Oil prices held steady after a three-day drop as investors assessed the impact of Western sanctions against leading Russian crude producers, alongside a mixed industry estimate of US inventory changes.

President Trump will follow through and enforce harsh new sanctions against Moscow to pressure Vladimir Putin into negotiations to end the war in Ukraine, according to Matthew Whitaker, the US ambassador to NATO.

Indian state-owned refiners are considering whether they can continue to take some discounted Russian oil after the measures were imposed, though some processors will pause purchases for now.

On Tuesday, Indian Oil Corp. said it is “absolutely not going to discontinue” purchases of Russian crude as long as it complies with international sanctions.

“The market is now trying to assess the longer-term impact of the additional sanctions, which will be determined by the quantity of actual barrels removed from supply,” Standard Chartered analysts including Emily Ashford said in a note.

Overnight prices stabilized after API showed across the board big inventory draws…

API

-

Crude -4.0mm

-

Cushing

-

Gasoline -6.35mm

-

Distillates -4.36mm

DOE

The official inventory data confirmed the API’s report with large drawdowns in inventories across crude and the products…

Source: Bloomberg

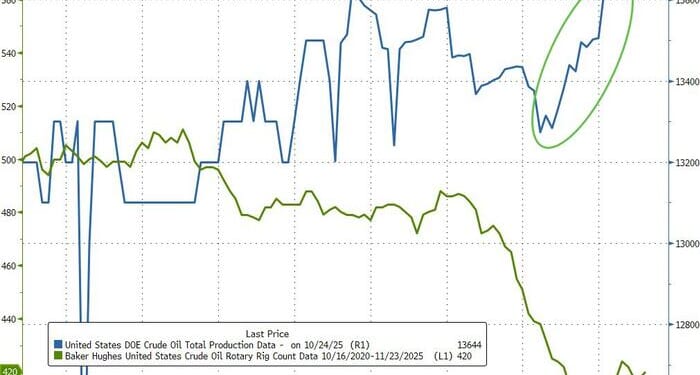

US Crude production rose to a new record high last week

Source: Bloomberg

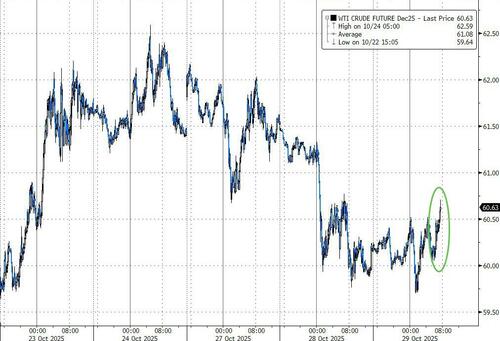

WTI rallied modestly on the big crude draw

Source: Bloomberg

Oil is on track to notch a third monthly decline, with prices dragged lower by expectations of a global surplus as OPEC+ raises production. Key alliance nations are set to hold discussions this weekend, and may sign off on another supply increase. Traders are also tracking progress toward a US-China trade deal, with Trump and Chinese counterpart Xi Jinping due to meet on Thursday.

Loading recommendations…