dealt with why the tariffs on India backfired, I realized that I had no clue about the exact nature of US trade and that of the BRICS countries. So I turned to GROK and Perplexity AI for answers. Not only will this exercise inform you about US trade, but you will also see that these AI engines come up with different answers. So let’s dive in.

Based on the most recent available data for 2024, the top ten countries exporting to the United States, ranked by import value for trade in goods, are as follows:

- Mexico: USD 505.85 billion

- China: USD 427.2 billion

- Canada: USD 421.1 billion

- Germany: USD 157.1 billion

- Japan: USD 142.2 billion

- Vietnam: USD 117.6 billion

- South Korea: USD 115.1 billion

- Taiwan: USD 102.3 billion

- India: USD 85.7 billion

- Italy: USD 73.7 billion

According to GROK, the total dollar value of exports to the US from the top ten countries (Mexico, China, Canada, Germany, Japan, Vietnam, South Korea, Taiwan, India, Italy) in 2024 is approximately USD 2,147.85 billion, representing 64.1% of the total US goods imports (USD 3.35 trillion). For further details, refer to the US Census Bureau’s trade statistics at https://www.census.gov/foreign-trade/statistics/country/index.html.

Okay, what does Perplexity say? The top ten countries exporting to the US in 2024, ranked by dollar value, were

1. Mexico: $509.98 billion (15.2%)

2. China: $462.63 billion (13.8%)

3. Canada: $422.17 billion (12.6%)

4. Germany: $163.54 billion (4.9%)

5. Japan: $152.06 billion (4.5%)

6. Vietnam: $142.47 billion (4.2%)

7. South Korea: $135.46 billion (4%)

8. Taiwan: $118.73 billion (3.5%)

9. Ireland: $103.75 billion (3.1%)

10. India: $91.23 billion (2.7%)

Only one area of disagreement with respect to the top ten countries… Perplexity likes Ireland, while Grok prefers Italy. But that is not the only discrepancy. According to Perplexity, the top 10 exporters to the US accounted for 68.5% of total US import value in 2024. Hell, they can’t even agree on the total value, expressed in dollars, for the top ten: GROK pegs it at $2.1 trillion, while Perplexity insists it is $2.3 trillion. What is $200 billion dollars among friends?

Apart from showing that the artificial intelligence machines are not necessarily intelligent, we can see that only ten countries account for more than 64% of total US trade. Did you notice that Brazil, Russia and South Africa did not make the top ten? And that India only accounts for 4% of the export trade from the top ten countries.

When you look at total US exports and imports, according to Perplexity, the United States exports are 11% of GDP, while imports represent 14% of GDP. That, boys and girls, is the trade deficit. Only three countries on the top ten list are BRICS countries: China, Vietnam and India. If you add up the numbers, US trade with those three BRICS countries represents 30% of the total… Not a huge amount.

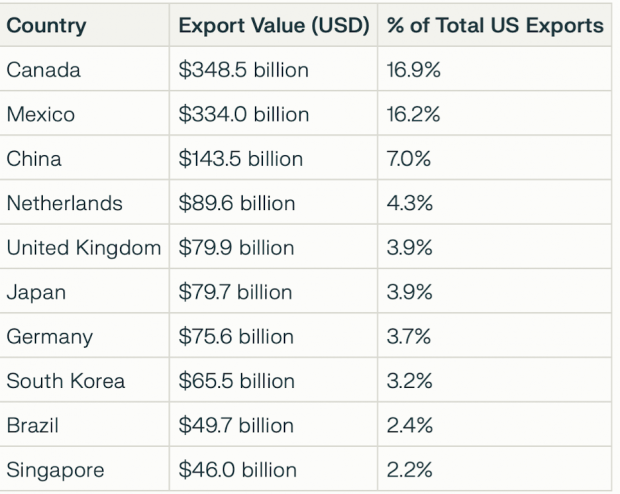

Now let’s look at the top ten countries receiving US export. For 2024, the dollar amounts of US exports to the top ten countries and their share of total US exports are:

The top ten countries accounted for $1,312 billion (63.7%) of the US total exports of $2,064 billion in 2024. Vietnam and India do not appear. The only two BRICS countries on this list are China and Brazil, which account for 9.4% of all US exports.

