Authored by Lance Roberts via RealInvestmentAdvice.com,

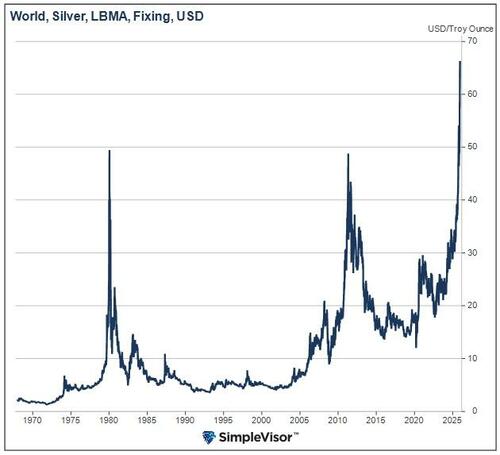

Silver’s parabolic rise has been remarkable. Its price has more than doubled this year and is nearly three times higher than in 2023. The current surge closely mirrors two previous price jumps shown below.

In this article, we examine the two similar price surges shown below to provide context for what may be occurring today and, importantly, for what might cause this bubble to pop tomorrow.

The Post Financial Crisis Silver Surge

As the turmoil of the Financial Crisis of 2008 began to ease in 2009, the price of silver embarked on a 500% rally, rising from $8.50 to $50.00 over two years. The Fed’s excessive monetary responses to the crisis, alongside heavy speculation, created a perfect storm for silver.

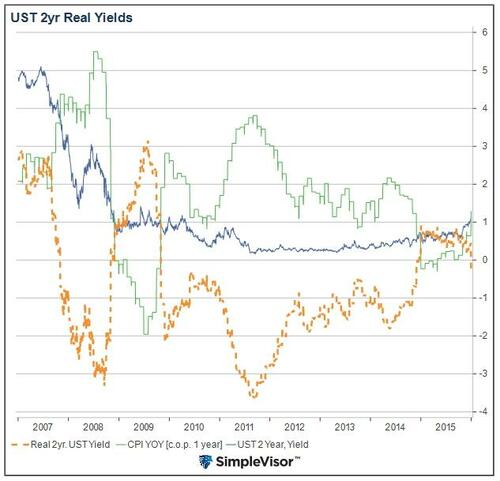

During the crisis, the Fed cut interest rates to zero, introduced QE, and implemented a host of monetary bailouts. As a result, real interest rates (adjusted for inflation) collapsed into negative territory. The graph below shows that 2-year UST real yields fell sharply in 2009 and continued lower until mid-2011. The increase in silver prices coincided with the decline in real yields. Such distortions in monetary policy, as evidenced by real yields, benefit silver as it is considered a high-beta monetary hedge against extreme monetary policy actions.

While the monetary environment was conducive to such a rally, there was also a supply-demand mismatch benefiting prices. The supply of silver is relatively inelastic, meaning that mining operations can’t promptly increase output to meet rapid changes in demand. The advent of ETFs makes the asset class far more accessible to a much larger class of investors, adding to the supply-demand imbalance. Maybe most impactful, speculative investors, using futures, options, and other forms of leverage, significantly boosted demand.

The boom ended in 2011 when the Chicago Mercantile Exchange (CME) raised margin requirements five separate times in nine days. The graph below, courtesy of Business Insider, shows the doubling of silver margin requirements and the destructive impact on prices. The CME’s action forced deleveraging in the futures markets, resulting in silver falling by nearly 30% over a few weeks. Demand for physical silver didn’t necessarily vanish, but leverage and the extra buying power it created did. Additionally, QE2 ended in June 2011; real interest rates began to rise, and the U.S. dollar appreciated.

The Fed’s unprecedented monetary policy actions and speculative leverage drove up silver prices. As those factors reversed, and the CME made leverage costlier, silver prices crashed.

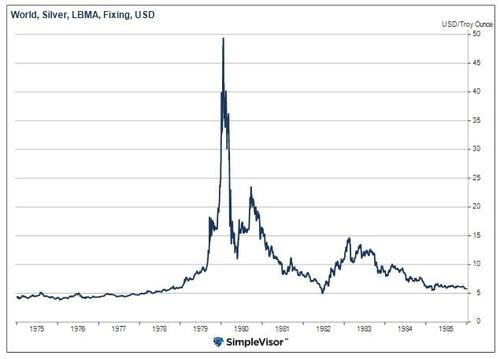

The 1970s Hunt Brothers Squeeze

The Hunt brothers, Nelson, Lamar, and William, had extensive holdings in oil, real estate, cattle, and sugar. Concerned about the effects of what they believed were careless monetary and fiscal policies, as well as the risks posed by the newly formed oil cartel (OPEC), they sought to hedge their businesses and assets. Since it was still illegal for individual investors to own gold, they chose physical silver.

The Hunts began buying silver in 1973, when the price per ounce was $1.50. Over the next six years, the Hunts increased their holdings to more than 200 million ounces, valued at more than $4.5 billion.

Silver Rule 7

In late 1979, their massive holdings and the impact they were having on silver prices prompted action by the Commodities Futures Trading Commission (CFTC) and the CME. Both entities sought to restrict their purchases and compel the liquidation of the brothers’ silver assets. In January 1980, the CME enacted Silver Rule 7, which imposed stringent restrictions on the purchase of silver futures on margin. This rule significantly increased the amount of collateral required of traders, thereby curbing leveraged speculative buying. It also included restrictions on the number of contracts one could hold and effectively halted new margin buying.

These changes meant that if a trader wanted to continue buying, they would have needed to put up nearly 100% cash for their positions instead of borrowing on margin — effectively eliminating leverage.

