‘Nationalization’ by Another Name

As we’ve already discussed (twice), there is no reason for the U.S. government to be involved in what is inarguably a small transaction involving two publicly traded companies that are both eager to seal the deal on mutually acceptable terms. The “national security” arguments for blocking or amending those terms are bogus: As I explained in December, “the U.S. military needs a tiny amount of domestic steel output and gets none of it from U.S. Steel,” and security experts across the political spectrum—including officials in both the Trump 1.0 and Biden administrations—saw no serious concerns. The government’s involvement was and remains about politics, and the whole drama serves as a serious black mark on U.S. international economic policy (and Biden’s time in office).

The terms released by Lutnick, however, make the matter much worse. They show that the new U.S. Steel will be controlled in large part by the U.S. government, and this arrangement will raise long-term questions and problems that just simply banning the sale—a clearly bad move, too—wouldn’t raise.

One might argue that this isn’t really “nationalization” because the U.S. government isn’t a majority shareholder in the company or involved in its day-to-day operations, but will instead dictate just a few actions that the business might take. But this view, which I’ve now seen a few times online, would be wrong for several reasons.

For starters, the golden share would govern a wide range of U.S. business activities, including investment levels and locations, firm management, workforce and salaries, plant operations, sourcing, pricing, and (apparently) trade litigation. As a result, U.S. Steel will have to obtain Uncle Sam’s permission to do a lot of stuff. Depending on the details, in fact, the arrangement really could give Washington a say on U.S. Steel’s routine operational decisions—if the government wanted one. (No terrible political incentives there!)

Just as importantly, the government’s formal control over these decisions will inevitably give it potential influence over other firm decisions that aren’t covered by the golden share. If, for example, the U.S. government objected to Nippon Steel’s decision to partner with a Chinese steel company in Asia, Washington could try to stop the deal by threatening to invoke its golden share powers in an unrelated U.S. transaction. And these implicit powers are obviously amplified by the fact that the one holding the golden share isn’t a private individual but the United States’ government, with all the additional benefits—legal, practical, etc.—such status confers.

Given this “extraordinary” U.S. government involvement, the Atlantic Council’s Sarah Bauerle Danzman concludes, “US Steel may not be state-owned, but it is certainly now controlled by the US government.”

Yet the view that this golden share effectively nationalizes U.S. Steel isn’t just based on these practical realities (and my admittedly libertarian sensibilities). It’s the stated view of the United States government in at least two highly relevant contexts.

First, the United States has long treated a private company controlled by a foreign government as equivalent to that government under U.S. “trade remedies” law and related litigation, with “golden shares” and other relevant facts supporting those determinations. Most damningly in this regard is how the Commerce Department treats “public entities” (aka “public bodies”) in its investigations of subsidized imports, repeatedly finding that foreign companies with little or even no direct government ownership can nevertheless be “meaningfully controlled” by a foreign government—and thus akin to the government itself—where the state remains involved in important aspects of the company’s business operations, such as plant closures or board of directors appointments.

