Our shift in coverage on Under Armour began in late September, when we flagged a UBS report from analyst Jay Sole, who forecasted a major inflection point for the long-struggling Baltimore-based apparel company. Sole argued that sentiment would turn positive in FY27, setting the stage for stock outperformance. That bullish thesis has certainly seen its timeline accelerated, with a surge in heavy insider buying igniting a sharp rally this month.

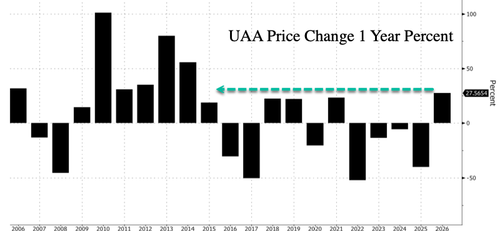

Shares of UAA have surged this month, with year-to-date gains of 27.5%.

If these gains hold through year-end, it would mark the best year for Kevin Plank’s company since 2014.

Let’s begin with UBS analyst Sole’s inflection point call after a ten-year bear market:

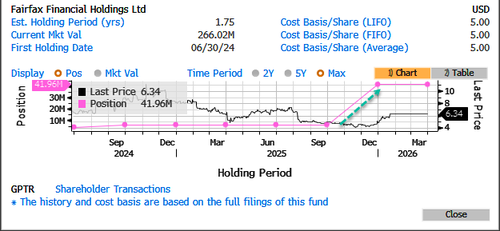

Then what really piqued our interest was Fairfax Financial Holdings’ disclosure earlier this month of a 22.2% ownership stake in UA, making it the company’s largest shareholder.

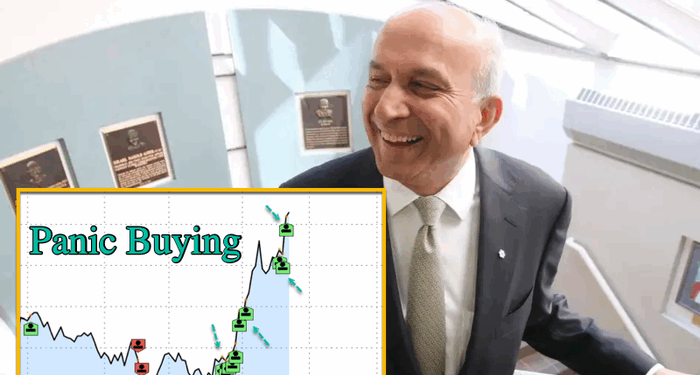

Insider buying has continued. Bloomberg insider transaction data shows Fairfax Financial continues to panic-buy UA stock, with 5 million more shares disclosed on Wednesday. Last week, the firm bought 3.61 million shares.

Latest data from Bloomberg shows a sudden surge in Fairfax Financial’s buying spree, with total shares nearly 42 million, at a market value of $266 million. Fairfax Financial is run by Prem Watsa, often called “Canadian Warren Buffett.”

The timing of Fairfax Financial’s UA buying spree comes as the company is in a turnaround pattern.

Latest UA developments:

-

Data breach probe: Under Armour is investigating claims of a November data breach allegedly impacting about 72 million email addresses

-

Leadership changes: Effective February 2, Kara Trent becomes Chief Merchandising Officer and Adam Peake is named President, Americas.

Street Views

-

Citi: Raised price target to $6.50 from $5, kept Neutral.

-

Truist: Raised target to $6 from $5, kept Hold.

We must also point out that Bloomberg data has UA’s float 35% short. A squeeze candidate for sure.

Loading recommendations…