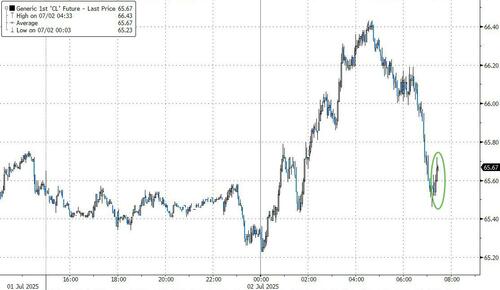

Oil prices have pumped and dumped this morning as traders turn their focus to a key OPEC+ production decision and this morning’s official supply and production data (following a big draw at the Cushing Hub reported by API overnight)..

“Crude oil prices remained roughly unchanged week-on-week as the market focus shifts from the ceasefire in the Middle East to this Sunday’s virtual OPEC+ meeting,” Goldman Sachs analysts including Yulia Zhestkova Grigsby wrote in a note.

“We do not expect a large market reaction if OPEC+ decides to increase production on Sunday as consensus has already shifted towards this outcome.”

The question this morning is will the official data confirm API’s sizable Cushing draw.

API

-

Crude +680k

-

Cushing -1.42mm

-

Gasoline +1.92mm

-

Distillates -3.46mm

DOE

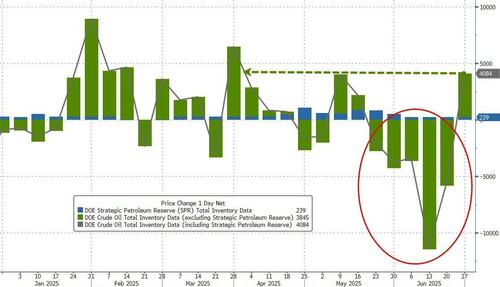

A big crude build (the first in six weeks and biggest since March) was offset by a relatively big drop in stocks at the all important Cushing Hub last week as gasoline inventories surged and distillates declined…

Source: Bloomberg

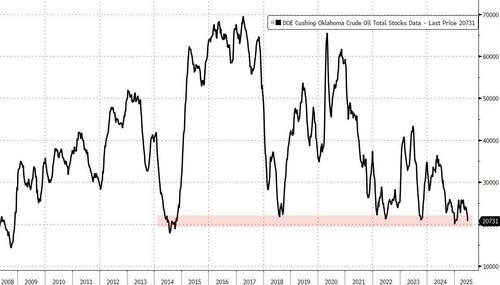

‘Tank Bottoms’ loom for Cushing once again…

Source: Bloomberg

Including a small 239k addition to the SPR, last week saw the biggest build in total crude stocks since the start of April…

Source: Bloomberg

US Crude Production was basically flat at or near record highs despite the rig count continuing to decline…

Source: Bloomberg

WTI is rebounding off its lows of the day after a big roundtrip overnight…

Source: Bloomberg

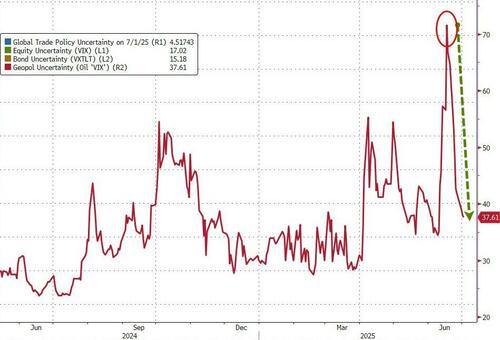

Trading activity in crude futures has declined since the truce between Israel and Iran led prices to plunge early last week, with volatility returning to levels seen before the war.

Concerns are likely to return to a glut forecast for later this year, with an OPEC+ meeting this weekend expected to deliver another substantial increase in production quotas.

Loading…