By Michael Every of Rabobank

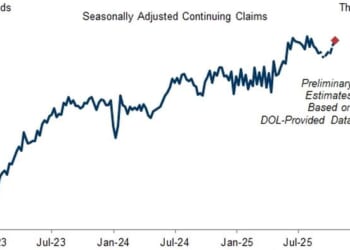

US challenger job-cuts data were… challenging: the highest level of October firings in 20 years. While we wait for the US Supreme Court to decide on the challenge to one set of Trump tariffs, before they are replaced by others, and to see if the US Senate will reopen the US government today, as it rejects the Trump challenge to ‘nuke the veto’, we are also challenged by:

The China-US deal to ease rare-earth export controls for a year may have hit a snag. China’s regional authorities have reportedly said export controls from April remain in place so there is still a need for special export licenses and intrusive questions. That’s a week into the one-year Trump-Xi deal. The US also added silver and copper to its critical minerals list, as Trump hosted Central Asian leaders, aiming for their rare earths, as Japan and the US announced they would mine deep-sea rare earths together. Does any of this read like they expect the deal to hold long-term?

Gunvor had to scrap their deal to purchase Lukoil’s foreign assets, following the Russian firm’s sanctioning by the US, after the US called it a Kremlin “puppet.” We have been warning geopolitics would force entry into the commodity trading complex: here’s a warmup.

The Financial Times reported recent US trade deals with ASEAN countries contain ‘poison pills’ which mean they can be cancelled by the White House if any action signatories take with China threatens “essential US interests” or “poses a material threat” to it. Do you think this kind of logic will only apply to those particular counterparties? No: it will apply to everyone who struck a deal.

That’s as the South China Morning Post asks, ‘Can the EU walk a strategic autonomy tightrope in the China-US tug of war?’, quoting a former diplomat that China’s efforts to persuade the EU to treat ties as a strategic partnership are “reaching their limits”. Equally, a coalition of 16 US State attorney generals warned some of the country’s biggest companies not to comply with the EU’s new sustainability regulations: Europe is already watering said legislation down to appease Qatar. Moreover, US firm Kyndryl just entered into an agreement to acquire Solvinity, a provider of secure managed cloud platforms and services in the Netherlands, including for the Dutch government, while VW announced it will be developing driverless cars using Chinese AI. ‘EU strategic autonomy’ meets reality and goes home without its lunch money.

Trump has today made it sound like he’s building bridges to India, calling PM Modi “a great man,” stating he has largely stopped buying Russian oil — news to India, Russia, and oil markets — and that he could go there in 2026. If so, expect the 50% US tariff to come down regardless of what the Supreme Court thinks. It seems highly unlikely that the US would need to insist on a poison pill re: China for any India deal that is then struck.

And speaking of striking things, geopolitics continues to march alongside geoeconomics:

In the Middle East, the US is reportedly to establish a military presence at a Damascus airbase to broker a Israel-Syria security pact, as Israel carries out airstrikes vs Hezbollah in southern Lebanon, the US reiterates Hamas has pledged to disarm too, and Kazakhstan, which already has relations with Israel, will join the Abraham Accords.

In Latin America, the US Senate blocked a resolution that would have kept Trump from striking Venezuela, and the US is considering a new military base in Ecuador. Argentina’s Milei is meanwhile defying calls to float the Argentine peso freely as dollarisation rumours rumble on.

In Europe, drones closed Brussels airport for the third time in a week, Romania called on the US to overturn its decision to drawdown 800 troops based there, as the EU agreed to open its Horizon research fund to defence projects.

In Asia, the SCMP says, ‘China could win a contest with the US ‘before a shot is even fired’: strategists’ as “Decades of neglect and decline have made logistics the weakest link in Washington’s deterrence strategy in the Pacific.” Japan and New Zealand have begun talks on a potential frigates acquisition, and China’s military says Australia’s AUKUS plans put it in an “increasingly precarious position.”

Meanwhile, just as market worries over inflation AND job losses start to appear in tandem, we get the world’s first trillionaire in the form of Elon Musk, who just won his giant pay rise from shareholders. As the Australian Financial Review notes, “The [for now] billionaire’s new deal isn’t about money. It’s about putting himself at the center of the way society operates – in his words, having “strong influence.”” You’d think a trillion dollars opens a few doors.

The Financial Times also just had back-to-back links yesterday worth noting. First, ‘AI pioneers claim human-level general intelligence is already here’: it was fun having a job while it lasted. Second, ‘Are bubbles good, actually?’ on Jeff Bezos’ defence of AI mania: it’s perhaps not hard for AI to mimic certain levels of human ‘intelligence’ (and, to be fair, the article argues bubbles are historically a very silly way to build ambitious projects vs proper planning).

As stocks wobble and China restarts de facto QE with a small bond purchase, France’s far right says it will push for the ECB to do the same if it comes to power, following a policy path paved by Reform in the UK and, to a degree, the Trump White House vis-à-vis the Fed. How long until other EU elections drag central banks into the mix? How long until populists are in the position to actually make that shift happen?

Or, how long until central banks do it anyway if job losses suddenly start to spike? If that doesn’t challenge some preconceptions of how things work, I’m not sure what will.

Loading recommendations…