Silver nearly hit $50 per ounce in mid-January 1980 and then, due to the abrupt changes in margin requirements, fell to $10 per ounce by the end of March. At that point, margin calls on futures contracts and borrowings against existing silver holdings depleted the Hunts’ cash, forcing them to liquidate their holding to cover margin debts.

Leverage Builds and Leverage Kills

The Hunts initially took physical delivery of silver and did not use leverage. Over time, though, they understood the power of using their silver as collateral to buy more. Buying silver futures on margin enabled them to positively influence the price at a fraction of the cost. Such leverage allowed them to multiply their purchasing power and drive silver prices higher. The only requirement for the Hunts scheme was to maintain sufficient cash to adequately fund their futures margin account.

In addition to the CFTC and CME efforts, the Federal Reserve also played a role in breaking the Hunt brothers. Fed Chairman Paul Volcker sharply raised interest rates in January 1980, from 11.75% to 20.0%, making margin borrowing for the Hunts and other speculators much more expensive. One week after the Hunts ceased market activity, Volcker began lowering interest rates.

Leverage allowed the Hunts to distort the price of silver, but it also killed their legendary squeeze. They incurred over $1.1 billion in losses on the trade. They also lost civil lawsuit claims, which, in part, led them to declare bankruptcy.

The Tiffany advertisement below describes the economic effect the Hunts had on various industries.

Current Silver Situation

Today, there are many sound, fundamental reasons for the recent rise in silver prices, as there were in the 1970s and in the post-financial-crisis years. For example:

Monetary & Fiscal Tailwinds: Like in the post-Financial Crisis era, the post-pandemic environment has certainly provided those with a reason to hedge against monetary tomfoolery with precious metals. The monetary debasement narrative certainly adds to the conversation. Moreover, with QE resuming and a few signs that DOGE hasn’t reduced fiscal spending, there does not appear to be an end in sight to the monetary and fiscal problems we face.

Supply Deficit: Silver has been in a multi-year supply deficit, with demand exceeding newly mined supply and silver from recycling.

Surging Industrial Demand: Silver is essential for solar panels, electric vehicles, power electronics, semiconductors, and data-center infrastructure. Given the rapid growth in these sectors globally, silver demand is increasing.

Limited Supply: Roughly 70% of silver production is a by-product of mining for other metals. This means that higher silver prices alone do not incentivize new supply, thereby slowing the market’s ability to rebalance. Moreover, reserve depletion, declining ore grades, mine closures, and underinvestment in exploration and development constrain supply.

Valuations

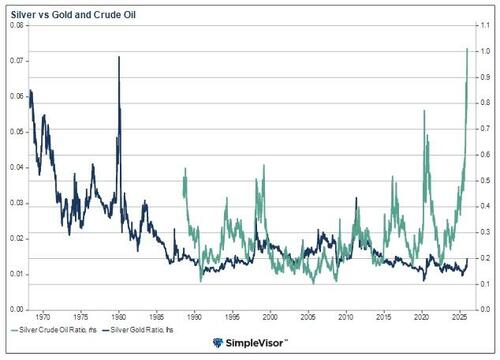

Silver investors often use ratios to assess silver value. Among the most widely used are the silver-to-gold and silver-to-oil ratios. The chart below shows both ratios. The silver-to-oil ratio (green) is at record highs going back to at least 1990. As the graph shows, there have been numerous spikes in the past. Assuming this too is a spike, either oil prices are ready to ramp higher, or silver is due for a mighty correction.

The silver-to-gold ratio remains cheap despite silver’s recent outperformance versus gold. If the ratio were to return to its late-2011 highs, silver prices would have to rise significantly more than gold prices. While a continued increase in the ratio is undoubtedly possible, note that the trend has been downward for most of the 55 years shown.

When Will The CME Raid The Party?

The problem with traditional valuation and fundamental analysis, as discussed above, is the precedent the CME has set when the price of silver goes parabolic. Accordingly, we think it’s only a matter of price before the CME and/or governmental action pulls the rug out from silver speculators.

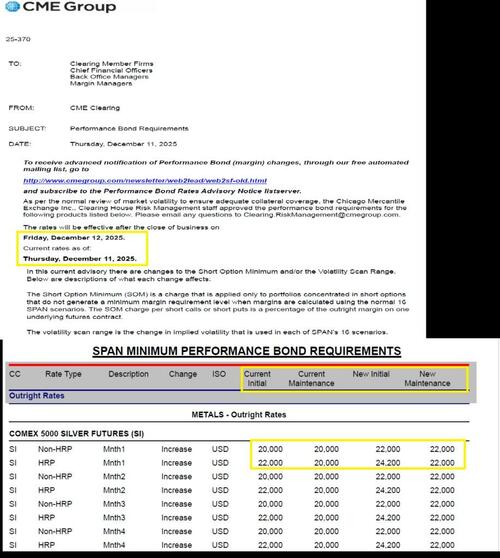

If you disagree, consider that on December 12th, the CME raised silver margins by 10%, as shown below. In 2011, the first margin increase also had no impact. It was the subsequent actions that were the problem.

Silver investors should carefully read the sections above detailing the post-financial-crisis period and the Hunt Brothers boom-bust cycles. Changes in margin requirements and rules triggered mass liquidations of silver, resulting in an abrupt reversal of fortunes. Such actions are unpredictable and happen extremely fast.

Summary

At its core, this article provides yet another lesson on the high price that leverage can inflict on investors. When the market for an asset becomes highly leveraged, the risks increase markedly. We are reasonably confident that this bullish charge in silver will end poorly, as it has in the other two instances. What we don’t know is when the shift will occur. Complicating the timing is that the CME could, on any day, terminate the leverage.

Fool me once, shame on you. Twice, then shame on me. But fool me three times….

Loading recommendations…