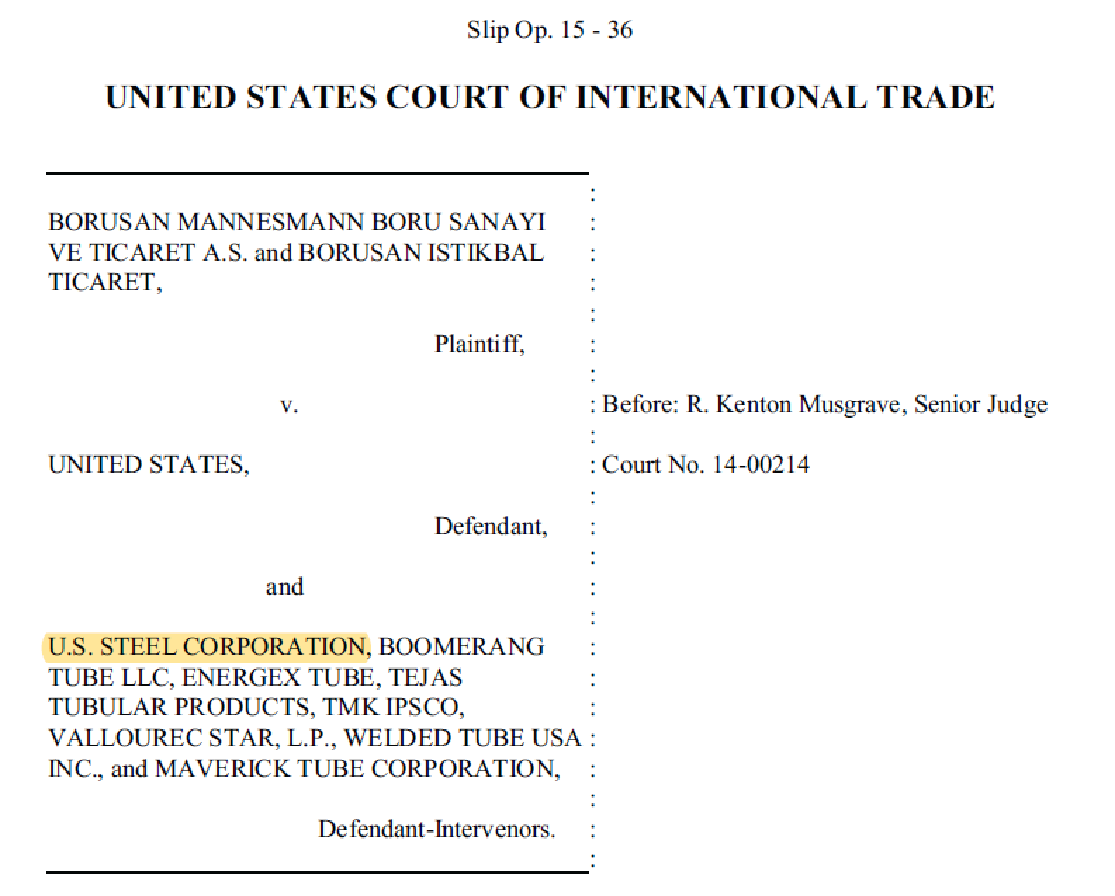

These so-called “countervailing duty” investigations often involve China but not always. In one particularly relevant case litigated before the U.S. Court of International Trade, in fact, Commerce treated two Turkish steel companies as “public entities” because the Turkish government exercised “meaningful control” of them, as evidenced by 1) the government’s possession of “certain usufruct rights (i.e., veto power over any decisions related to the closure, sale, merger, or liquidation of [the companies])”; 2) the government’s influence over the composition of the companies’ boards of directors; and 3) that the companies had “embraced” the Turkish government’s steel production and trade policies. The court—yes, the same one that (temporarily) nixed Trump’s tariffs last month—sided with Commerce, whose positions were also supported by … none other than U.S. Steel:

The U.S. has also repeatedly fought for an expansive determination of “public body” at the World Trade Organization—including in Turkey’s challenge to the above-mentioned decision. (In that dispute, the Trump administration supported its position by pointing to the fact that, as a condition of purchasing the relevant steel company from the government, its parent agreed to invest more in domestic steel production capacity—just like Nippon Steel today.)

Other trade remedies provisions also look to golden shares as evidence of corporate control. In fact, recent revisions to the Commerce Department’s regulations repeatedly cited special “golden shares” as evidence that a company under investigation is controlled by another company or by the state, even though the controlling entity doesn’t officially own a majority of voting shares in the company. In supporting these conclusions, Commerce cited to the independent Organization for Economic Co-operation and Development (OECD): “Even when a government has a minority share in an enterprise, it can still be a controlling share, when a government is still the biggest owner or has a golden share, which allows de facto control regardless of formal voting rights” (emphasis mine).

Finally, the Trump administration incorporated the U.S. government’s broad view of state control over private commercial entities into the U.S.-Mexico-Canada Agreement. In particular, the deal contains a chapter disciplining the trade-related activities of “state-owned enterprises” (SOEs), which it defines to include commercial entities owned by the government or controlled “through any other ownership interest.” Per the accompanying footnote, this includes a golden share situation quite similar to the new one for U.S. Steel (emphasis mine):

[A] Party holds the power to control the enterprise if, through an ownership interest, it can determine or direct important matters affecting the enterprise, excluding minority shareholder protections. In determining whether a Party has this power, all relevant legal and factual elements shall be taken into account on a case-by-case basis. Those elements may include the power to determine or direct commercial operations, including major expenditures or investments; issuances of equity or significant debt offerings; or the restructuring, merger, or dissolution of the enterprise.

As Temple University’s Zachary Bailey notes, the USMCA’s definition of an “state-owned enterprise” to include a golden share situation was an intentional expansion over the one that the U.S. championed in the Trans-Pacific Partnership and remains the U.S. government’s position today. Given what we know about the U.S. Steel golden share, it’s not tough to see how—if the USMCA and trade remedies standards were applied to, say, Canada Steel—folks in Washington would loudly insist that the company be treated as an arm of its government.

So, Now What?