Thus, we can see that BRICS does not have substantial trade ties with the US. So let’s look at the top ten trading partners of each of the founding members of BRICS for 2024:

China’s top ten trading partners for exports in 2024 were:

1. United States: $524.9 billion

2. Hong Kong: $291.4 billion

3. Vietnam: $161.8 billion

4. Japan: $152.0 billion

5. South Korea: $146.4 billion

6. India: $120.5 billion

7. Russia: $115.5 billion

8. Germany: $107.0 billion

9. Malaysia: $101.2 billion

10. Netherlands: $91.1 billion

Russia’s top ten trading partners in terms of exports in 2024 were approximately:

1. China – $128 billion (21.1% of total exports)

2. Netherlands – $42.1 billion (8.3%)

3. Germany – $29.6 billion (5.7%)

4. Turkey – $26.4 billion (5.2%)

5. Belarus – $23.1 billion (5.2%)

6. Italy – $25.1 billion (3.6%)

7. South Korea – $13 billion (3.4%)

8. Japan – $12 billion (3.3%)

9. Kazakhstan – $11.6 billion (3.1%)

10. United States – $15.4 billion (2.7%)

Are you as surprised as me to see three European countries and the United States on this list? Despite sanctions, it seems there are products and resources those NATO countries still need.

India’s top ten trading partners in terms of exports for 2024 were:

1. United States – 17.90% of exports

2. United Arab Emirates – 8.23%

3. Netherlands – 5.16%

4. China – 3.85%

5. Singapore – 3.33%

6. United Kingdom – 3.00%

7. Saudi Arabia – 2.67%

8. Bangladesh – 2.55%

9. Germany – 2.27%

10. Italy – 2.02%

Brazil’s top ten trading partners in terms of exports in 2024 and their percentage share of Brazil’s total exports were:

1. China – $94.4 billion (28.0%)

2. United States – $40.6 billion (12.0%)

3. Argentina – $13.8 billion (4.1%)

4. Netherlands – $11.8 billion (3.5%)

5. Spain – $9.9 billion (2.9%)

6. Singapore – $7.9 billion (2.3%)

7. Mexico – $7.8 billion (2.3%)

8. Chile – $6.7 billion (2.0%)

9. Canada – $6.3 billion (1.9%)

10. Germany – $5.9 billion (1.7%)

These ten countries accounted for about 66.7% of Brazil’s total exports in 2024, with Brazil’s total exports valued at approximately $337 billion.

South Africa’s top ten trading partners in terms of exports in 2024 and their percentage share of South Africa’s total exports (valued at about $110.5 billion) were:

1. China – $12.4 billion (12.3%)

2. United States – $8.2 billion (8.3%)

3. Germany – $7.3 billion (7.7%)

4. Mozambique – $6.6 billion (6.1%)

5. United Kingdom – $5.3 billion (5.7%)

6. Japan – $4.9 billion (5.2%)

7. India – $4.7 billion (5.0%)

8. Botswana – $4.33 billion (4.2%)

9. Netherlands – $4.27 billion (4.1%)

10. Namibia – $3.9 billion (3.7%)

These ten countries accounted for roughly 61.3% of South Africa’s total exports in 2024

Take note that Germany and the Netherlands are the only countries in the world that trade with all five BRICS founders. Imposing tariffs on the BRICS nations is likely to cause more economic problems for Germany, whose current economic growth number for 2025 is projected to be approximately 0.3% according to recent data from Trading Economics and economic forecasts by the Ifo Institute and Bundesbank. The Netherlands is not much better — the Netherlands’ economic growth forecast for 2025 is around 1.2% to 1.3% according to multiple sources including the European Commission, Dutch policy analysts, and economic institutes.

Here is the important point: China is the only member of BRICS with significant and substantial trade relations with the US and Donald Trump, despite multiple threats, is pulling back from imposing punishing sanctions on China. There are simply too many critical products that the US needs from China. Hitting China hard carries a significant risk of economic blowback on the US economy.

As I noted in a recent article, we are witnessing the dawn of a new international financial order. The days of the US hegemon dictating what other countries can do is over. This article from the Financial Times highlights a critical new development:

Developing countries are moving out of dollar debts and turning to currencies with rock bottom interest rates such as the Chinese renminbi and Swiss franc. . . .

“The high level of interest rates and a steep US Treasury yield curve . . . has made USD financing more onerous for [developing] countries, even with relatively low spreads on emerging market debt,” said Armando Armenta, vice-president for global economic research at Alliance Bernstein.

“As a result, they are seeking more cost-effective options.”. . .

By borrowing in currencies such as the renminbi and the Swiss franc, countries can access debt at much lower interest rates than those offered by dollar bonds. . . .

Companies in emerging markets are also selling more bonds in euros this year, with the amount of this debt in issue rising to a record $239bn as of July, according to JPMorgan. The overall stock of emerging market corporate bonds in dollars totals about $2.5tn.

The era of the US dollar as the reserve currency is ending… it appears to be moving more rapidly than many financial experts anticipated. We are witnessing the birth of a new economic and political world, one that will bring India, Russia and China into more prominent roles. And there is nothing the US can do to stop this, short of starting a nuclear war and ending civilization.

This article was originally published on Sonar21.