After several weeks of very ugly bond action, overnight Japan finally panicked and in a coordinated trial balloon through both Reuters and Bloomberg, the MOF announced that it would trim ultra long-dated supply, reduciing the amount of 30Y and 40Y bonds Japan would sell… and not a moment to soon since yields had hit record highs in what was a bidless market, sparking record paper losses among life insurers.

In the aftermath of the announcement, yields both in Japan and across the globe have tumbled, and that certainly helped today’s US Treasury auction of $69BN in 2Y paper pass smoothly.

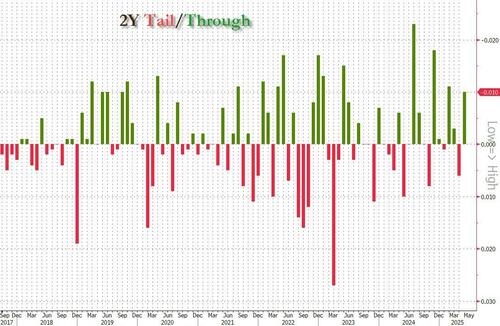

At exactly 1:01pm, the US Treasury announced it completed the week’s first coupon auction when it sold $69BN in 2 Year notes at a high yield of 3.955%, up from last month’s 3.795% if below the march 3.984% and the five consecutive prior auctions all of which priced above 4%. The auction also stopped through the 3.965% When Issued by 1bps, the 3rd stopping through auction in the past four.

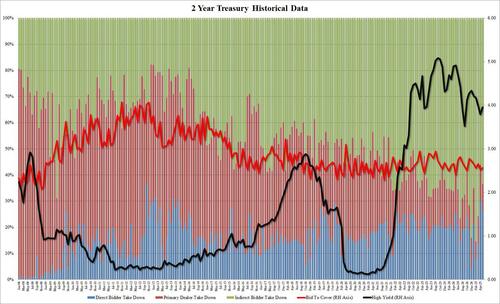

The bid to cover was 2.567 slightly higher than last month’s 2.515 if below the six auction average of 2.648.

The internals were also solid, with Indirects awarded 63.3%, up from 56.2% in the ugly April 2Y auction; and with Directs taking 26.2%, the second highest this decade, Dealers were left holding 10.5%, down from 13.7% in April and just below the 10.9% six-auction average.

Overall, this was a very solid auction yet one which undoubtedly good a boost from Japan’s panicking Ministry of Finance whose “bond put” has been triggered and from now on, the choice of whether to short JGBs or yen will almost surely point toward the latter. And, sure enough, after trading around 4.65% just two trading days ago, the yield on benchmark US paper was near session lows ahead of the auction and at 4.45% at last check, some 20 bps lower in two days.

Loading…