The golden share’s implications are significant and troubling. First and most obviously, it’s beyond rich that the political party supposedly fighting “American socialism” today and once highly critical of a “socialist” president’s temporary bailout of “Government Motors” is now championing the president’s perpetual control of U.S. Steel. Some of the rhetoric associated with that past criticism was loopy, but Republicans were generally right to oppose the Democrats’ desire to be involved in private companies’ business operations. Now, I guess, we have two political parties open to such things.

Then there are the immediate economic and political concerns. As we’ve repeatedly discussed, U.S. trade and economic policy are already heavily biased toward the domestic steel industry, despite the harms said bias imposes on (far more numerous and important) American steel-consuming companies, the U.S. economy, our nation’s security and geopolitical interests, and our political system. (That Lutnick’s summary of the golden share deal expressly includes anti-dumping policy—which his own department administers in a supposedly neutral way!—is a sign of just how deep this rot goes.) Now that the president officially has a stake in one U.S. company (headquartered in a swing state, no less), we should expect that bias—and its harms—to only get stronger.

The deal’s longer-run implications and precedent are also worrying. For starters, the history of “nationalized” firms—along with basic common sense—should give us little reason to think that Washington’s extensive involvement in U.S. Steel’s business operations will make the company healthy and profitable. Injecting politics and an implicit government backstop into what should be purely commercial decisions is rarely a recipe for a lean and mean private enterprise. A big benefit of Nippon Steel’s investment was to reinvigorate the moribund U.S. Steel. Will we get a zombie firm instead?

There are also risks beyond U.S. Steel. The Trump administration, for example, has deemed automotive goods to be a “national security” issue just as it did for steel (hence, new tariffs under Section 232), and several other investigations—on minerals, copper, semiconductors, wood products, and pharmaceuticals—are now underway. Assuming some of these cases result in their own tariffs (a very safe assumption), future transactions involving foreign and U.S.-based companies in these industries could attract more golden shares and similar levels of government control. That risk, investment and security analysts now worry, could “scare off” future investment in the United States, and when confronted with such concerns, a Trump administration official refused to rule out more golden share arrangements, saying only that it would be required “only rarely.”

Almost nothing to fear, comrades! Invest away!

Anyway, even if this administration wouldn’t dare go down the golden share road again, what’s to stop, say, a future President Alexandria Ocasio-Cortez or J.D. Vance from doing so?

The Trump administration’s effective control of U.S. Steel also has serious implications for future U.S. trade negotiations. I’ve been critical of the federal government’s position on lots of trade issues (understatement), but they’ve been directionally correct—albeit clumsy in practice—on the problem of China and other governments using state-owned enterprises as a backdoor means of implementing highly distortionary industrial policies. I can quibble with certain details, but rules like the ones Washington has demanded in the TPP and USMCA are, along with impartial dispute settlement, generally a step in the right direction toward ensuring that American companies continue to support open trade and the global trading system—unlike costly and ineffective unilateral tariffs. For the U.S. government to now take a China-style approach to U.S. Steel undermines those efforts and strengthens the rhetorical hand of interventionist governments around the world, including the one in Beijing.

Finally, U.S. Steel’s new status as an SOE or “public body” would mean that all its domestic transactions (yes, all) are subject to scrutiny and potential discipline under the USMCA and global anti-subsidy rules, respectively. And that would have legal and commercial implications for both U.S. Steel and any American companies doing business with it. For example, a national government could initiate a countervailing duty investigation of, say, American-made cars imported into that country; find that U.S. Steel’s domestic sales to Ford, GM, and other automakers were unfair government subsidies; and apply duties on future imports of these subsidized vehicles, thus putting them at a significant competitive disadvantage. The governments of Mexico and Canada might also consider whether certain U.S. government support for U.S. Steel—grants, loans, etc.—is a prohibited form of “non-commercial assistance” under the Trump-negotiated USMCA.

These outcomes aren’t guaranteed, of course, but the golden share makes them a new risk under the very legal rules that Washington has championed. Investors may wish to act accordingly.

Summing It All Up

The Trump administration’s “golden share” control of a wide array of U.S. Steel’s domestic business activities should be seen as a de facto nationalization of the company, given what we know about the new relationship and the very standards pushed by the U.S. government in related contexts. But regardless of its technical name, the deepening of the already bad relationship between Washington and U.S. Steel raises a host of serious economic and geopolitical concerns that could weaken the economy and the rearguard defense of free market capitalism here and abroad. It’s a move I’d expect from Bernie Sanders, not the party once opposed to such things and supposedly fighting “socialism” today.

I consider Joe Biden’s refusal to approve Nippon Steel’s purchase of U.S. Steel to be one of the worst decisions of his presidency. Given the apparent alternative, however, it looks pretty darn good.

Chart(s) of the Week